Gold lost more than a point last week when news broke the U.S. dollar had hit fresh new highs against the Euro and Japanese Yen. That was on the first trading session of the week, a day when gold lost 1.8%. Remember, the U.S. is the world’s reserve currency, and when currency is strong gold is weak.

Adding to the false impression of a strong currency market was the “raft of improving U.S. economic data” many media outlets were reporting. They cited improving consumer confidence and a bettering condition for labor and employment. Again, this news broke on the first day back from the Labor Day holiday, Tuesday, September 2, 2014.

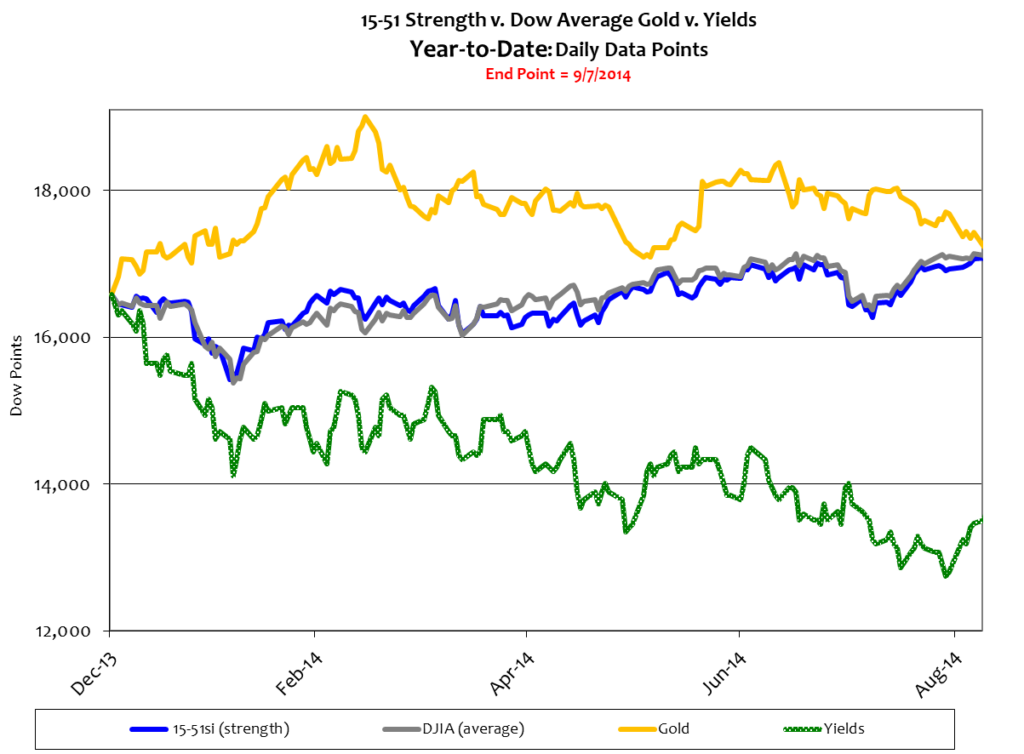

Institutional investors that are programmed to trade on the newest news place trades according to logarithmic formulae. When the value of the Yen and Euro fall against the dollar the trade goes in: buy the dollar and sell gold; sell bonds and buy stocks, because a stronger currency indicates economic strength and increasing profit for enterprise. That’s why yields reversed course and rose 5.2% last week. See below.

Logarithmic trades are performed by machines without hearts, eyes or ears. Everything is a number, and every situation can be defined in a series of 0’s and 1’s. But the language of computers, binary code, is not intuitive. It must be fed information by people, and that’s where the corruption begins.

Information inserted to trading platforms is an instruction to act. But if the data never gets there – say, if it isn’t entered into a system to be considered – trading goes on as if the condition doesn’t exist. The computer, without a free and intuitive mind of its own, simply doesn’t know a new fundamental has been made available, and so it conducts no trade to compensate for the new condition.

At eight-thirty in the morning on Friday, September 5, 2014, just three days after news broke about the “strengthening” U.S. dollar, the Bureau of Labor Statistics released is most recent jobs report – and it was awful. Employers added just 142,000 jobs in August, and numbers for July were revised down by 28,000 jobs. Through July employers had averaged just 226,000 jobs per month, a pathetic amount by any account, and well below what is required to truly correct the course of economic output. One would think this negative employment fundamental, a reoccurring theme in this “recovery”, would have been considered during trading hours on Friday, September 5.—But no, stocks ended higher on the day.

Perhaps the Wall Street establishment cut the Friday workday to instead head to the Hamptons for a little more R&R; maybe they spent the day at the golf club; or maybe they arrived to work late only to skip out early to a liquid lunch that consumed the rest of their day – whatever the case, the newest employment data was never automatically fed into their trading system for the shortened week of September 5.

That’s hard to fathom, isn’t it? – especially when considering that Wall Street brokers are always the first to preach that a team of dedicated people monitoring every piece of information every second of the day is required to invest successfully.

They clearly don’t practice what they preach. Look at my shocked face.

More sadly, however, is that the Wall Street establishment is just as robotic as their programmed trading logarithms; and like computers, they too don’t have a heart, clear eyes or keen ears.

Wall Street players select and direct what information is considered for daily trading, and when. Their motives are geared to fortify their agendas – not the true market narrative, or what’s in the best interests of their clients. But there’s no reason to be confused or misled.

Employment gains during economic booms normally average 500,000 per month. America hasn’t come close to that during the whole “recovery” – even though the stock market is indicating a boom greater than that of the internet driven tech-boom. While 226,000 job additions per month is bad enough, a 35% drop from that in August should have certainly caused the stock market to reverse the course of “stronger dollar” gains reaped earlier in the week. It should have been automatic, or should I say, programmed to be automatic.

Point number one: stock market trading is choreographed by Wall Street players and manipulated through large institutional investors; always has been, always will be.

Point number two: just because markets move on news doesn’t make the news, or the move, valid. Consider this…

The Euro Zone has been a chaotic mess that has been well chronicled in these blogs. Adding to its sordid history, European Central Bank chief, Mario Draghi, recently launched a QE effort and surprised the region by cutting lending rates again (to .05%) and placed a charge (.20%) on deposits. That is to say lenders won’t receive interest income as usual on deposits they hold; instead they will be charged interest expense for the cash they keep on hand. This is a move to encourage banks to lend, and to penalize them if they don’t.

The EU needs banks to start lending so enterprise can grow and expand. But lower interest rates won’t do this, nor will a charge on deposits. No one wants to borrow money over there because enterprise doesn’t see a worthwhile return on investment. Monetary policy can’t fix that.

Levels of investment and lending are at all-time lows in Europe because the EU’s economy is dying a slow death due to massive government regulations, poor fiscal policy and incompetent management, and extraordinarily high taxes. As a result, their currency should be falling against the U.S. dollar.

Japanese Prime Minister Abe followed the U.S. lead and adopted easy money policies to make their currency more competitive in a devaluing world. The Yen was too strong, and their goods were too expensive in overseas markets like the U.S., the Euro Zone, and China. This, of course, was Abe’s intention when his government employed easy money policies. So it should be no surprise that the Yen is falling as compared to the U.S. dollar. That’s what Japan was trying to do.

But this dynamic does not make for a strong currency market, or a strong U.S. dollar. Monetary strength cannot be derived from currency devaluation. Instead, monetary strength is derived from vibrant economies. And unfortunately there aren’t many of those in today’s world market.

News of a strengthening U.S. dollar is misplaced. Ditto to last weeks moves in gold and yields.

In fact, the only way investors can mistake a monetary race to the bottom as strength is to be blindly programmed like the binary code of an unseeing, unhearing, heartless machine.

Conditions remain ripe for gold and a significant correction in stocks.

Stay tuned…