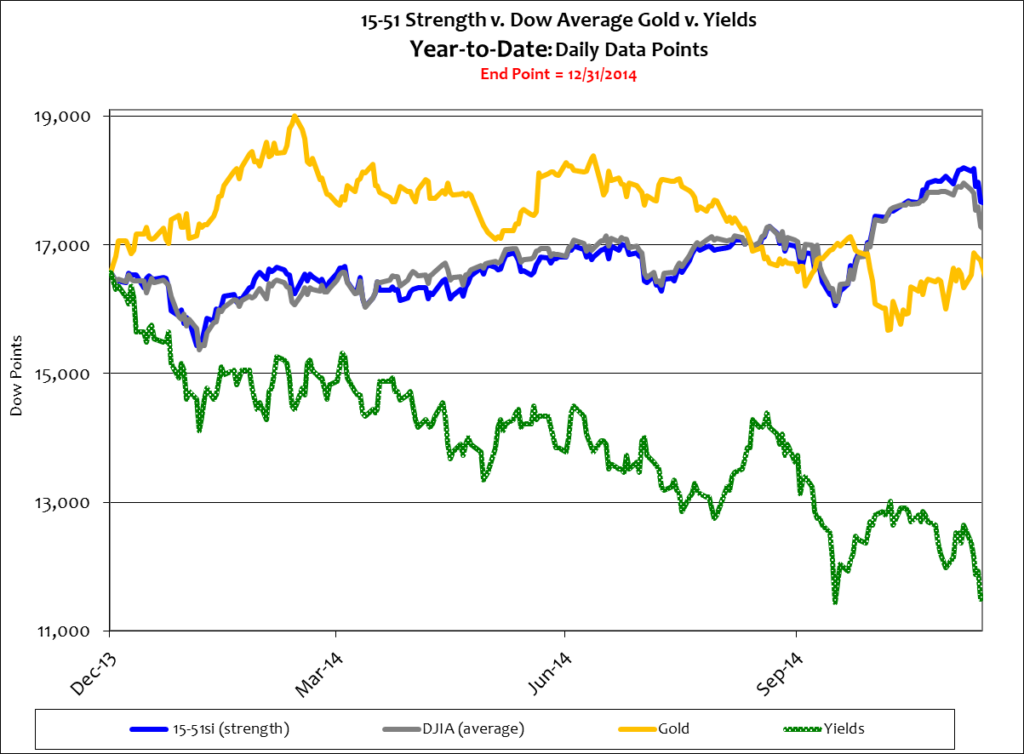

Stocks got slammed this week on the good news that oil prices continued to drop. Oil is now just $57 per barrel, down 50% from a year ago. Yet the Dow Jones Industrial Average lost 3.8% in the week and 15-51 Strength lost 2.9%. Gold added 2.6% and yields dropped sharply, again. The 10 Year T-Note is now trading at a paltry 2.1%. See below.

The hysteria surrounding the drop in oil prices is actually hysterical – a laugh out loud condition. For days we have heard some speculate that lower energy prices will add further drag to an already struggling world economy, and thus stocks went down.

That’s silly. Lower oil prices cannot hurt the economy and it’s disingenuous to say so. In fact, the same argument was made when oil prices were skyrocketing. Pundits can’t have it both ways.

The drop in oil prices is being cause by two things: 1) lower global demand, and 2) higher global supply.

There is little doubt that lower oil demand is being driven by a weak and weakening global economy. Growth is slowing in most major Markets, and some big producers like Japan and Germany are falling into recession. But it’s not a drop in oil prices that is causing those economies to shrink, or will cause them to shrink more; it’s their shrinking economies that are causing oil prices to fall, and perhaps fall more. Shrinking demand in the broader market is the real problem – and lower oil prices can only help that condition.

Higher global supply is coming from a boom in shale oil drilling in America and OPEC’s recent decision not to curb their output in the face of falling global demand. As mentioned in Records Abound, OPEC has their head in the game: They know lower oil prices put pressure on American drillers, and hurt Russia and the ISIS terror network.

Lower oil prices are good for many reasons.

Yet there were other pundits promulgating that the drop in oil prices is fueling deeper concerns about Euro Zone deflation, and so stocks went down. That, too, is silly.

Let’s make this simple: Lower energy prices are bad for oil suppliers and good for everybody else. Lower oil prices can lead to broader market growth and inflation because more dollars are being directed to more sectors of the economy, thereby lifting demand, and perhaps pricing, in those sectors.

Lower oil prices are better for the economy as a whole than higher oil prices could ever be.

Indeed, higher oil prices can contribute to broader market inflation because it is used in the production of so many goods, and because energy is required to transport all products to markets. I get that. But that’s not the Market problem right now. Lower demand is.

Besides, falling oil prices does not automatically bring about a fall in general prices – certainly not in the same way as higher oil prices will bring about a general rise in prices. Producers are more likely to capture the fall in oil prices as retained earnings, and then lower production to meet lower demand. Any drop in general prices relating directly to oil are long off into the future, at the very least.

That doesn’t mean world governments shouldn’t take deflation and the Market condition seriously. They should. These things could easily spin out of control.

The one surefire way to reverse deflationary pressure is to increase dollars circulating in the marketplace – and the best way to do that is to empower the consumer by cutting tax rates across the board, and by reducing the amount of government presence in market activity. If earners are given more of their hard earned money to spend they will spend it. Production will increase, unemployment will decrease, the economy will grow, and inflation will naturally return.

But, sadly, empowering consumers with more of their hard-earned dollars is never a viable option for today’s governments – Democrat or Republican, communist or socialist.

The problem with today’s governors is they are all in the same basket: They want to control the Market through central planning, a Keynesian approach, which has proven bankrupt throughout the course of history. That’s the reason deflation is such a threat. Governments do not want to empower People; they instead want to empower themselves. (see: Their Side, for more info.)

Increased government subsidies and monetary shell games cannot solve the deflation problem because they are only temporary in nature and rife with corruption. Tax rate changes are permanent (or at least long term in nature) and have a much greater impact on the economy because working People are rewarded with additional dollars to spend freely in the markets they choose.

Workers and earners are the vibrant consumers markets need to thrive. Stealing from them to boost welfare and Wall Street is not a solution to thwarting deflation.

So forget about the deflationary fears relating to the drop in oil prices and stocks. They’re misguided and misplaced. Over-reaching central planners do much more harm – query: Jonathon Gruber.

So why was the stock market down so significantly this week?

Simply put: Wall Streeters wanted an excuse to sell over-valued stocks because they’re scared of the lofty valuations at the present time. This week’s move was merely a price-value correction.

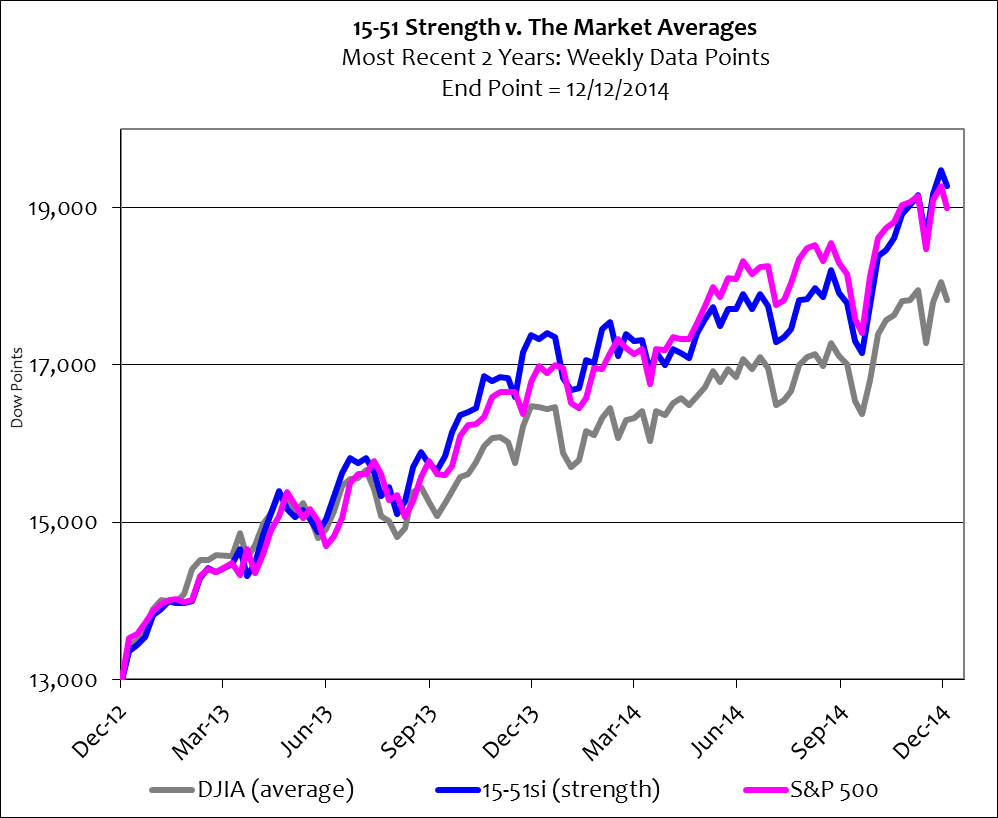

For more than thirty years I’ve been closely watching “the market,” and while it’s impossible to have seen it all, certain trends seem to reoccur over the course of time. For instance, during the tech-boom in the 1990’s the S&P 500’s performance trend crossed over the Dow’s at the top of the market, and then crossed under it at the bottom. This characteristic (the S&P 500 crossing over the Dow at the market top) is common in advance of corrections. This dynamic also happened during the housing-boom — and now it has happened again with the QE-boom. See below.

The S&P 500’s performance trend remained above the Dow’s for three years leading up to the crash of ’08. In today’s market, the S&P trend has been over the Dow’s for a little more than a year. So if history repeats, the next major correction (much different from mere price-value corrections) will likely occur around the time the Obama presidency ends.

And wouldn’t that be apropos.

Stay tuned…