November unemployment held steady at 5%, as 211,000 jobs were added in the month. The scuttlebutt now is that the “strong” jobs performance paves the way for the Federal Reserve to finally make a move and raise interest rates during their December ’15 meeting.

If we are to believe the mass media’s spin on this — that the Federal Reserve suddenly has the qualifications to raise interest rates because unemployment came in at 5% for the second straight month — then there isn’t anything we won’t believe.

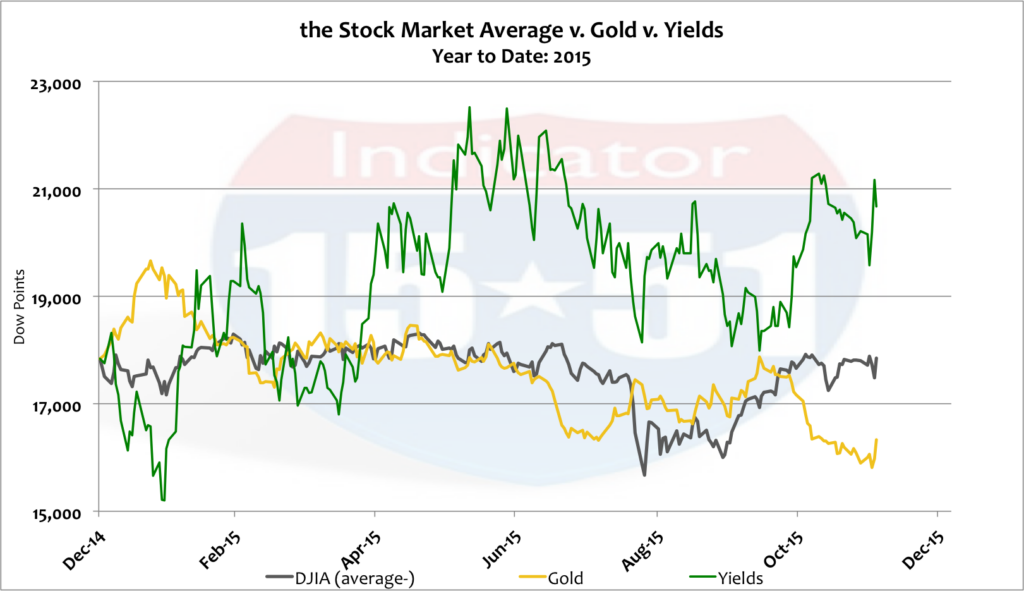

The unemployment rate has averaged just 5.3% for that past twelve months. The economy has grown steadily year-over-year, albeit meekly, for several consecutive years. Banks have consistently tested to be solvent in a post-crash context, and the stock market has regained its footing after the scare China put into the world in August. Yields have jumped and gold remains weak — consistent with a booming economy and strong dollar — so all is hunky-dory, right?

Why, then, is the Federal Reserve so scared to raise its core interest rates?

Everyone knows that legitimate economic booms can easily handle higher interest rates while maintaining robust growth. So what’s the big deal now? Why is Fed chairwoman Janet Yellen so tentative to raise rates from nothing to a quarter-of-a-point?

First things first, it’s hard to consider that the number of jobs added and the unemployment rate are “strong” as long as labor participation remains at levels not seen since the 1970’s. To be specific, the last time participation in the labor force was as low as it is now (62.5) was during Carter’s malaise in October 1977. Since that time labor participation averaged 65 during the Reagan/H.W. Bush expansion, 67 during Clinton’s tech boom, and 66 during the housing boom under G.W. Bush.

That, along with the weakest post-recession GDP growth since the last Great War, makes Obama’s QE boom the worst performing expansion in modern history. And while that may initially sound like a political statement, “Obama’s QE boom” is actually a factual descriptor.

Consider that in the first seven years of his presidency, Barack Obama has received 100% of every budget element he has requested. Not even Clinton was so lucky. Therefore, the operating activity during Obama’s term is entirely his — and he can’t blame Congress for spending frivolously, like G.W. Bush can and did.

So the Federal Budget deficits incurred under Obama’s tenure are his and his alone. He asked for them, and he got them, unencumbered.

Recall the history and purpose of quantitative easing (QE)…

The Federal Reserve, a supposed non-partisan group, is charged with managing U.S. monetary supply and carrying out interest rate policy. They created and employed QE to keep interest rates low in the wake of the 2008 crash, when U.S. central government went on a historic spending spree that still hasn’t ceased to this day. The purpose of this spending effort was to artificially, and temporarily, lift the free market economy out of recession.

The byproducts of this massive government spending program was unprecedented budget deficits that in turn created an unprecedented amount of new government debt (a.k.a. U.S. Treasury Securities).

But there wasn’t enough demand to service that debt and keep interest rates low. So the Federal Reserve stepped in by printing new money. That new money was forced through Wall Street banks that were then mandated to buy U.S. Treasuries with a significant portion of the new money.

In essence, the Federal Reserve created new demand for U.S. Treasury securities by printing new money — this to keep interest rates low — because at the time global capital was frozen or dried up. So without the new Fed demand interest rates would have naturally risen to incentivize investors to buy U.S. Treasuries. But the Fed didn’t want that. They wanted low interest rates. And as the Obama administration continued to pile up massive trillion dollar deficits year after year, QE became the mechanism to fund his government.

Regardless of whether he started the practice or not, the QE boom is Obama’s — just as the housing boom was G.W. Bush’s, and the tech boom was Clinton’s.

It might also be helpful to note again that the Obama administration has changed the definitions of many benchmark fundamentals, like the calculations for the unemployment rate and Gross Domestic Product. They did so to make things look better than they actually are — to mislead the public — because let’s face it, most people don’t talk about the unemployment rate and tie it to labor participation in the same breath. As a result, a low unemployment rate like 5% serves as a litmus test for the entire labor market and economy — ‘at 5% everything must be good.’

But Fed chairwoman Janet Yellen knows the whole story. She knows labor is weak, economic growth and value are fragile; and she knows the quagmire that QE created. She knows the world is a mess and getting weaker and more unstable. And she also knows her interest rate move will have significant global consequences.

There’s no doubt Yellen is torn.

By rights the Fed should have moved years ago. According to government benchmarks unemployment has been under control for years; economic growth has been steady since recovery in 2010; and the Fed’s low interest rate policy had run its course several years ago, and has actually been hindering growth and lending since. But the Fed didn’t move. Not because it wasn’t good for America, but because they were scared of the global ramifications. And they are still scared today (see: THE FED’S MISPLACED PRIORITY for more info).

So the majority of the rate dilemma is that Obama’s QE boom has been all sizzle and no steak. It has failed to produce an economy that encourages work, profit, and investment. And unfortunately the world followed his lead, which is why the much of the world is suffering from the same kind of quandary — regardless of a few seemingly strong fundamentals (like the unemployment rate).

But the heart of the issue is that so many central bankers in the world today believe that banks actually create jobs — that somehow low interest rates are the pathway to long-term market viability — and that cheap and easy money policies can actually lead to prosperity.

Indeed, every borrower wants cheap money — but banks must be willing to lend at those low rates. Remember, banks no longer have to lend money to earn profits. They can instead focus their efforts in the more profitable areas of investment brokerage or insurance.

This is not to mention that many businesses have been unable to borrow money at these historically low rates due to the massive amount of industry consolidation that took place in the wake of the ’08 crash. This should not be overlooked as a significant growth impediment for the foreseeable future.

Think about it. Banks got much larger over the last several years, and as logic would infer, big-banks prefer to do business with big-businesses. But small and midsized businesses are the ones that fuel the vast majority of economic growth and viability. Yet consolidation has squeezed them out of the debt markets.

There are so many reasons for the economic fragility that is making the Fed so apprehensive, it is impossible to mention them all here. But there’s one more point I’d like to highlight before relating these conditions to investment activity.

QE was a tool used to increase the size and scope of government under the guise of “helping” the economy fight the post-crash recession. When government increases at such a rapid pace, businesses get bigger through consolidation to balance the power in the marketplace. In a bigger world, individuals get smaller. They lose worth, opportunity, and independence.

For instance, in the wake of the ’08 crash government programs and regulations like TARP, HARP, and DODD-FRANK, propelled the financial industry into a wave of consolidation. That lead to local and community banks being sold off to bigger players because they found it impossible to compete in the environment created by big-government regulators — which ultimately hurt individuals and small businesses.

The same thing is happening right now in the healthcare industry. The big-government program known as the Affordable Care Act or ObamaCare (which had nothing to do with care or making it affordable) has spurred a wave of consolidation throughout the industry: Aetna is planning to buy Humana, Anthem is seeking to buy Cigna, DaVita Healthcare Partners is buying the Everett Clinic, Walgreens is acquiring Rite-Aid, and Allergen is in a deal to merge with Pfizer, and the list goes on and on.

And what is the individual left with?

Less options, worse coverage, and more costly premiums, co-pays, and deductibles.

All of this market chaos makes simple quarter-point interest rate decisions seem like rocket science — even to the Fed. And that’s the same reason why the markets look so confused right now.

Let’s take it step by step.

An interest rate hike is a tightening monetary event — a strengthening of the value of money, as dollars cost more to borrow, and dollars earn more interest on bank deposits. In other words, stronger dollars earn more money for their owners. Weaker dollars earn less.

In strong dollar environments, when economies are humming, and interest rates and stocks are rising, the value of gold (long a dollar hedge) falls. This dynamic is indicated in the short-term view below.

From this eleven-month view it looks as if the economy is entering a high growth condition accompanied by a strong dollar, as yields are up, gold is down, and the stock market looks poised to move higher.

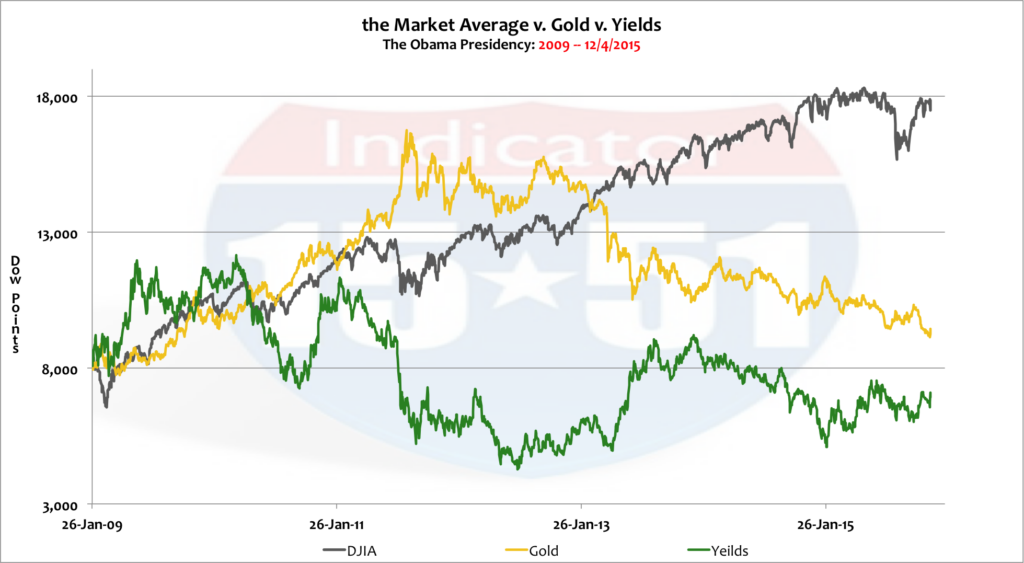

But that’s not where we are in the cycle. The economy is slowing, yields are still at historic lows (the 10 Year Yield is at just 2.25%), gold has been in correction mode since 2011 (it’s just $1,083 an ounce, GLD is $104), and the Dow Jones Industrial Average is just 500 points off its all-time high (18,312). The actual trend is much more clearer in the wider view shown below.

If the Fed acts now it will once again be acting too late — “the market” has topped out, the economic growth trend is weakening, sovereign states have accumulated way too much low interest debt that they cannot pay back, stocks are high, gold is low, and yields have a long way to go before they can be considered “normal.” Raising them now will only push the next major correction closer to commencement — and it’s going to be an ugly global nightmare that will cause a heck of a lot of pain for everybody — especially with an empty medicine cabinet at the infirmary.

And that’s what scares the dickens out of Dr. Yellen and her hospital staff at the Fed.

Stay tuned…