I don’t normally read the USA Today but was traveling on business and a complimentary copy appeared at the doorstep of my hotel room every morning. Interestingly, an article appeared in the March 15, 2016 edition that reaffirmed the foundation of my investment philosophy. The article entitled, Most Fund Managers Not Hot Shots, appeared with a subtitle caption, Study: 66% can’t match S&P results.

The 66% metric related to “actively managed” funds for a single year, 2015. But the study reveals that performance is even worse over longer periods of time. For instance, 84% of professional fund managers fall short of S&P results in the latest five-year period, and 82% underperform in the most recent ten-year period.

The article predictably pointed to a few common misconceptions, like, “Fees explain a lot of the long term underperformance,” and that 2015 was a particularly difficult year to pick stocks, as “The median stock did worse than the S&P 500 overall,” which led to the conclusion that investors are generally better off with low cost index funds that mimic the actions of broader market indices like the Dow Jones Industrial Average and S&P 500.

But is that good enough?

The Dow Jones Industrial Average has gained 68% over the last ten years. During that time inflation was 20%, leaving a net Dow return of 48%; or approximately 5% per year. That’s $5,000 in gain per year on a $100,000 investment.

That’s the best-case scenario for mutual fund owners. And while an annual 5% gain may initially sound good, it’s actually terrible. Think about it this way…

Over the course of a full year’s work (40 hours per week for 52 weeks) $5,000 amounts to just $2.40 per hour – an illegally-low paying job. The federal minimum wage is currently around seven bucks an hour.

The average household income for a mutual fund investor is $80,000 per year, or $38.46 per hour. That is to say that the average investor earns a total of $40.86 per hour ($38.46 on their labor, and $2.40 on their investments.) The gain on investment raises their annual income to $85,000 – a 6.5% bump.

No doubt, the average investor can make money if their mutual funds match the Dow Jones Average over the long term. But again, is that good enough?

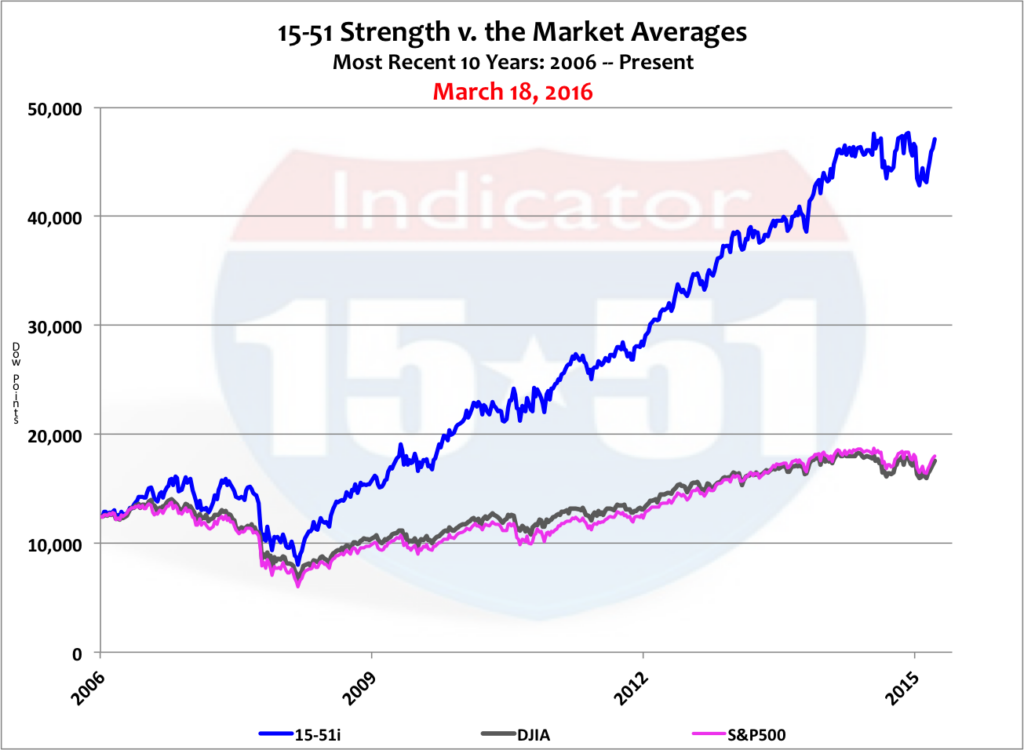

Contrast that performance to those who make the most of their investment dollars by applying my easy to use 15-51™ method. Using the same 10-year period and $100,000 investment, my 15-51 portfolio returned 246% after inflation, or 25% per year. That amounts to $12.14 per hour for a full workweek – five times the going rate of the best mutual funds!

And with more than $25,000 in gain per year, the 15-51™ investment return raises the average investor’s annual income to $105,000 – a 32% boost in wealth!

You see, investment isn’t just about making money. It’s about maximizing the monetary worth of your hard-earned dollars. It’s about making the most from your money.

And who best to produce that wealth?

You.

Yes, you.

Now, I know it’s hard to believe that you can outperform every mutual fund manager on the planet. After all, Wall Street has spent billions convincing people that mere mortals aren’t qualified to comprehend or perform the investment function successfully – and that message is reiterated all over the place.

It resurfaced again last week in a Wall Street Journal article entitled, The Three Worst Words of Stock-Market Advice: Trust Your Gut. At then end of that article, author Jason Zweig quoted a legendary value investor and Warren Buffet mentor.

“No wonder the great analyst Benjamin Graham wrote in his book “The Intelligent Investor,” after which this column is named: “The investor’s chief problem — and even his worst enemy — is likely to be himself.”

Nothing could be further from the truth. The greatest asset every investor has is himself. His worst enemy is the Wall Street establishment.

All investment begins with investment in self. And as such, the investor’s chief problems are their failure to develop successful investment strategies and techniques, and their propensity to rely too heavily on a corrupt financial services industry, a.k.a. the Wall Street establishment.

Successful stock market investing – that is, greatly outperforming any major market index and therefore all professional fund managers – is easy to do and simple to comprehend.

The reason mutual funds fail to outperform major market indexes has nothing to do with fees or stock picking challenges. It’s because they’re not built to beat “the market.”

My 15-51 allocation method™ is designed and constructed specifically to outperform the stock market averages. It is above average in every respect. That’s why it consistently produces above average performance results. See the ten-year chart below.

My 15-51 portfolio has half the risk and produces six times more reward than any mutual fund or major market index. The entire portfolio, and complete step-by-step instructions of the investment process, can be found in my award winning effort, LOSE YOUR BROKER NOT YOUR MONEY. It’s easy to understand, simple to use, and consistently produces results that are far superior to anything available on the market today.—And no one stands be behind their method like I do. Readership is supported by me personally, right here, free of charge.

Stay tuned…