When the topic of wealth redistribution surfaces most people think about taxes. While it is true that taxes are the most visible form of involuntary wealth redistribution, it is not the most egregious form of the practice. No. That high crime is free-market fraud with the intent to pillage – and Wall Street is notorious for it.

Taxes take earnings from individuals and place them in the hands of governments. The essence of government spending is to fund things that individuals or enterprises can’t do – or to a further extent, won’t do.

For instance, individuals and enterprise can never defend these United States as effectively and efficiently as a centralized effort can. Taxes are required to coordinate a cohesive force and united front to thwart an enemy attack. That security is a totally legitimate basis for taxation, and most people have absolutely no problem paying for it.

Much to the contrary, however, many taxpayers would never direct their hard earned profits to subsidize an unsustainable amount of welfare, food stamps, free housing, and free non-essential healthcare services, to able-bodied individuals without the ambition to help themselves in the first place. This unfounded level of charity has become commonplace in American government today, and it breeds a culture of dependence.

Government funded social programs have made it too easy for people not to participate in the labor force. That runs contrary to our founding principles, the cause of individualism, and everything that made this country great.

Irresponsible social programs increase the national debt and place a much higher tax burden on the working class – the middle class. Excessive taxes, whether under the guise of social equality or military defense, is a complete bastardization of the American system. It bankrupts the middle class, zaps incentives from small businesses, and crashes the free market.

Elections are about selecting fiscal managers to balance the budgets of tax revenues and appropriate expenses. And for the last twenty years both Democrats and Republicans have proven inept at the job. Even so, it is impossible to fire them all – however grand the idea. They perform functions that individuals and enterprise can’t do: and as a result, central governments and their according taxes will forever be a necessary evil in a civilized society.

That said, taxpayers must come to grips that a large portion of their taxes paid will be misappropriated and produce little to no return on investment. That makes gains on private investments all the more important.

Just one week after this news headline appeared in the Wall Street Journal on-line: Wall Street Takes Shine to Argentine Bonds – Argentina defaulted on all of its outstanding debts. That’s right, large U.S. financial institutions like Bank of America, Goldman Sachs, and JP Morgan Chase have been aggressively seeking to lend more money to the failed Argentinean government just moments before they defaulted on all their debts. And if you own a mutual fund in fixed income investments – that money is yours.

According to some estimates the Argentinean default will cost American investors more than $30 billion, and that’s a great shame.

Let me ask rhetorically: What do governments do with the money in their control, whether the monies are derived from taxes or borrowings?

Governments spend money according to their political agenda – infrastructure, education, defense, or social welfare. Social programs have increased dramatically in Argentina since 2007 and the government has produced multi-billion dollar deficits ever since. Billion dollar deficits might not seem like a lot of cabbage here in America where trillion dollar annual deficits have become commonplace, but billion dollar deficits are a really big deal in a Market like Argentina. Consider this…

Total economic output (GDP) in Argentina is just $475 billion; America’s economy is $17 trillion. Argentina’s debt to GDP is an extremely low 46% (or $215 billion) while America is 100% leveraged ($17 trillion in debt.) By the looks of these numbers it appears that Argentina should have an easier time paying its debt than America. But that’s not true.

The Argentine Market is in much worse shape than its American counterpart: Argentina’s economy is steadily shrinking, their inflation is 26%, and their tax rates are crazy: corporate income taxes are 35% (like in America), but their personal income taxes are 35%, sales tax is 21%, and their social security tax rate is 44% (27% paid by corporations and 17% paid by individuals) – and, as you might expect, their labor participation is a dismal 49%; which is to say that one out of every two Argentineans don’t work.

In short, the Argentinean government has bankrupted their Consumers, zapped incentive to profit from Enterprise, and crashed their bond Market.—Yet the Wall Street establishment was looking to lend that Market billions more of new money.

But that isn’t their money. It’s your money – if you own a fixed income or high yield mutual fund, that is.

By creating the perception that ‘you’re too stupid to invest on your own’ Wall Street creates a Captive Market: You need them, because you can’t do it yourself. They advance the false impression that investing is too complicated, too difficult, and requires too much time that ordinary folks can’t muster. Investment is not a one person job, they say, it requires a team of skilled and experienced professionals. So they say, Give us your money because we know what to do with it. We’re the experts. You’re not. Trust us. We’re the best money can buy. You’re just you: incapable. You need us.

Under this false guise Wall Street snatches money from American middle class clients who have worked hard and saved judiciously– and then directs that money into the failed Argentinean Market. Does that sound smarter than you?—And one should note: this isn’t Argentina’s first rodeo. Not too long ago in 2001 they defaulted on $100 billion, which was the latest notch on their long and lengthening rap sheet. Yet Wall Street was looking to lend them even more money – more of your money, if you own a leverage fund, that is.

Why would they do this?

Money and Control.

First, Wall Street banks receive a sizable fee to sell Argentinean debt to their American customers – you know, the “rich.” The risk is sizable, but heck, it’s not Wall Street’s money – it’s yours. And just like lending money to a heroine addict, the next fix for Argentina wouldn’t solve anything. More debt would only prolong the agony of self-destruction, just like an addict.

Prolonging the default provides Wall Street with the opportunity to earn high rates of interest (Argentina recently sold short-term bonds at 26% interest) for their clients, who then pay the Wall Street establishment management fees and performance bonuses – without risk of loss, of course. Remember, Wall Street doesn’t loan their money to Argentina; they lend your money. Fees, underwriting, and commissions for connecting you with Argentina is how Wall Street makes money. In other words, placing bad investments overseas is a money maker for the Wall Street establishment. And they do it all for you.

Aren’t they nice?

Second, the ugliest way to make money is to control people. Both the government and Wall Street do this.

The government does this through taxation and social program spending like Social Security. They take more of your money through taxes and thus make it harder for you to save and invest, which bolsters the need for a nationalized retirement plan.

Wall Street does this by convincing their customers that they need their product (investments) and their services (mind and management.) They create product demand by pointing out the obvious: Social Security is bankrupt, and supplementing it is vital. Then they create service demand by corrupting markets and confusing customers with complicated rhetoric and onerous explanations. If they are successful, then you are their Captive Market. They control you, your money, and your net worth.

Independent wealth is the greatest liberator. Think about it. If you become a savvy investor and have enough money so that you don’t have to work, don’t have to worry about retirement and the rising costs of senior citizen healthcare, then who would need Wall Street? Who would need Social Security?

Social Security is a domestic means of wealth re-distribution. That is, a redistribution of wealth that occurs within U.S. borders. Okay, fair enough, let’s assume we want that: domestic redistribution of wealth.

That is much different from an American transfer of wealth to foreign countries.

When the government taxes your earnings and then sends a multi-billion dollar aid package to the Palestinian territory – they send your money there. It’s a transfer of wealth from one country to another.

The Wall Street establishment does the same thing but in a different way.

When Wall Street solicits your capital and places it with Argentina they temporarily transfer your money to that country. When the country defaults on its obligation to repay the monetary transfer becomes permanent – like a tax. In other words, by way of Wall Street’s control over the capital of American investors, Wall Street forces Americans to pay for social welfare programs in Argentina – without the ability to vote that government out of office or change its policies.

Talk about taxation without representation.

Wall Street profits from your money to procure bond transactions and then spreads the remains throughout the world to nefarious recipients. Wall Street and the U.S. government steal wealth from middle class Americans (92 million Americans own mutual funds, one out of three people) and create a higher degree of dependency and control over American consumers and investors by so doing. This expands the role of government and Wall Street banks, as the loss of capital ensures consumer/taxpayer reliance on them for generations to come.

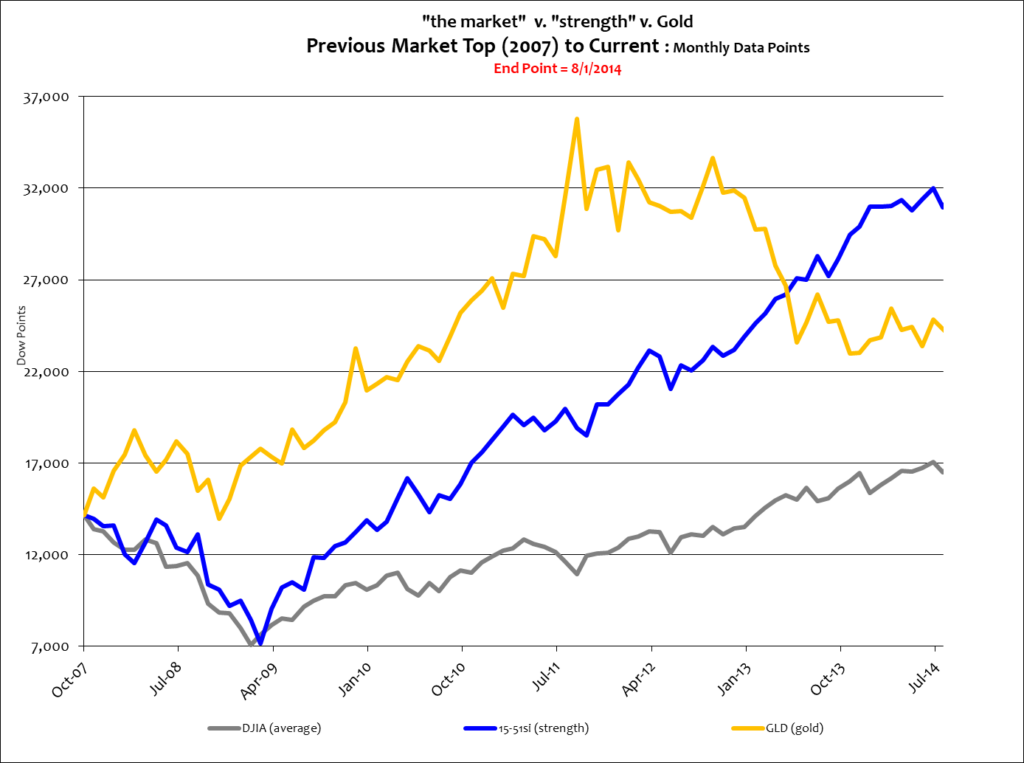

The objective of the Dow Jones Industrial Average is to indicate the market, Nominal GDP, which it reliably does. The DJIA, therefore, indicates average returns. Since the last market top (October 2007) the Dow has gained just 16% – which is a tough pill to swallow if you just lost your luggage in Argentina.

The objective of my 15-51 method is to produce above-average returns – without taking the extraordinary risks associated with foreign investments in poor markets like Argentina. In the time period shown above my 15-51 portfolio more than doubled; it gained 118% since the last market top – which is more than seven times the Dow’s return.

It’s never a bad time to take control of your investment capital. No one cares more about it than you do, and no one will do a better job managing than you will. And let’s face it: it doesn’t take a rocket scientist to figure that there is absolutely no reason to lend Argentina money until they get their house in order, and they’re a long way away from that.

Argentina was a bad bet.

The sad thing is that Wall Street was too stupid figure it out or too corrupt to admit it.

And the travesty is that they did it all with your money.