Hard to believe it’s been two years since my last blog but that is indeed the case…my apologies for the hiatus but I’ve been doing some heavy research and analysis on stocks, markets, and of course my 15-51™ method. The findings have been incredible – and have spawned a new angle in financial science that more accurately identifies strength (and weakness).

Applying the Science of Strength, as I call it, promotes enhanced stock selections and facilitates building stronger portfolios that produce even greater returns with a dramatic reduction in risk. I’ll be sharing it with members of my new network, a venture dedicated to supporting independent investors. More on that in a bit.

My last blog entitled, PERFORMANCE AND OPPORTUNITY, was posted in September 2022 and highlighted several key points that investors should always appreciate; the first of which is: investment is all about performance.

If your portfolio isn’t doing exactly what you hoped, planned, or intended, it’s time to reevaluate it with a sense of urgency. (Let me know if I could help.)

Second, there is only one way to make money with investment and that is to buy low and sell high and to do so after the effects of inflation (also known as Real return on investment). Because let’s face it, if you’re earning 8% per year and inflation is running at 10% per year you haven’t gained anything, and in fact, have lost 2% per year.

The purpose of investing is to accumulate long-term wealth, which is impossible to do if gains do not cover fees and inflation.

The third point investors should appreciate from my last blog is that the easiest way to make money is to buy low when everything is on sale and selling at deeply discounted prices, like during major stock market corrections when value is abundant. Investors need cash for that.

Being 100% invested is never an ideal strategy.

And the final point I’d like to reiterate from that blog is this: a major buying opportunity, long in the making, continues to head our way.

It may be hard to see on TV but the world maintains a steady march towards economic calamity, civil unrest, world war, and another financial crisis. Never before has the global system been so abused and mismanaged.

In the U.S. consumers are strapped, cost of living remains persistently high, wages haven’t been compensated, and the economy is lethargic because of it. And here comes Trump with the promise of cutting government by $2 trillion annually.

That’s great—America needs smaller government! And while that’s a good thing long term, budget reductions are inherently recessionary because government spending is shrinking.

And the financial establishment won’t like that one bit. Remember, government losses create U.S. Treasury Securities (bonds). Wall Street is the broker of record for said bonds and is responsible for selling them to the world. They do it for money – sales fees and commissions – it’s their business. Less government debt translates to less U.S. Treasury bonds to sell, and that means less Wall Street profit. And for them, there’s no better way to show their disapproval of this than with a swift stock market selloff.

Recessions always trigger stock market selloffs.

One of the truly remarkable marketing campaigns ever executed is how the Democrats have convinced America that Wall Street is owned and operated by a bunch of rich, white Republican capitalists, when in fact it is owned and operated by a bunch of rich, white Democrat socialists who profit immensely from the big business/big government partnership.

Small businesses aren’t listed stocks, and few play the political big-donor game. Hence the reason Wall Street and government do everything they can to put the little guy out of business. Think Covid-19. When Wal-Mart was allowed to operate but Mom-n-Pop general stores had to remain closed because they weren’t “essential”.

American policies are stifling, piggish and highly inflationary.

Think about it this way, the U.S. Congress spends more money per year ($7 trillion) than the entire Germany economy ($4.5 trillion) and Trump is promising to cut the size of the Russian economy out of the budget ($2 trillion).

U.S. central government collects $5 trillion in annual taxes (also greater than the entire German economy) but somehow they can’t live on that. And so every year they add two trillion in new debt to the $35 trillion we already have outstanding. Piggish is the word.

New debt translates to new money, which produces more inflation.

Add to that regulatory burdens like: No Child Left Behind, the Patriot Act, Obamacare, open borders and the expansion of Social Security and Medicaid to include illegal, non-citizen migrants, that are destroying our way of life and the American ideal itself.

It’s no wonder a guy like Trump won.

The roots of big government are wide and corruption runs deep. And no one knows this better than Trump. Purging the bureaucratic state will not be easy. Which is the reason he’s building the kind of cabinet he is. He’s assembling a special ops team to battle the enemy from the inside – and the administrative state will not cede without a tenacious fight.

Governments control markets – and that government will be at war with itself while the new administration attempts to take the wheel and navigate a completely different course.

In other words, crazy times are here and more are coming.

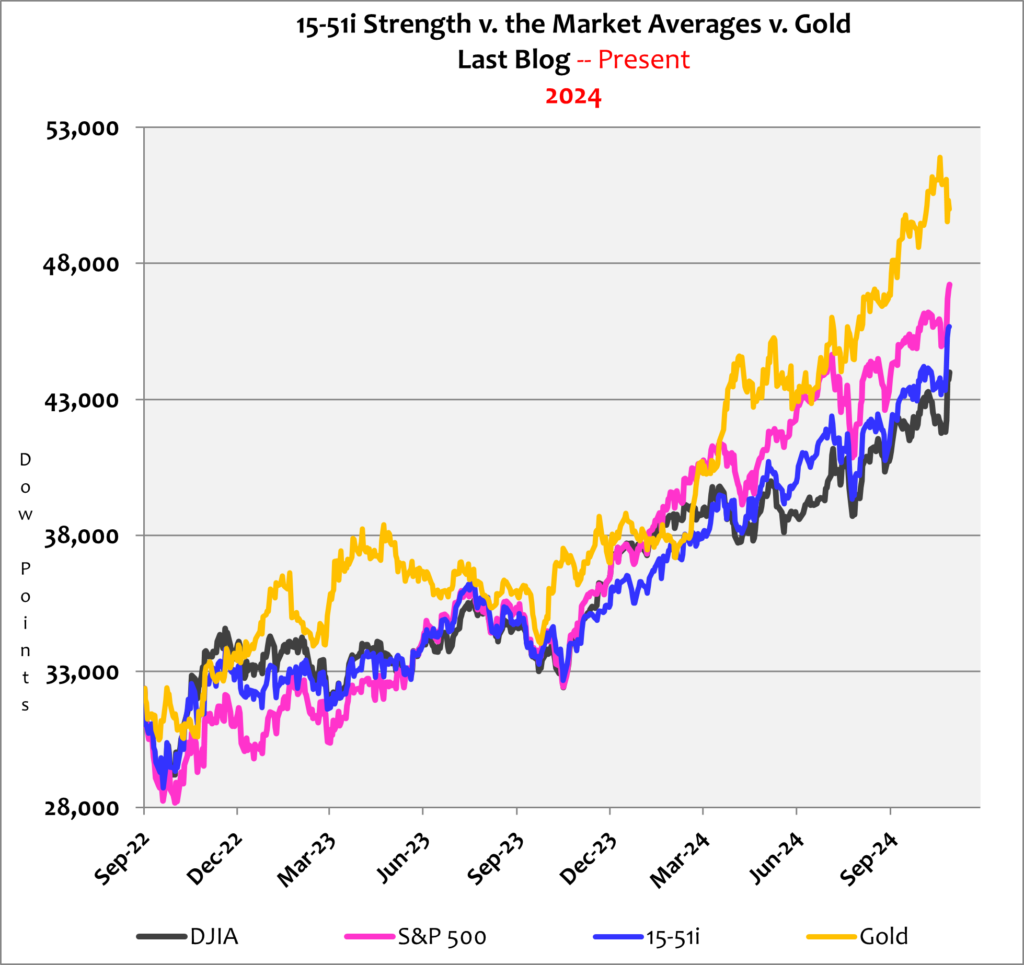

Despite this, stock market valuations have never been higher. In the two years since my last blog the stock market Average (average of DJIA and S&P 500) and the 15-51i strength indicator gained 41% to all-time highs; the tech-heavy S&P 500 posted a two-year index-high of 46%. Gold jumped 49% higher during the same time, which is really no surprise when considering the atrocious fiscal and monetary policies coming out of Washington DC. That’s also the reason Bitcoin is establishing new highs. See below.

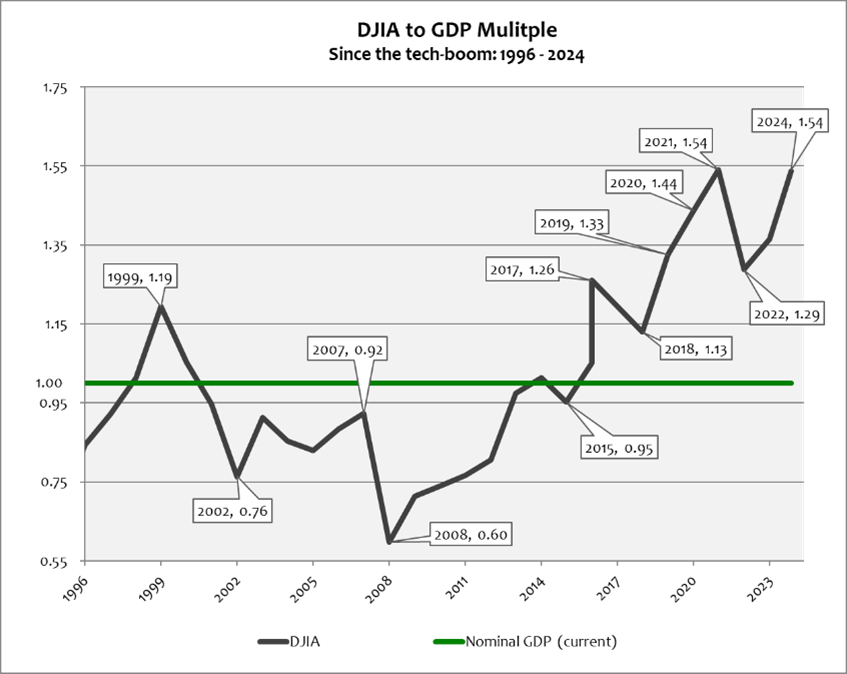

So exactly how high are stock valuations?

Over the last three decades, spanning three major stock market expansions (the tech boom, housing boom, and the QE boom) and two major contractions (the tech-bust and the 2008 financial crisis), the Dow Jones Industrial Average to GDP multiple has never been higher, a valuation last reached, ironically, in Biden’s first year in office. See chart.

The Covid correction went full cycle in 2020, meaning the stock market hit bottom early in the year and fully recovered by the end of year – a very rare occurrence to say the least.

The next correction will hit harder and last longer because it will be more real, more serious, and more transformative than Covid (if you can imagine that) – because there is more inflation and corruption in the market system and stock prices.

It will nevertheless present a tremendous opportunity. Now is the time to reassess your strategy and portfolio positioning.

As mentioned at the top, I’m creating a new support platform for investors – a safe place, free from establishment pomp and circumstance and any kind of sales pressure or promotion – where investors of all skillsets can go for unbiased information and analysis, and a different kind of coaching and support. I posted a short video on my website that provides more detail (click here). Check it out and let me know if you want to chat.

I’m back in the saddle — so you’ll be hearing a lot more from me moving forward.

Until next time,

Stay tuned…