Recent craziness in the stock and bond markets has nothing to do with tariffs and all to do with politics. It’s an anti-Trump statement made by the global elites who don’t want any disruption to their apple cart – and who are mad at Trump for throwing a wrench into their egg basket.

First, tariffs alone cannot cause recession in America. If that were true, every time taxes were increased a recession would ensue. But that never happens.

Tariffs are just taxes, and like all taxes, can lead to higher prices because they raise the cost of production, which is ultimately recaptured from consumers in the form of higher prices. And while high inflation can certainly lead to less spending and recession, there’s always something much larger at play than simply taxes.

Besides, rarely does a 20% tax hike lead to a 20% increase in price because businesses stagger or mitigate their effect so not to disrupt the supply chain or chase away consumers. Because of that dynamic, tariff impact is generally felt gradually, over longer periods of time.

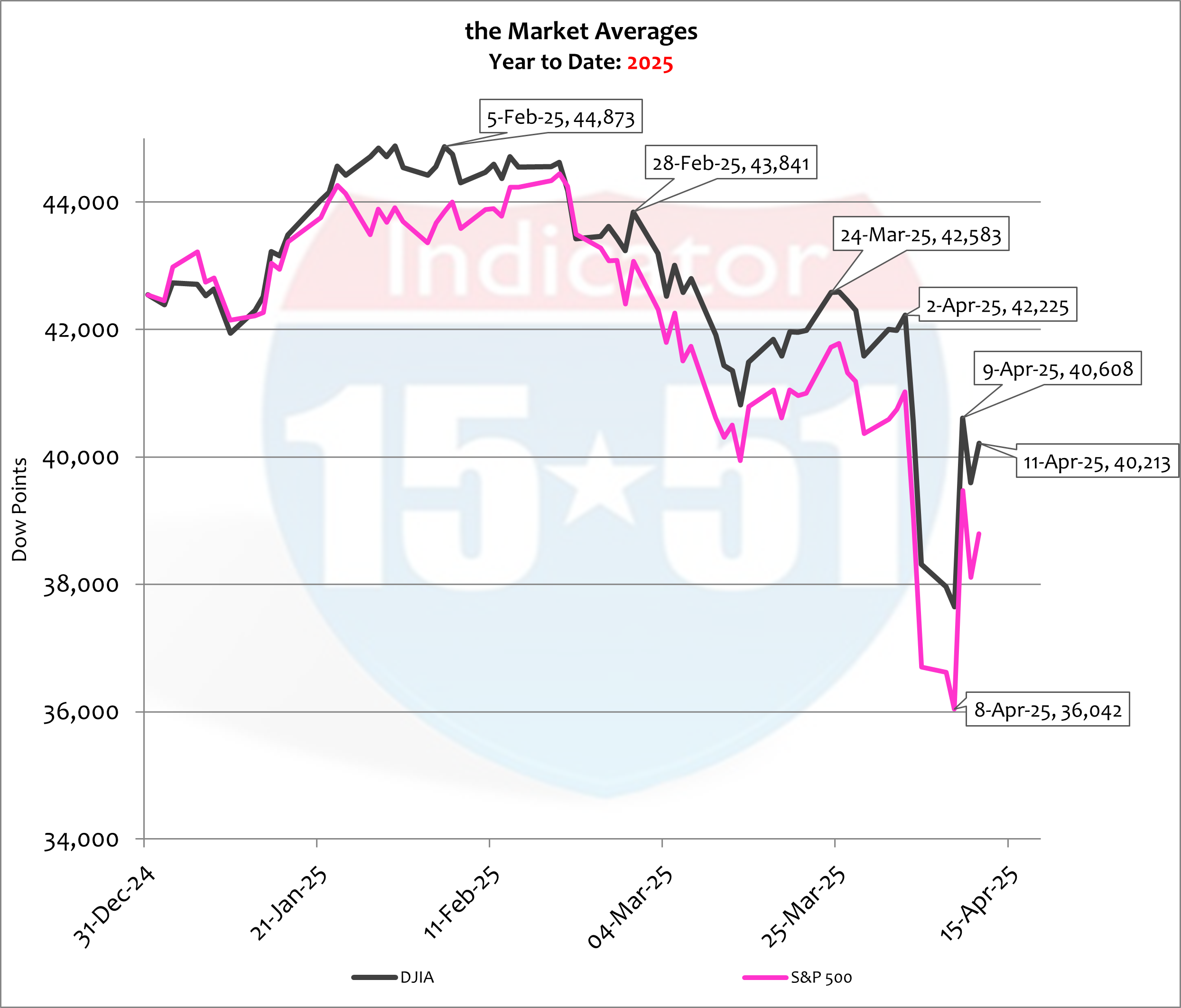

Yet today’s financial markets are fast and furious and seemingly confused – although the downward trend is certain, as the correction continues to build lower-highs and lower-lows as it moves through time. The erratic behavior indicates something to me. And that is: there’s something seriously wrong in the marketplace – and the establishment wants us to believe it is all about tariffs.

I say that because negative stock market volatility began in early February 2025 when the tariff talk began; kicked into gear as deadlines approached in March, and reached full-throttle on Liberation Day, April 2, 2025 – BUT suddenly reversed when Trump announced a “90 day pause” on tariffs, which pushed stocks up 8% on a single day, April 9, 2025.

Such activity paints the picture of a villain called tariffs.

But they can’t be the culprit.

Consider how easily tariffs can be mitigated by eliminating income taxes at the corporate and individual levels. In fact, some plans are already being debated in the Republican side of Congress. Add this potential remedy to the long and drawn-out impact of tariffs and the result is little threat to today’s economy.

So why the insanity in the stock market?

Here’s the real problem…

Nothing throws an economy more out of whack than over-expansion of the credit markets – something the U.S. has been doing in criminal fashion for 20 years or more.

You hear comparisons to the Smoot-Hawley tariffs in the 1930’s and how they were somehow responsible for the Great Depression. That’s not even close to being true let alone an accurate comparison to today. Instead, it was the incredible amount of debt accumulated during the “roaring 20’s” that led to the correction that turned into our most famous depression. Tariffs were only one piece of that mismanaged puzzle.

Fast forward to modern times, the Great Recession was triggered by the 2008 financial crisis, which again had nothing to do with taxes or tariffs but was the direct result of irresponsible expansion of the credit markets for housing, primarily subprime mortgages. It caused the market to correct, recession followed – and the answer to it was to print more money (“stimulus”) and incur more debt.

And here we are today.

The coming recession will be brought on not by tariffs but by the most corrupt and irresponsible expansion of debt the world has ever witnessed – America is 124% leveraged, China is at 90%, India and the EU are around 83%, and Japan is at an extremely dangerous 242% of her GDP (not a typo) – and all continue to run deficits in declining markets.

When governments print money they do so to grow (spend) beyond natural means, and because it is unnatural, it is unsustainable. And because it never produces the ROI it purports, it must be repeated again and again to inflate the deflating economy – more stimulus, more debt, more new money, which produces more inflation, more meager growth, and a larger correction.

And politicians don’t care because they own the money press and get addicted to the power they acquire with it, and the kickbacks they enjoy from it. Nevertheless, at some point, the debt load becomes too great and markets correct or crash, or both.

The only question is when, as Mises suggested, whether a “result of voluntary abandonment of further credit expansion [which is what Trump is trying to do with DOGE], or later as a final and total catastrophe of the currency system involved [what Trump is trying to avoid].”

There is no way to avoid recession because of what has already been done to bring it on. Here are the gruesome details again: the United States has $36 trillion in national debt against a $29 trillion economy (a leverage factor of 124%) with money supply (M2) running 25% higher than healthy – that’s $7 trillion too much currency in the system.

And it must come out to fight inflation.

And how do they (the Federal Reserve) take money out of the system?

They withdraw it from the money center banks, a.k.a. the Wall Street establishment.

“This market” is ripe for significant correction and recession if for no other reason than government needs a sensational event to shield its monetary drawdown – and with $9 trillion of U.S. debt to refinance in the next twelve months, to fulfill its justification for a lower interest rate policy.

And who better to blame for catastrophe than Trump – this time for his “stupid tariff policy.”

This dynamic must remain in your calculus.

Because around the corner is a great opportunity.

Capitalizing on it requires cash.

That’s my two cents.

Stay tuned…