Everyone likes justification for his or her cause. It is this need for validation that moves me to read every article detailing just how awful and corrupt the Wall Street establishment truly is. I know it all too well, of course. But even so those articles are read entirely and printed, and then added to a stack of similar proof. It’s a feel-good pile for me – proof that I am doing the right thing.

But that mountain of evidence serves another valuable purpose. In times like these when new news is so scarce and the markets are flat I refer to that heap of filth in search of inspiration. Reliable, as always, several of those articles will be featured in this blog whose central theme is very appropriate: Times like these are a great time to get back to the basics, back to the beginning, all the way back to Step 1.

Is your portfolio doing what it’s supposed to do?—Are you achieving your investment objectives? Can you retire comfortably on your current trajectory? Are you content with your risk exposure? What would happen to your portfolio should another major correction hit?—And how would such an event affect your retirement plan and timeline?

Market standstills are a great time to ask and answer those questions. Use the pause to re-evaluate your portfolio and its components, its performance and allocations, and the Market’s condition and prospects.

Investing is about building future wealth. In order to achieve desired future results investors must have an idea of what that future might look like. Success is near impossible without such consideration – a condition that incubates crisis. The first article from my collection highlights that very point.

In a Wall Street Journal piece entitled, Is There Really a Retirement-Savings Crisis?, the feature begins with a dismal announcement: “Social Security trust funds are expected to be depleted in 2034” and that the average person aged “55 to 64 has little more than $100,000 in retirement savings.”

At that point my mind was made-up. Yes, a retirement crisis does exist. But I read on anyway. It was feel good time.

The article quotes two experts with different views. One believed a crisis did indeed exist and the other didn’t. For people looking for actionable information from this article they received none. To use a military phrase, it is bad intelligence. The simple reason is that both expert positions fail to appreciate the accumulating burden of rising healthcare costs and its downstream effects.

We already know what happens when government gives free healthcare to a certain slice of the population: costs for everyone increase dramatically, choices deteriorate, and the government becomes a larger and more corruptive player in that Market (because they control a bigger piece of the market through funding, pricing, regulations and coverage mandates). Their overpowering presence creates more market dysfunction and higher prices.

Medicare, a program for which I am an ardent supporter, is a prime example of the kind of Market corruption government can inflict upon an industry by servicing just one small piece of a market. Consider first that the government never pays retail prices for any consumer good or service. So when they “insure” senior citizens they apply huge discounts to the stated prices of providers. This forces healthcare providers to make up the lost profits from other consumers, a.k.a. services to non-senior patients. This dynamic causes prices for everyone to rise – including the price for services to senior citizens.

Medicare is an entitlement program to seniors because they have paid for the insurance policy via a tax on lifetime earnings. Like Veteran healthcare (VA), Medicare is a valid and much needed federal program. Can anyone imagine what the free market would charge Granny and Grandpa for health insurance at the ripe old age of 75, or for a severely wounded Solider still in his or her 20’s?

In these cases government involvement in the market is required and just.

But that doesn’t also mean the government should pay steeply discounted prices. They should pay retail pricing to maintain price stability for all other consumers participating in the independent free market. Not doing so corrupts market dynamics at the most basic level (price). It is the beginning of socialized healthcare, as it takes money from some patients (via higher prices) to provide (discounted price) services to others.

The federal government has never served senior citizens or veterans well – Medicare and the VA are living proof. Until healthcare services for those two demographics are working perfectly the government has no right getting involved with services to any other market demographic – let alone the whole kit-and-caboodle.

Paying retail prices for Medicare services would do two important things. First, it would ensure better care for seniors because there would be more profit in those services. Second, paying retail prices would automatically restrain the central government from intruding on a larger section of the healthcare market because they wouldn’t have the resources to do it. The absence of such a constraint forces healthcare premiums steeply higher – and threatens the future of the entire system.

The Medicare program is bankrupt even without paying full retail. And somehow the solution from the boys and girls down in Washington DC is universal healthcare for everyone – something they have no chance to afford. In fact, you can already hear rumors about Medicare cuts in connection with Trump’s proposed tax cuts. In other words, politicians are willing to sacrifice Medicare for universal healthcare coverage for all, essentially a Medicare for all.

And what rational person believes that the future condition of the entire healthcare system will be in better shape than the horrid condition Medicare is in today?

In order to save Medicare and properly care for our veterans the government should increase spending to those two demographics to cover retail pricing and then cut every other dollar out of healthcare spending that isn’t dire need or necessity for the poor and disabled – another just government role. The free market must then be allowed to service the rest of us.—And it can (see: Gruber Acknowledges Supreme Letdown, for more.)

But sadly that doesn’t appear to be in the cards for today’s body politic.

The end game to the gross and unconstitutional path the US government is on with regards to healthcare is a lifetime of increasing tax burdens, dramatically higher premiums to all consumers, and a much lower quality of healthcare service – not to mention massive new government debt. Deficits are already higher than ever before; and there is no end in sight. Solvency cannot sustain such a drain.

That said it is critically important for those planning for their retirements to expect severe increases to healthcare costs over the next 10 to 20 years – retirement age for many investors.

But neither knucklehead – excuse me, expert – in Is There Really a Retirement-Savings Crisis? gave the rising cost of healthcare its proper due. And that’s a real disservice to readers because the threat of rising healthcare costs will also deplete what’s left in Social Security, which isn’t nearly enough to cover obligations to lifetime taxpayers.

As the aforementioned article reveals Social Security will be tapped out in less than 20 years. It is only a matter of time until Social Security benefits (again, an entitlement for those who paid into the program for a lifetime) will be cut dramatically to “save” universal healthcare for all. Put another way, Social Security will be sacrificed to spare universal healthcare for the younger and less fortunate – you know, those who have many more election cycles left in life. What is more important, politicians will pose, money or health?

And health will win.

The sad part is that the American people – the parents and grandparents of today – are letting the children and Congress put the country into a bleak quid-pro-quo position. Dramatic alterations are necessary now to salvage the future. Otherwise the future will be very, very expensive.

A conservative investment approach is to plan for the worst and pray for the best. In other words, conservative investors should plan not only for a sharp rise in end of life healthcare Medicare costs (say triple the costs of today) but also for a steep decrease in annuities from the nation’s retirement account, Social Security, to occur in the next 20 years (say one-third of what could be expected today). Thanks again to universal healthcare coverage.

That’s an unfortunate, but reasonable, assessment based on history and the current political trajectory.

It is easy to deduce, therefore, that a-hundred-grand isn’t nearly enough to finance retirement for many people in many parts of this country. And when so many people cannot afford retirement up to their life expectancy, then yes, that’s a retirement savings crisis.

I knew it at hello.

It’s easy to get freaked out by that sorry notion. Many people take articles like the one above to their broker for assessment and advice. A healthy dose of caution is warranted when doing this, however. Brokers are like used car salespeople. They will say anything to make a sale. But don’t just take my word for it. In October 2016 the Wall Street Journal reiterated that fact in, We Put Financial Advisers to the Test – and They Failed.

There isn’t much new news here but there are some interesting tidbits to keep in mind must you deal with a broker or financial advisor. According to the article, research shows that advisers “seemed to exaggerate existing misconceptions…to sell more expensive and higher fee products,” and “appeared willing to make clients worse off in order to secure financial gain for themselves.”

Brokers are compensated on what they sell. High fee products are best for them and their Wall Street affiliate. So it’s only natural to figure that premium priced products would be high on their list of recommendations – whether or not they were in the best interests of their clients.

Yep. That’s them.

While this isn’t breaking news the author did put forth two ideas that I’d like to highlight. The first is ludicrous: “By the time you learn whether a retirement strategy was the right choice, it is usually too late to change it.”

That’s categorically incorrect – and quite stupid. It is never too late to assess performance and change to a better course. Never.

Indeed, no one can turn back the hands of time. What’s done is done. Even so, investors do have a choice. They can either stay the losing course and allow history to repeat itself, or they can take a completely different approach to make the most of the future.

The second point I’d like to examine from that article is this point: “Not surprisingly then, much research shows that a large fraction of the population is poorly prepared to make financial decisions by themselves. Typically, when faced with complex and important decisions we rely on trusted experts for advice.” The author then places brokers into the same realm as doctors and lawyers.

First things first…Brokers aren’t nearly that high on the professional totem pole. Doctors have to go to medical school after college and lawyers must attend post-grad law school. Brokers only need a high school diploma or GED to play ball in their park – and most lack the ability to understand a damn word that comes out of their very rehearsed mouths. Calling them “experts” is the worst of all false advertisements. They are more like actors in a theatrical production.

Regarding experts in general…they are just regular people doing a job for money. Doctors are confounded all the time; they mistreat and misdiagnose all too often. My grandfather called doctors “the great facilitators of death.” And heck, it was back in the year 1591 that William Shakespeare wrote his famous line, “The first thing we do, let’s kill all the lawyers.” He didn’t make that statement because only a couple of people had bad experiences with lawyers. It’s because bad lawyers are an epidemic — then and now.

Brokers and financial advisors are much lower in the pecking order than those two professions. If one-out-of-ten lawyers are good then one-out-of- a-thousand brokers might be worth the trouble. But they’re not the only culprits in the industry. On the periphery are the so-called experts quoted in almost every venue of the mass media. These people appear as impartial authorities when they too are just actors in the grand theatrical production that is Wall Street. All of them read off of the same script.

The second element in that article I’d like to highlight is both scary and validating: “a large fraction of the population is poorly prepared to make financial decisions by themselves.”

There is no way to save Medicare and Social Security – and the free market for that matter – without a population who can successfully invest to fund their retirement needs and desires. And it’s scary that so many are incapable.

The rewarding part of that quote is that my mission in life is to educate that very large fraction of the American population. It is validation that my cause is right and necessary.

The feel good pile never disappoints.

Successful investing is easy to understand and simple to do. Beating the market indexes (a.k.a. success to many investors) appears difficult because virtually every “expert” fund manager fails to do it. More proof of this came on April 12, 2017 when the WSJ posted Indexes beat Stock Pickers Even Over 15 Years. This excerpt says it all, ‘“We often hear from active managers, ‘You need to measure us over a longer-term cycle,’” said Aye Soe, managing director of research and design at S&P Dow Jones Indices. ‘”Even over a full market cycle, which includes peaks and troughs, we still see the majority of active managers performing unfavorably against their benchmarks.”’

The only chance mutual fund investors have to change that dynamic is to actively buy them low and sell them high. Otherwise they will lose valuable time and money and leave little chance to recoup it – index fund or not.

Consider that after the market crashed in 2008 it took “the market” six years to regain its previous high. And since mutual funds rarely perform to the level of market indexes, it took them much longer to reclaim their previous highs. That could amount to ten years or more in a no growth condition.

It is impossible to overcome that kind of downtime while maintaining the passive practice of investing in mutual funds and taking whatever the Wall Street establishment ekes out.

Consider also that the average age of a mutual fund owner is 50 years young. If a correction happens now (and we are due one) many mutual fund owners will be knocking at the door of retirement when they finally regain losses incurred during the next correction. The poignant question to then ask is: Do you have enough money to retire now?

If not something must change.

If instead those investors had sold a portion of their mutual fund holdings high (before correction) and reinvested those dollars low (after correction) they would have transformed ten bad years into a decent decade.

Investors must be the masters of their own destiny. At the very least they must instruct action (to buy and sell) at strategic times to optimize gains and preserve capital. Otherwise it will not happen – index funds or not.

The 2008 crash also proved that fund managers don’t see their role as capital preservers, as most mutual fund values fell much worse than the market indexes did during correction. Fund managers see themselves as investors, not market timers. Sure they try to buy low and sell high. And yes many do so for valuation reasons. But they take those monies and reinvest it in other stocks that are under-valued according to their calculations. That’s just internal stuff that doesn’t change their overall investment posture. Mutual funds generally remain fully invested.

Full investment allocates nothing to capital preservation.

That is why investors must take an active lead role in strategic decisions regarding their investment plans, allocations, and risk posture. Brokers and financial advisors can’t be trusted.

Wall Street firms instruct brokers to do what is best for the establishment, which is not only to have their clients’ invest but to invest fully. In their collective opinion idle capital is a mortal sin, a waste of God’s grace. And so they infuse the erroneous concept that broadly diversified portfolios are the best means of mitigating risk and preserving capital. Invest, invest, invest, they preach. It’s the best way to face the tides.

So if you are relying on your broker to protect your nest-egg by recommending proactive measures at strategic moments then you are waiting for a tomorrow that never comes. Brokers are trained salespeople that think only as they are made to believe. And they are conditioned to believe that nearly 100% investment all the time is in the best interests of everybody – broker, firm, and client.

Broker and firm? Yes, of course. Nothing beats 100% of everything.

But for the client nothing could be further from the truth. The last two major corrections proved that many times over.

It is important to appreciate that brokers are simply actors delivering prepared lines that the establishment writes. This point was driven home in a recent WSJ article entitled, As Interest Rates Rise, It May Be Time to Tweak the Portfolio. The article intends to provide advice for investors to consider in this higher interest rate environment. But to the contrary of sound advice the instruction presented in this article is nothing more than advertising lifted from the establishment’s playbill – “stay really diversified, find growth outside of the U.S., [and] watch investment costs.”

I can’t think of any worse advice to offer. Three reasons…

First, the expert featured in this article is a gentleman named Michael Macke of Petros Advisory Services (a broker), who explains that a very broad portfolio “should give you the highest odds of growing and protecting your wealth in retirement.” The article recommends investors to add a mutual fund that holds nearly 3,600 stocks to their collection of funds.

That’s classic Wall Street.

Good luck beating the market benchmarks with a basket of those kinds of funds. It’s too much diversification – so much so that it will cause below-average portfolio returns and sharper declines during corrections.

The “advice” given in this article, and many others like it, is put forth as facts when they are factually incorrect.

Second, foreign markets are higher risk, more volatile, and inferior to the U.S. market. Consider that international mutual funds invest not in countries but continents – Europe, Asia, South America, etc. etc.

Want to invest in Germany? You can – but you must also take Greece, Italy, Spain, and France etc.

Want to invest in communism? Invest in China – along with India, Pakistan, Vietnam, and Hong Kong, etc.

Does any rational person actually believe that a collection of companies from those countries will outperform U.S. companies over the long term, say 10 or 15 years? Is it possible to think such a portfolio would be less volatile? And can it be reasonably expected that those countries would survive the next financial crisis better than America?

Don’t put me in that bunch. I’d rather take my chances investing in the best and freest market in the world – one that I can see and touch, monitor and participate.

Furthermore, if professional funds managers underperform in the best market in the world (America) then they will most certainly underperform in foreign markets – where there is much more volatility and risk, and a greater amount of political and economic uncertainty. This not to mention the obvious prudence of not investing in anything investors can’t appreciate or grasp.

Doing anything blindly is risky.

Is such an approach (full investment and broad diversification that includes foreign investment) good for investors – or is it better for Wall Street firms trying to broker maximum capital on a global basis?

Articles of this kind are not information but advertisements worked into daily life like something from the Truman Show. The intent of the ads is to push investors to contact their brokers and financial advisors where they will hear the same kinds of things. Then all of the sudden the lies become facts that quickly morph into false reality – just as the establishment had calculated.

And no good sales pitch ends without the old, I’m looking out for you, line. The article mentioned above had one too. The final bit of advice left to investors was, “Watch Investing Costs…Fees Matter.”

What a joke that is.

People who preach that investment costs matter also believe that performance mediocrity is an absolute given. Fees, regardless of level, should never matter in the grand scheme of things. Think about it, if a fund charges an absurd amount, say 10%, but delivers 20% per year after fees then what does the fee really matter? What matters is the performance of the fund, which too many times is not worth the fee charged. Nevertheless, it is the performance, not the fee, which is the true issue.

No rational person can argue that if an investor is going to own mutual funds that index funds are the best way to go about it because they outperform all other mutual funds. There’s simply too much data to deny that claim.

But is the performance of index funds good enough – even if they are bought low and sold high – when considering the brewing retirement crisis?

The goal and purpose of LOSE YOUR BROKER NOT YOUR MONEY is to teach people successful investing strategies and tactics by showing them how easy it is to outperform any market index or mutual fund, and to do so with far less risk. With this knowledge in hand the “low-cost” index fund becomes very expensive, as the lost profit from not using the 15-51 method greatly outweighs the mere impact of fees.

In other words, why join them if you can beat them?

It was more than a hundred years ago that Charles Dow proved to the world that market diversification is possible with a small number of stocks. To this day his legendary Dow Jones Industrial Average still has only 30 stocks and remains synonymous with stock market activity; it is “the market,” and produces a trend-line most mutual funds never approach. It proves that a smaller portfolio is a better and more profitable model than is vast diversification via thousands of stock holdings.

Kick aside the fact that the S&P 500 has been consistently outperforming the Dow over the passed several years. This dynamic can falsely lead investors to feel as if they need more stocks to achieve greater returns. But that’s wrong. The S&P now owns the Dow Jones Industrial Average and they clearly want their index to outperform the Dow. There’s no other reason for a 500 stock portfolio to consistently beat a 30 stock assembly. The Dow’s problems are simply too easy to fix (see: What’s Wrong with the Dow, and How to Fix it). And the S&P guardians know it. To them bigger is better, so they sandbag the Dow to demonstrate its inferiority to their beloved S&P 500 index.

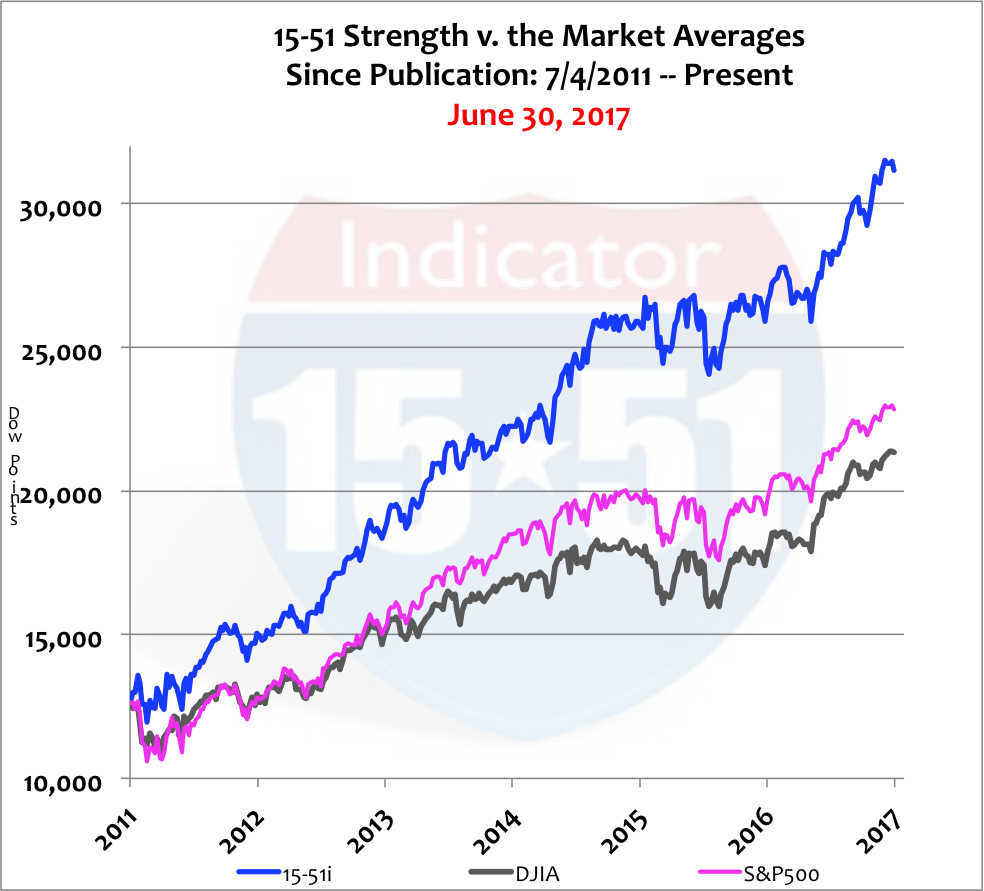

Unlike Dow theory my method proves that even in this day-and-age market diversification is possible with just 15 stocks. The 15-51 Indicator is a market portfolio designed and built to indicate stock market strength; in other words, to produce above-average stock market returns. To be successful it must produce a trend-line that mimics the movements of both the Dow and S&P 500.

The chart below shows the performance trends for all three stock market indexes since LOSE YOUR BROKER NOT YOUR MONEY was first published six years ago (July 4, 2011).

During this six-year timeframe the Dow Jones Industrial Average gained 69%, the S&P 500 added 81%, and the 15-51 Indicator surged 147% higher – and they all had the same rhythm of movement.

My investment philosophy is based on facts and common sense. For instance, there is no better way to preserve capital than not being all-in (fully invested). A cash reserve is a requirement to efficient and effective portfolio management. Like all investment decisions the appropriate amount of reserve is completely individual.

Approximately 70% of my portfolio is in cash as I sit and wait for the next major correction. I’ve been there for more than three years now, and before that my portfolio was 50% in cash for several years. Those were strategic decisions made by me for me. Profits have been locked in for years and not even the swiftest correction can take them away. That’s how to preserve capital.

I’m still in the stock market but not significantly. And that’s fine with me. The economy is limping along and Trump can’t get anything through Congress. Labor participation is still at 40-year lows and wage growth is sluggish and uneven. There’s absolutely no reason for stock prices to be valued this high.

The balance of my portfolio is in metals (gold and silver) to hedge my exposure to inflation and stock market correction.

At the heart of my perspective is the obvious fact that there is much more profit in buying low than by holding high. Cash should not be considered a moneymaker as an investment class. It is a mechanism to make money. Reserving capital now is the best way to profit greatly later.

Experts in the Wall Street establishment would view such a strategy and portfolio structure as blasphemy, an impossible approach to making money. Yet my portfolio consistently beats all of theirs – and with a fraction of the capital at risk.

How?

Because my portfolio is better than theirs. It is smaller and easier to manage, and has minimal fees for on-line trading.

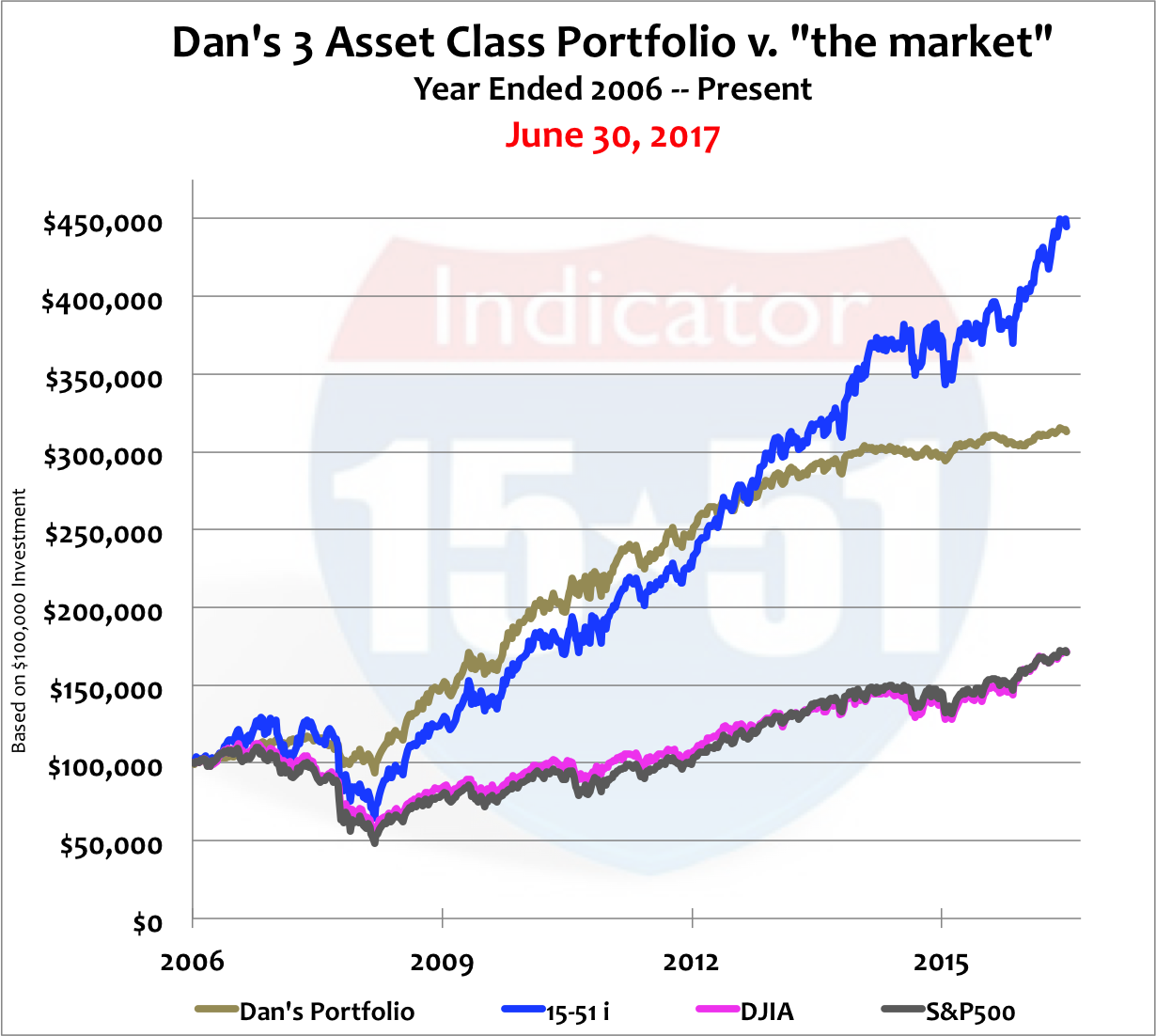

Below is the performance of my multiple asset class portfolio for the last ten years assuming a $100,000 starting investment (which happens to be the average dollar amount a mutual fund owner has at risk in the investment markets). The performance trend below does not include interest and dividends.

So yes, I haven’t made too much money recently. And yes, I could have made much more money by being 100% in stocks (the 15-51 Indicator was up 345% during this time). But that’s not the point, purpose, or objective of my portfolio. My objective is to build wealth by tripling market returns with far less capital and with minimal downside risk to major corrections. And my portfolio does it.

During this ten-year period my three-asset-class portfolio produced three times the market averages did, 213% versus 71%, and did so with a fraction of the risk and a stockpile of cash.

The greatest benefit of the 15-51 method is that it facilitates capital preservation and risk mitigation by its ability to achieve superior stock market returns with less capital. This profit superiority affords the investor to bypass exposure to high-risk markets in hopes of higher returns. They aren’t needed. This simplifies a portfolio and makes it easier to construct and manage.—All of which are concepts the Wall Street establishment will never confirm or accept, offer or sell.

Trusting their “advice” is like handing Satan the key to your soul.

The validated facts are these: there is a retirement crisis in America; neither brokers or fund managers act strategically on investors’ behalf to maximize profits and preserve capital; they lie and mislead, and consistently produce below-average returns over 15 years or more.

The good news is that it is never too late to change course and that there is no better time than the present. Stocks are high and the central government is paralyzed. U.S. interest rates are poised to rise and that will start a fire overseas. Bonds and international mutual funds are high-risk gambles.

Times like these are perfect for getting back to basics. And the best place to start is with Step 1…

Stay tuned…