Ronald Reagan once perceptively noted, “We don’t have inflation because people are living too well. We have inflation because government is living too well.”Exactly.

The last time America’s financial condition could be considered healthy was back in the late 1990’s, when Bill Clinton worked with the Gingrich Congress to effectuate some semblance of fiscal sanity. It is a model America should relentlessly pursue.

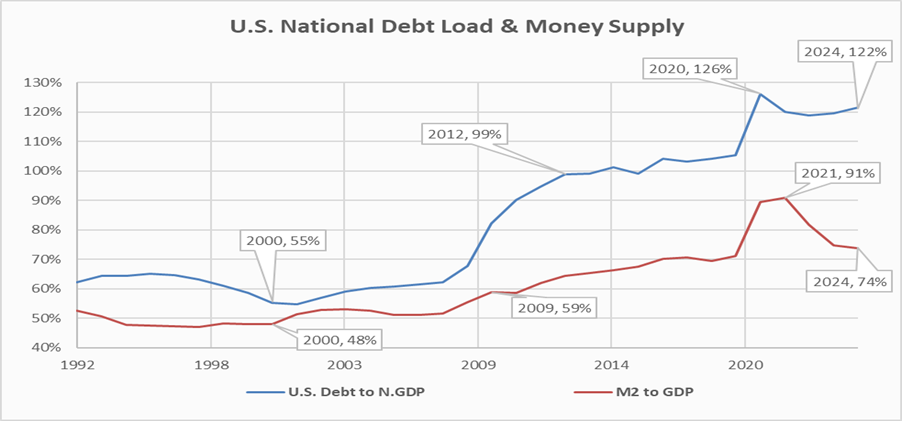

When Clinton left office the national debt was a somewhat reasonable 55% of Gross Domestic Product (GDP) and that level was declining, thanks to a 13% budget surplus that was increasing.

Back then the money supply (M2) was stable at 48% of GDP and central government’s share of the economy was 17% – and declining, which is good, and approaching where it should be (around 10%).

Today the picture is very different.

Today national debt is 122% of GDP (more than twice what it should be) – thanks to an annual budget deficit of 27%. Imagine spending 27% more than you earn each week and borrowing it from your credit card company.

Because of the remarkable deficits incurred since 2008 money supply (M2) has exploded to a whopping 74% of GDP (recall that it was 48% during the 1990’s).

The reason for such monetary expansion?

Because government spending increased to 24% of GDP (33% higher than Clinton’s final year).

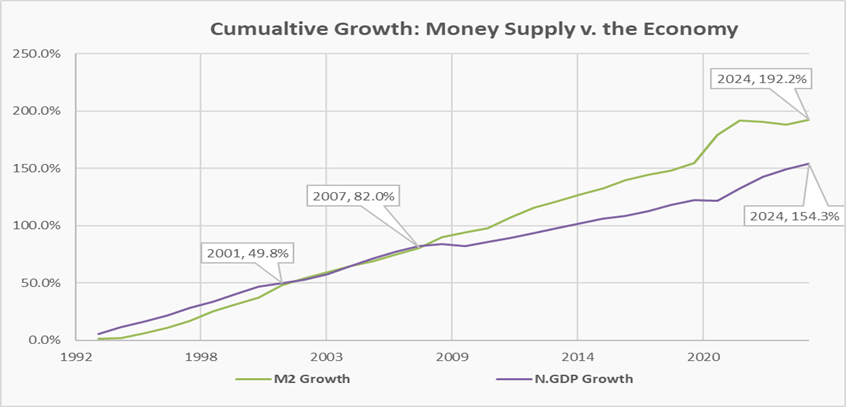

Inflation is a monetary condition that occurs when money supply grows at a faster pace than economic activity, creating the condition of too many dollars chasing too few goods.

Fiscal insanity and irresponsible money policies began after the September 11th attacks, picked up speed during the 2008 financial crisis, and became absurd during Covid-19 – when real economic growth averaged 2.4% while the increase in money supply averaged 7.5%. This flipped the monetary dynamic upside down, as can be seen below.

More money than economic activity and presto – inflation.

Two important things to know about inflation. First, government deficit (spending beyond their means) creates the need for more U.S. debt (Treasury Securities) for which the Federal Reserve must print money to accommodate, which causes inflation.

Inflation is a tax people pay to cover government’s overindulgence – a condition ignited by crisis that is usually manmade, and many times self-inflicted.

Second, the Wall Street establishment loves inflation because they broker the debt (U.S. Treasury securities) to the world and earn commissions doing so – not to mention banks own a ton of U.S. bonds that they obtained with free money injected by the Federal Reserve (with techniques like quantitative easing, QE) used to increase money supply and control interest rates (not to mention control the banks themselves).

The point here is this: government (including the Federal Reserve) and Wall Street are connected at the hip. They do business together and make money from each other. Inflation doesn’t affect them because they control the printing presses for money. They print what they need and charge it to us (by way of a tax called inflation). In other words, it’s them against us.

Enter Trump and his appointee Elon Musk and their new and ultra-aggressive approach to budget negotiation through audit, transparency, accountability and fiscal responsibility. The reason for it?

To return America’s fundamentals back to those of the Clinton/Gingrich strong dollar era.

This is a battle Trump must prosecute on three fronts.

The first front is to return U.S. central government back to a budget surplus.

During Clinton’s final year total government spending was 13% of Real GDP, which translates to $3.7 trillion today, against projected revenues of $5.1 trillion, would produce an annual budget surplus of $1.4 trillion. That surplus would reduce national debt by the same amount. (As a sidenote: Biden’s final budget called for an irresponsible $6.9 trillion in total spending, and a $1.9 trillion deficit.)

Did I mention deficits create inflation?

The second front is to dramatically reduce national debt outstanding. Why is this important?

Consider this year’s interest expense (a.k.a. debt servicing) on U.S. national debt represents 20% of total tax receipts. Now factor in that more than half of the national debt ($18 trillion) must be refinanced in the next two to four years – at double the rate, thanks to inflation.

So in the blink of an eye almost half, or 40% of government revenue goes directly to debt servicing (approximately $2 trillion per year). And if the government doesn’t have that money (meaning the increase in interest expense causes a deficit) it must print new money (and debt) to cover the obligation (deficit) – which produces more inflation.

Remember, Clinton’s debt to GDP ratio was 55% and we are currently at 122% (an $18 trillion spread), which is to say Trump needs not only a budget surplus to bring that ratio back in line but also significant economic growth (GDP growth) – which is the third front Trump needs to tackle.

And how does he plan to do it?

By liberating the free market with less bureaucracy and regulations, greater and more permanent tax relief, deescalating world wars, and leveraging tariffs to equalize American production against world output.

Trump is acting like a person who knows exactly how screwed up everything is and how little time he actually has to fix it – like a desperate man in a fight for his life – and not willing to let 535 imbeciles (most of whom are connected to the fraud in some major way) drag the effort out in meaningless debate for the next four years to hide their participation in it, while America plunges deeper into the abyss.

Trump knows he needs to cut way more than the $2 trillion annually he campaigned on (like twice that amount) and that’s why he and Musk are charging so hard.

Malignancy will otherwise persist.

Trump can become a hero to all should he be successful – which includes delivering congressional term limits by the end of this restructuring.

Then it’d be worth the pain.

What kind of pain, you ask?

Renowned economist Ludwig Von Mises once poignantly stated: “There is no means of avoiding the final collapse of a boom brought about by credit [debt] expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit [debt] expansion, or later as a final and total catastrophe of the currency system involved.”

Relative to today, Trump is voluntarily abandoning further credit expansion (by cutting spending and thus the issuance of new debt, and further monetization of said debt through policies like QE) which has no choice but to encourage correction.

And he’s doing so to save the dollar.

When structuring your portfolio for the future knowing when correction will arrive is less important than knowing the possible extent of it, which helps determine the proper blend of hedge, safety, and opportunity you need to win the battle of these trying times.

While no one knows when and the ultimate severity of correction, we do know two things: 1) it gets closer every day, and 2) when it comes it will be significant.

For instance, to stop persistent inflation the Federal Reserve must withdraw a significant amount of currency that was injected during the Covid era – some $7 trillion worth (to return America back to Clinton’s M2 level).

The Fed executes this action, called monetary policy, through the money center banks located on Wall Street. A byproduct of injecting new money into circulation is stock market inflation (rising prices) while withdrawing it deflates stock prices.

Withdrawing $7 trillion will create quite a frenzy – even if done in a slow, methodical manner.

But there’s no better way to do it than a big stock market correction to mask the task, while they blame Trump, and drain wealth from your retirement account in the name of monetary policy – to combat inflation, which is abundant in the stock market. See below.

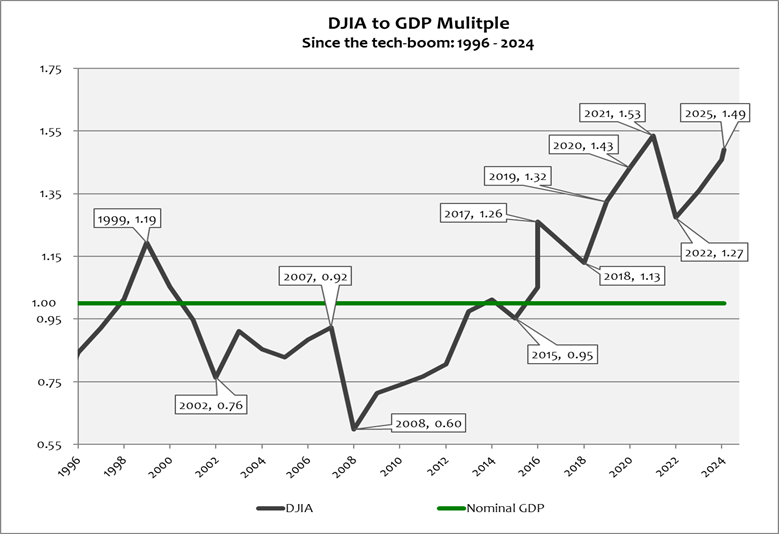

This chart shows the multiple the Dow Jones Industrial Average traditionally trades around the actual market (GDP). Multiples are valuation techniques (i.e. Price/Earnings ratio). The purpose of this chart is to help assess the pricing condition of stocks in general.

At the tech-boom peak in 1999 “the market” traded at 1.19 times the current dollar economy (Nominal GDP).

Today it trades 25% higher than that (at 1.49) – and this economy is nothing like the tech-boom, is much more leveraged (122% v. 55%), while floating 33% more currency.

The greater the degree of inflation in a market, the greater degree by which it corrects. Newton called it gravity.

So if stocks retreat to the low-side valuation reached after the ’08 crisis the Dow would hit bottom at 17,820 (a 59% fall from Dow 44k).

But due to its inflationary condition I wouldn’t be shocked to see it deflate even more – you know, to really scare the hell out of people, again – to something like 11,967 (a whopping 72% drop). Can totally see that, and perhaps even lower. Nothing would surprise me at this point.

And that’s exactly what I meant when I said at the end of my book (published in 2011) that the next correction would make the ‘08 meltdown look like child’s play.

Prepare now – and let me know if you want to chat or join a podcast to discuss it.

Until next time,

Stay tuned…