Stocks remained largely unchanged this week as December activity for wages and prices were reported. The Producer Price Index (PPI) for finished goods rose .4%; CPI (Consumer Price Index) rose .3%, and Real hourly earnings fell .3% in the period. That’s prices up (a.k.a. inflation) and earnings down in America, and when the topics of last week’s blog are considered (unemployment and welfare) it’s easy to see that working consumers and taxpayers are the big losers in today’s economy. Perhaps this gave the stock market pause this week.

Or maybe it was the International Monetary Fund (IMF) who warned this week about the rising risk of deflation, the general decrease in prices. While falling prices may sound good to consumers who are experiencing falling Nominal wages, it is an absolute bear to correct in the marketplace.

Prosperity wants moderate, predictable, and manageable price progression. Investors want the same thing. The reason is quite simple: rising profits are much easily had in a market with rising prices. Inflation is a sign of forward progress, where stronger currencies and vibrant demand-driven markets cause production and labor to expand, which in turn causes the prices of goods to rise. Indeed, runaway inflation is a horrible thing – especially when price inflation greatly exceeds the general rise in wages. However bad that may be, it is much easier to correct than runaway deflation.

Deflation is the complete opposite of inflation. Falling prices signifies that production and supply are in excess of demand, which causes lower prices to spur-on demand. Such a condition ultimately causes production contraction and higher unemployment, as fewer employees are required to produce fewer goods. Deflation signifies a shrinking Market – one that makes profit and ROI advancement much more difficult to realize. Deflation is a sign of demise, and is extremely difficult to correct.

Of course, the IMF used the deflationary argument to urge new Federal Reserve chairwoman, Janet Yellen, to avoid “premature withdrawal of monetary support” – a.k.a. QE.

What a load of bull…

If quantitative easing (QE) was an effective monetary program then production would be expanding, market activity would be growing, and labor participation would be rising. In such a case the concept of deflation wouldn’t even be considered a valid point of conversation, let alone reported as a “major market risk.”

After so many years into the multi-trillion dollar QE program the condition of falling prices shouldn’t even be mentioned. Increasing the monetary base causes currencies to weaken and prices to rise – always; as weaker currencies require more dollars to purchase the same amount of goods. That’s inflation, not deflation.

The problem with QE is that the new money hasn’t gotten down to the basic Market level – Consumers and Enterprise. Instead, the monetary benefit of QE has remained with big Wall Street banks and poorly managed sovereign States. That’s why inflation can only be seen in the stock market.

The stock market has long been considered a leading indicator of market activity – a prelude, if you will, to what the market economy will experience at some future point in time. But that dynamic has become less true in a world where radical monetary and fiscal policies of central governments placate rich bankers instead of the general populous.

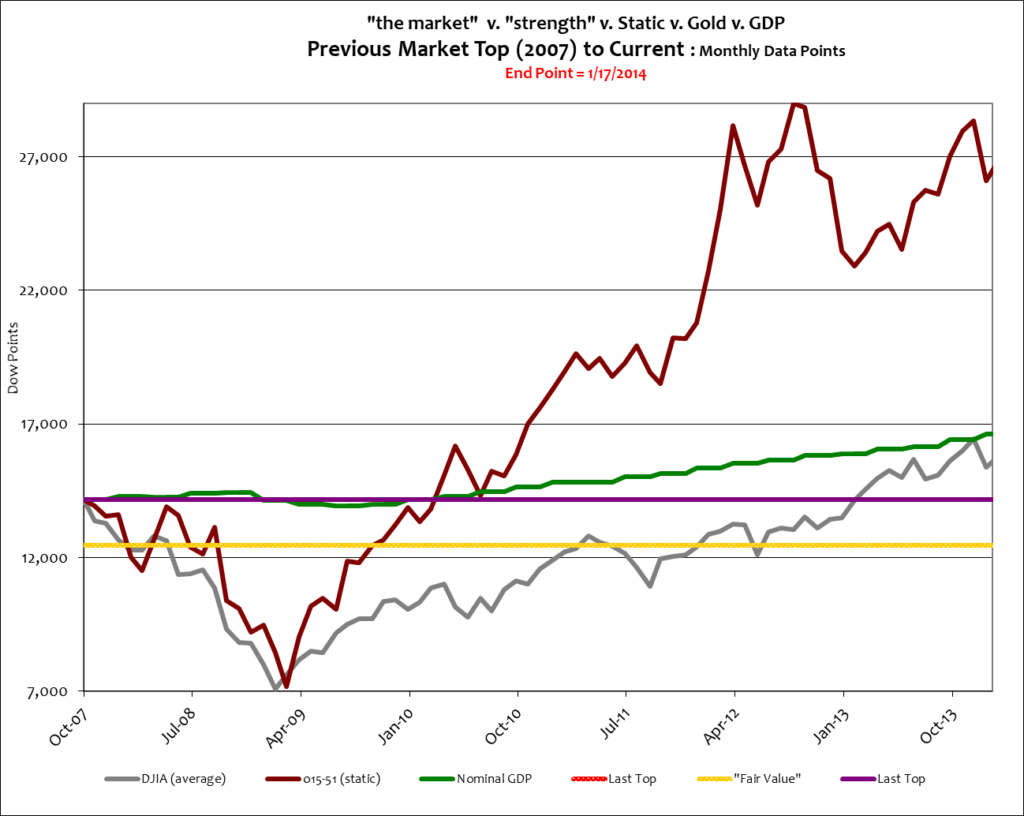

For instance, recent stock market activity indicates that the market economy is on the upward move and totally recovered from the last downward correction. See below.

The Dow Average, looking to indicate the market average, has finally reached its objective of Nominal GDP. Great. It took the portfolio long enough, and many structural changes, to get there. But its performance shouldn’t be mistaken for Real market growth – because as you can see, Real GDP hasn’t grown at all since the last market top.Stock market strength via the 15-51 Indicator has almost recovered completely since its September 2012 correction. But this, too, shouldn’t be confused as a reasonable valuation.

Gold seems to be building a bottom base, but its market is also corrupt. Indeed, its future movements will be interesting to evaluate. However, investors shouldn’t consider its value to be Real in relation to the current Market dynamic. All markets, including the bond market, are extremely manipulated.

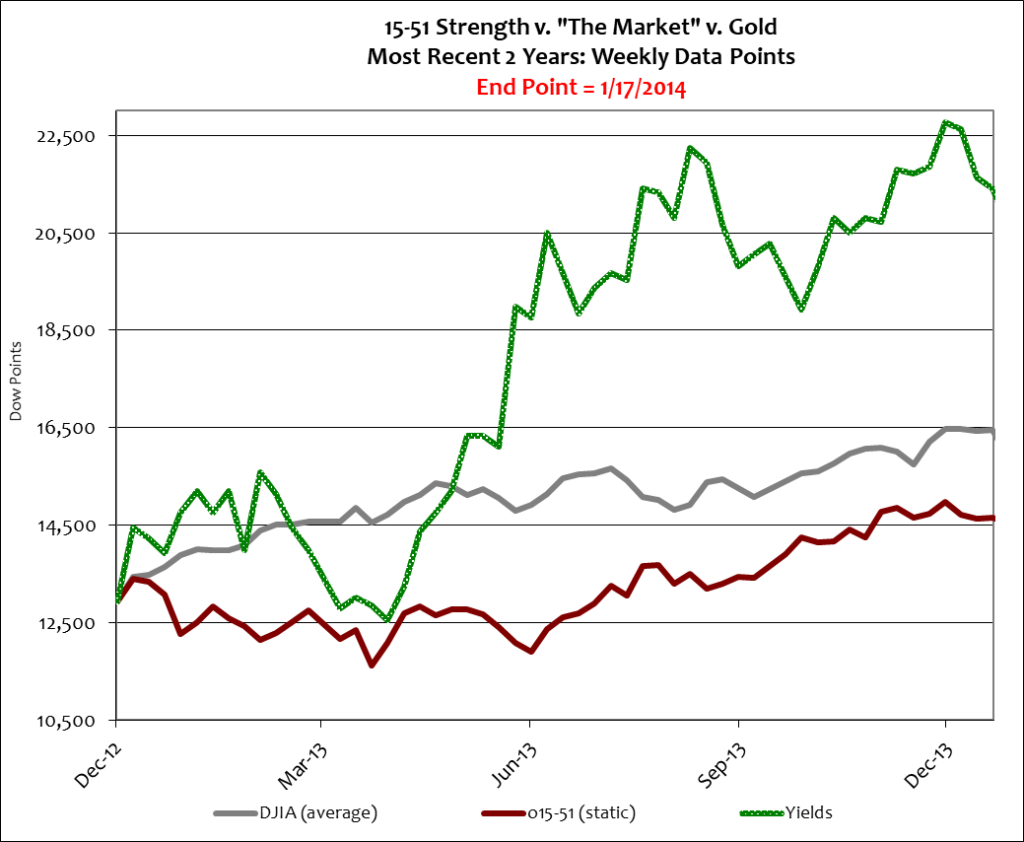

Yields have been all over the place for several years: down, up; down, up, down; up, down…That’s an indication of a market that doesn’t know how to properly value its underlying assets. That is to say, volatility is an indication of uncertainty. And when you consider that the real problems in the American Market are derived from failed monetary and fiscal policies that are creating too much money and too much debt – it’s easy to understand the instability of yields. See below.

QE, the monetary force intended to keep yields low, has created another stock market bubble – the irrational exuberance of stock valuations – while not expanding the economic base. So for those saying there is no inflation present in “the market” – they clearly haven’t looked at the stock market.But has QE made big banks stronger? Yes – but only to an extent.

Indeed, big banks have more cash and profit, more marketable securities, and less “toxic” assets. Yes, there is no doubt that they are stronger for it. However, as a condition for QE banks have been mandated to buy significant amounts of U. S. Treasury securities with the new money.

Mandates corrupt markets and the businesses that operate in those markets.

For instance, as banks continue to accumulate massive amounts of U.S. Treasuries at all-time low interest rates their fiscal position becomes more and more vulnerable to rising yields. When yields rise the value of bond positions fall. So in the next major financial disaster – one where global currencies and bonds devalue significantly – big banks will have an abundance of depreciating bond assets that they can’t sell; for if they did, it would cause yields to spike even more dramatically, thus making their fiscal positions even worse.

And low and behold, what is upon us is another “financial crisis” – another one that the brainiacs on Wall Street and in big government didn’t see coming.

Such a condition can make positioning your portfolio for the year ahead a tricky effort. The best place to begin that process is by clearly defining your immediate (1-2 year) objectives. After that everything gets a whole lot easier.

Stay tuned…