The 2nd quarter is over and the economy is still far from where it was before Trump gave the order to shelter in place. In what was promised to be a short two week quarantine in March ended up destroying the entire 2nd quarter economy – numbers are due out in a couple of weeks. At the end of tunnel there may be light, but right now it is nowhere in sight.

Soon after Trump exercised an unconstitutional power to shut down the vast majority of the U.S. economy governors swiftly transformed themselves into kings (that’s what happens with bad precedent) and seized control of their individual markets, unilaterally determining which businesses were allowed to operate, for how long, and by what capacity – which thereby determines who makes money, how much, and when – which thereby removes choice and opportunities to consumers, and shrinks markets.

Never a good thing for business and investment, or the free market system.

Free markets operate freely where capacity is determined by the provider (supply) and the consumer’s ability and desire (demand) to transact business (the exchange of goods and services for cash) under their own free will. When freedom is removed from market dynamics it changes not only the Market but also its form of government.

For example, when capacity is dictated by executive fiat exercised at the whim of a governor’s sole discretion the concept of a constitutional Republic dies alongside the free market system – because the tenet of shared power amongst the three branches of government is eliminated, and because businesses ordered to operate at significantly reduced capacities are not free markets but markets controlled by government edict from a single authoritarian figure, i.e. president or governor.

That is not the capitalist way, nor the American way.

With the governments’ response to Covid-19 America has taken a huge lurch towards communism, which makes it baffling how so many people are still predicting a V-shaped recovery in a 3rd quarter that has just limped out of the gate. Only State media could predict such an impossibility.

While some states have just entered phase 2 re-openings another large swath are rolling back theirs due to a spike in Covid cases, or the sheer fear of it. Continued restrictions on business and productivity have no choice but to produce less revenue, less profits, less employment, less wealth, and therefore, less market activity as measured by Gross Domestic Product (GDP). Now there is talk about a softer and slower U-shaped recovery, or something more of an up-and-down W. There is never a suggestion, however, of a fall-and flatten L-shaped recovery – and that ought to scare the dickens out of all investors everywhere.

The politicization of the Covid-19 pandemic has turned Americans into enemies by vilifying those who peacefully protest that governors are not kings and lack the unilateral authority to mandate unconstitutional quarantines, business closures and capacity restrictions, and the wearing of masks; while glorifying violent mass-mob riots, the destruction of property that includes national monuments, looting, and rising causalities of black-on-black crime mounting in cities across the country looking to defund police operations – all of which forces consumers not to consume, or to not consume as they did before everything went to hell.

None of this is good for stocks and investments, make no mistake. The stock market’s recent resurgence is just a ruse fooling you into believing the contrary. The government’s response to this year’s coronavirus has been very damaging. It forced Americans to live on less by destroying the free market – like any good communist or socialist regime. Investors must take note. The American Market is in a whirlwind change.

The wearing of masks is a Statist driven policy mandating individuals to put others in the population above themselves. The idea surrounding masks is to “save” the community – whether that is possible or not – even though it may hurt an individual’s health. It is a sign of “respect,” they say. But none of that makes the mask mandate right or constitutional.

Somewhere along the line Americans have forgotten they were born free with certain unalienable rights endowed by their Creator – not the President or Governor – that include Life, Liberty, and the pursuit of happiness – which also includes the right to work and earn to an individual’s capabilities and desires, and whether or not to wear a mask.

What ever happened to mutual respect and individual rights and freedoms for all persons equally in this famed land of the free?

Consumers at odds with each other in public, and who are encouraged to stay away from each other and to not speak in fear of an infectious transmission, do not assemble, do not find common ground, and never unite against dictators and their unconstitutional policies.

The American system is under serious duress. It’s time to wake up!

In what will likely prove to be an economic depression once Q2 numbers are released in late July, today’s stock market hasn’t noticed or simply doesn’t care of that dreaded condition – nor the amount of wealth being drained from of the system. Yet stocks at 26,000 look poised to move higher.

Don’t fall for it.

There has long been a disconnect between Wall Street and Main Street, and perhaps the gap is wider now than ever before. The reason for that is because the Federal Reserve has placed a wedge in between the two called QE that has minimized, or at least delayed, the economy’s impact on stock values. In today’s environment liquidity drives stock prices more than anything else.

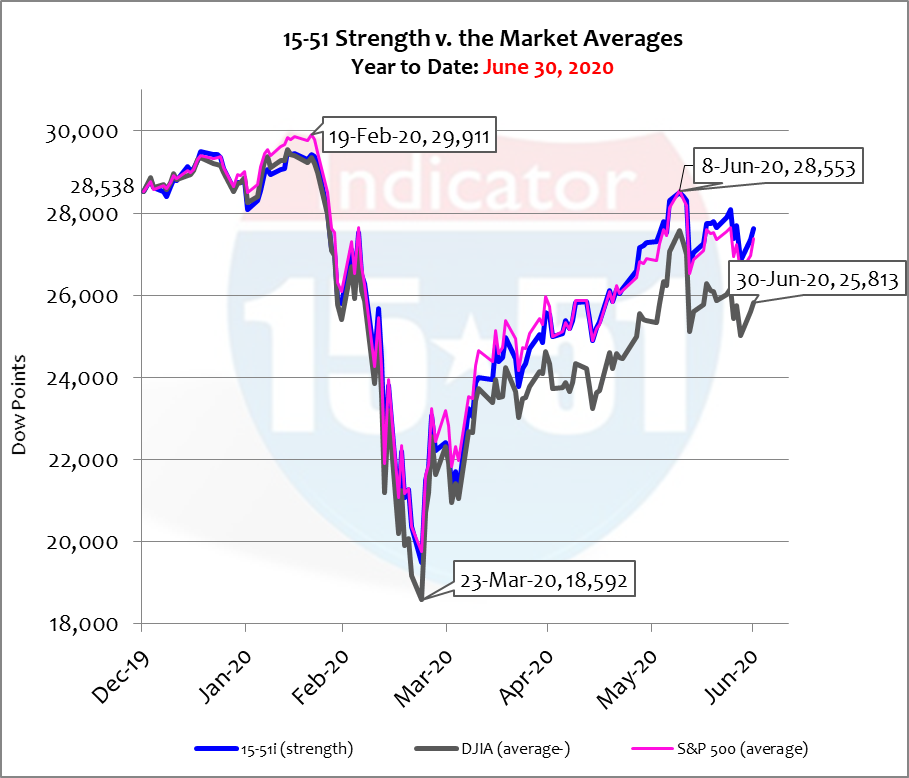

You may recall the stock market had an incredibly strong year in 2019 when the S&P 500 posted a 29% gain. The New Year started in similar fashion, rising more than 3% in the first six weeks of 2020. But then came the coronavirus and things have never been the same.

Stocks tumbled when the Wuhan manufacturing hub in the world’s largest supplier of goods, China, quarantined and disrupted the entire global supply chain. Europe was quickly infected and swiftly followed China’s lead and quarantined workers and consumers alike.

Restrictive policies like quarantines are commonplace in socialist and communist environments but are taboo in free societies with constitutional protections against them like in America. Yet by the middle of March American government spat in the face of those provisions and placed an entire free people, her enterprises and her marketplaces of business, under house arrest without any due process.

And you still don’t hear boo about it.

Covid-19 inspired government action that immediately tightened global supply and dramatically curtailed global demand. It was government action, not the actual coronavirus that shut down the global economy. Bad decisions, of course, are commonplace in government. But to break with well-established precedent – reaffirmed most recently by Leftwing darling Barack Obama, who resisted the urge to quarantine the free people of the United States twice in his presidency, first with the swine flu (H1N1) and then with Ebola – is to make a really bad decision. Shutting down the entire economy was that kind of really bad decision, which can easily lead to stock market corrections like the one experienced in February as the virus started to infect the world (see chart below.)

But severe economic conditions like shutdowns don’t magically disappear overnight, or in three months’ time as the stock market indicates in the chart above. Fifteen-million people remain unemployed (that’s a huge number) while many businesses remain closed or continue to operate at significantly reduced capacities, whether self-imposed or mandated by governments. Part of the country is entering phase 2 openings while another group are rolling back theirs due to a resurgence of Covid cases – something that should have been expected.

Viruses don’t just vanish (SARS has been around for 20 years and still there is no vaccine.) The phased approach to re-open, which took way too long to begin, now looks as if each phase was too vast, as some states are now pressing their healthcare limits causing them to slow their re-openings – to once again flatten the curve. Any time you have to do something twice you did it wrong the first time. Government is also notorious for that. And consumers remain skittish because of it.

Needless to say, economic recovery will be slow and uneven, making the often touted V-shaped recovery more of pipedream than a real possibility. It is propaganda at best.

And there is Wall Street’s disconnect to Main Street in a nutshell. Stock prices (Wall Street) rely less on economics (Main Street) and more on new money, liquidity, and credit (as managed by the Federal Reserve).

You may recall the Federal Reserve employs quantitative easing (QE) – the scourge of our time – to do two things: 1) to cover Wall Street’s losses and shortages (and therefore add liquidity to the monetary system), and 2) to cover central government debt and deficit while keeping yields low (and therefore grow government and its economic influence at the lowest possible rate).

Consider the perverted nature of QE, it exchanges new money for bad debt in order to create more bad debt from both government and banks – at the expense of We the People (who pay for the debt) and the free market (which loses value as government grows).

If we remove Thomas Jefferson from American history because he owned slaves we lose access to his arguments against the national bank, to be succinctly paraphrased as, If the people allow government to control the value and supply of money then it is only a matter of time before government controls people, enterprise, and markets with the money they monopolize to gain more power.

Many corporations rely heavily on credit to run their businesses and cover working capital shortages. So when the government’s response to Covid-19 dramatically halted economic activity it caused many companies to drawdown on their lines of credit to sustain their operations.—And banks ran out of money, again. In other words, liquidity ran dry, again. So Wall Street banks sold stocks to raise capital until the Federal Reserve could once again come to their rescue with more QE, which they did.

In the days and weeks that followed the sharp stock market sell0ff (which is nothing more than a cry for help from a spoiled brat) – more than five-trillion new American dollars were injected into the banking system via QE, which helped stocks regain their footing.

It was Federal Reserve action via QE – not an economic rebound – that re-inflated stock prices in the 2nd quarter. Bad economics persist. The stock market simply doesn’t care. It is, after all, the QE-boom.

The deal with QE, as always, is the Federal Reserve prints new money and hands it to the Wall Street establishment in exchange for toxic assets (a.k.a. losing investments made by them) with one simple mandate. Half of the new money must be used to purchase U.S. Treasury securities (government debt and deficit); the other 50% can be used in the normal course of their business operations (loans, investments, and other marketable securities like stocks, for which they “make the market”).

Like President Obama, Trump’s answer to his crisis was to spend, spend, and then spend some more with unprecedented government giveaways like PPP and EIDL that will likely push government spending to an ungodly $9 trillion in a single year – or 50% of the entire U.S. economy, an alarming fraction.

Does anyone else find it frightening that U.S. central government is taking over the economy and the Federal Reserve is financing the leveraged buyout with a corrupt Ponzi scheme called QE?

Jefferson was right.

Every time there is a crisis driven recession the government springs into action as if they have to save the day by spending ungodly amounts of money as if they can replace what the free market has lost. But that’s entirely impossible.

Government spending does not translate dollar-to-dollar to economic activity (GDP) because there is no entity more inefficient than a political bureaucracy rife with waste and corruption (I’d hate to think of the amount of waste that comes from government spending $6 to $9 trillion in a single year.) Besides, government spending can never out-produce or out-perform the free market because freedom is a better investment than government. There’s more profit in it because free markets invest and governments spend. One is long-term, the other is short-sighted.

Growth in government comes at the expense of the free market.

When market freedom is lost it is impossible to replace or replenish it until that freedom is returned, which usually doesn’t happen without a fight. And while stocks may seem to have corrected from this year’s corona plague – down around 5% from their February highs – nothing can be further from truth.

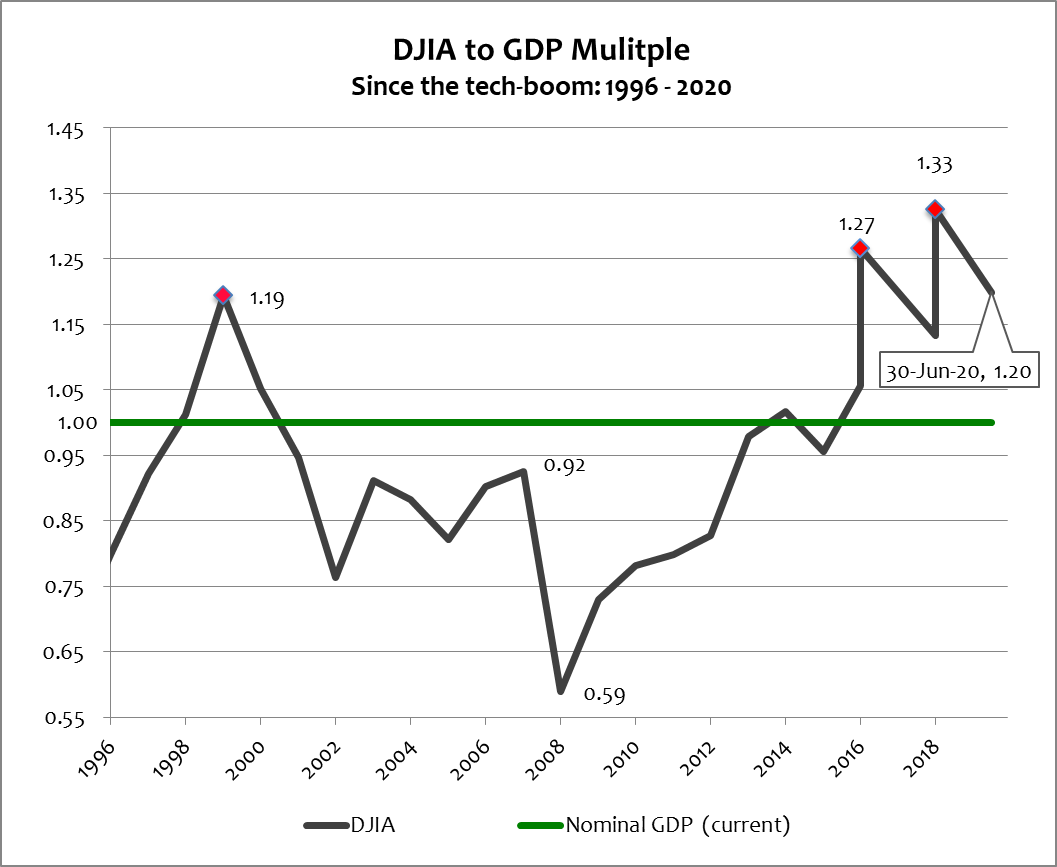

Consider the average value “the market” has traded to GDP (the economy) has been .94 for the last 20 years. Today it is 1.20 – or 28% higher than what can be considered “fair value” – and that’s based on Q1 GDP numbers (which includes a 5% recession.) That market multiple grows substantially should the economy fall another 5% in Q2, thus hurling America into the steepest depression in her history.

In other words, stocks are still richly valued at current levels – thanks to QE – and are a heartbeat away from getting richer once Q2 GDP numbers are released. See chart below.

The primary threats to a stock market that doesn’t care about the underlying economy is tight liquidity and expensive money. The two conditions to watch, therefore, are the price of goods and the cost of debt (a.k.a. inflation and yields).

Inflation that causes higher yields is a condition that scares the hell out of the Federal Reserve because it removes their favorite tool from operation, their solution to everything, their Godsend, QE. Quantitative easing (QE) can’t be used in such an inflationary condition because it would only make matters worse and create more inflation (a.k.a. hyperinflation.)

So then what? What will the Fed do to achieve its dual mandate of maximum employment and low inflation without QE, when they must tighten monetary supply (the opposite of QE, a.k.a. quantitative tightening) and remove cash from the system?

Tightening the money supply when everything is so tight will only make things tighter, which can only cause prices to move higher.

Can you imagine what the stock market will be doing while the country debates how to escape yet another ‘impossible to predict’ quagmire when QE is no longer an option during the heat of a Trump v. Biden election campaign?

Nothing is perfect, not even freedom. Think about it impartially for a moment. If we were all free to define freedom then what isn’t acceptable?

QE is no exception – and far more flawed than the concept of freedom could ever be. It may have been a necessary crisis tool during the crash in ’08 but the practice should have been halted as soon as that crisis was over. Instead it was used and abused for more than a decade allowing it to morph into a monster that is the antithesis of freedom; it facilitates the growth of corrupt government at the expense of individual freedoms and the free market system. Americans should be unanimously united against it, but instead are distracted by other things George Orwell predicted in 1984.

Investors must stay alert.

When inflation causes yields to rise all hell will break loose and it will start with the United States of America, who carrying more than $25 trillion in national debt, will pay a significant increase in interest payments when rates move from 1% to 6%. Everything will get more expensive. And while such a move can be affordable to America it will bankrupt many countries like Greece and Italy – heck, all of Europe including Russia, the Middle East, Asia, and even China.

Investors can’t get distracted by the surrounding nonsense of partisan bullshit. It skews judgement and leads to poor decisions, especially when considering the risk and reward relationship. At some point the Federal Reserve will have to reduce the money supply, and a bunch of it will come from the stock market and retirement accounts.

An economic depression should be factored into all prudent investment plans. Whatever the stock market does in response to it will be interesting indeed. But once again it’s all about the 3rd quarter recovery, inflation, and what the Fed does in response. In regards to the latter one thing is for certain: nothing will ever be easier than the cocaine that QE became – a habit more than 10 years overdue to kick, that has cost taxpayers more than 15-trillion-dollars in treasure and an immeasurable amount of freedom.

Detox is painful – especially when money is tight.

Gold is good and cash is king. Both are great when stock markets aren’t.

Plan for the worst, hope for the best, and be ready for anything.

Stay tuned…

Great Post Dan. I’m on the same page. Hope all is well with you and yours.

Thank you, Bill! Yes, all is well. My best to you and the crew,

Well said Dan. The sheeple need to wake up. Unfortunately for most they are hopelessly brainwashed by the state media.

Yesterday I saw a man riding a bicycle at a pretty good clip. Wearing a mask! That is suicidal. Things will get so much worse with that kind of fear in the general population.

Turn off the television “programming” and work on oneself mentally, spiritually, physically, fiscally and emotionally. and we the people might stand a chance to keep this once great country free.

Thanks Jay — and yes, you are exactly correct!

[…] economy is down 10% because the government reduced the Market’s size, capability, and potential. That […]

Hi Dan

Good to read your post. Agree with all.

I recently began that we have a new magic economic system. Stay well and

God bless

Thanks Joe — Good to hear from you!