Ever since the Federal Reserve changed policy positions in late 2018 the markets have reflected the dysfunction in their rationale. Fed chairman Jerome Powell espouses that his policy decisions are “data dependent.” They look anything but. Notwithstanding the agita caused by stock and bond market volatility nothing – and I mean nothing – in the economic numbers warrant the Fed’s decision to change posture from tight to loose and cut interest rates. In fact, anything that has changed in the economy has been slight, irrelevant, and/or positive.

Here are the facts…

The U.S. economy is consistently growing, and while it is slightly stronger under Trump, growth is still uneven (2ndquarter ’19 growth rang in at a 2% clip. Q1 was 3.1%). Obama’s economy averaged 1.9% Real growth during his presidency. Thus far into Trump’s tenure growth has averaged 2.6% per annum, a level much weaker than the tech and housing booms. Those expansions averaged 3.5% Real growth per year. Nevertheless weak and uneven have been economic trademarks of the entire QE-boom, now in its tenth year.

Steadily lower unemployment is being offset by gradually higher labor participation, a positive trend that began in Trump’s first year. The gains are small but consistent, and not a significant deviation from anything experienced in the several years prior.

Wages continue to gain, though ever so slightly ahead of inflation, which has been a persistent theme for many years now. While this metric is extremely weak compared to the prior two booms it is a common trait with this economic cycle. Again, the economic status quo has not been breached.

And “falling inflation,” the lame excuse the Federal Reserve used to cut rates is not falling at all, averaging slightly better (2.1%) than the Fed’s target (2%) for more than two years now.

In other words, if some legitimate basis to cut rates exists in the marketplace today then that same substantiation has been present for several years now, and long before quantitative tightening (QT) started early last year (2018).

By cutting rates this year Powell looks to be questioning his decision to tighten monetary policy just one year ago. He looks confused, scared and unsure of what to do.

And the markets reacted.

While the move to cut rates without qualifying data is extraordinary in its own right the one-quarter reduction is most unusual because it comes during an economic expansion – the first time in American history. But to use worries of “falling inflation” as the basis for the rate cut is most peculiar. Second quarter 2019 GDP results showed an even higher pace of inflation (2.5%) than the last several years (2.1%) – both above the Fed’s two-percent target.

Investors need to appreciate the inside baseball being played. It affects all of the investment markets, and therefore, every piece of your portfolio pie. Take your time with this discussion, it is as complex as it is important. I’ll try to make it as simple as possible…

Easing monetary events like the lowering of interest rates have always occurred when trouble was already present in the marketplace (like recession or steep stock market corrections caused by some economic or financial malfunction). But not this time. The early timing of this rate reduction scared institutional investors because it cries out to be a preemptive strike to “soften the blow” of the next financial crisis – one that the Federal Reserve sees as quickly approaching.

That’s the reason the stock market has been freaking out and safe havens like gold and U.S. bonds have been surging.

The most outrageous thing about Powell’s pitch for lower rates to cure lower inflation is that higher interest rates, not lower, will create more general price inflation because higher interest rates increase corporate operating costs and thus the cost of goods, which ultimately finds its way to consumers in the form of higher prices (inflation). That’s the way the world works, proven again in 2017 and 2018 when inflation finally returned to the Fed’s 2% target only after Janet Yellen started to tighten monetary policy shortly after Trump took office. This is especially the case because rates have been so low for so long that a drop from near-zero to closer-to-zero adds absolutely no economic impact.

And the most ironic thing about the Fed’s thinking is it assumes that lower interest rates via QE will actually increase market spending to a level great enough to cause general price inflation – something that never happened in the 8 years Obama served as president.

Those that understand the game know that using inflation as the basis to cut interest rates is total BS.

The reason easy money policies implemented during the QE-boom did not raise general prices in any meaningful way is because the effect of those policies never reached the consumer; they instead remained at the institutional level within Wall Street banks, government spending programs (like healthcare), and the investment markets. Inflation can easily be detected in all three venues.

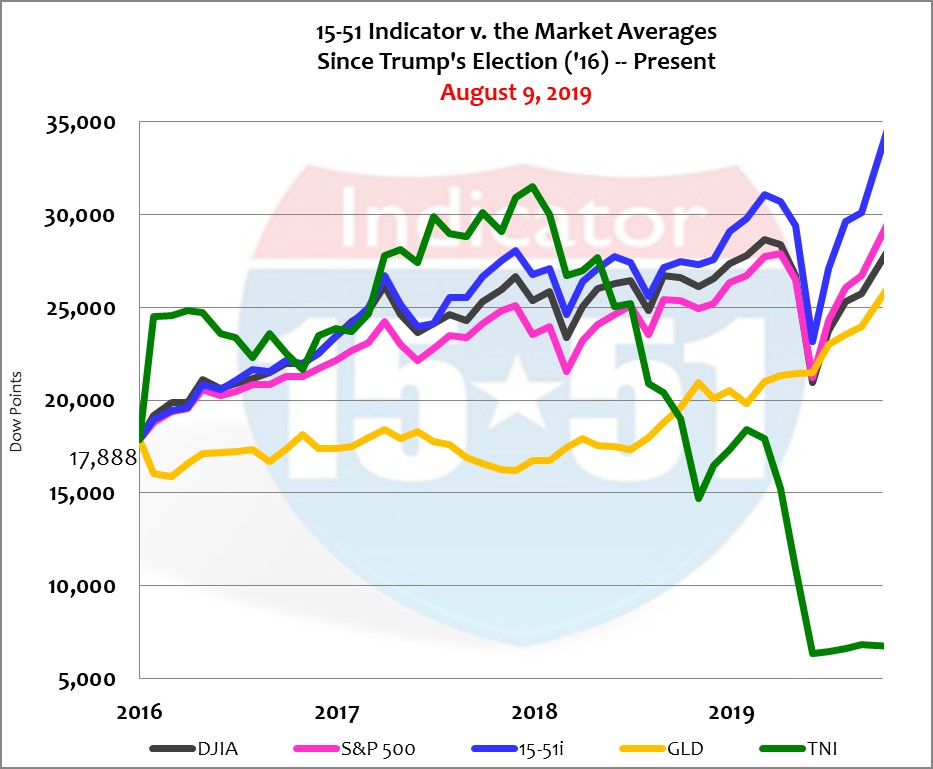

If ever a picture was worth a thousand words it is true with the chart below. The period begins with Trumps electoral victory in ’16 and extends through today (actual date noted in red). Take a look, discussion to follow.

There are a lot of lines in that chart so let’s take them one at a time. Allow your eyes to follow the green line, the 10-year yield trend…Yields jumped immediately following Trump’s election because he campaigned to significantly reduce tax rates for individuals and businesses. Tax savings increase currency available to circulate in the economy, which is inflationary (an impetus to the general rise in prices.) Yields immediately moved higher on that dynamic.

When income to consumers rises so does their spending. An increase to consumer spending is an increase to more than two-thirds (or 66%) of the market economy (GDP). The boost in demand for goods puts pressure on their supply, which can then cause prices to rise.

To partially offset that dynamic central banks usually raise interest rates to restrain spending, which reduces inflationary pressure to the supply chain. The Fed did this beginning in 2017 and more aggressively in 2018, which also helped push yields higher in those years.

Fewer taxes paid by consumers and businesses also produce greater corporate profits because more customers spend more money buying more goods (as long as inflation remains moderate). Greater corporate earnings entice investors to sell bonds (which pressures yields to rise) and buy stocks because there is more profit potential in stocks than bonds. (Remember, bond values fall when yields rise.) Those dynamics propelled stock prices to robust heights in ’17 and ‘18 (blue, gray, and pink lines in the chart above).

A low tax environment in an expanding economy is the best time to raise interest rates and tighten monetary supply. Perhaps that is why Powell placed quantitative tightening (QT) at the top of his priority list as soon as he took office in early 2018. He believed back then, like all other reasonable people still do, that the Fed must reduce the size of its balance sheet and unwind QE.

But then all of the sudden, and without substantive basis, a bumbling Powell completely reversed course just a few months later when the 10-year yield reached its peak for the cycle, just 3.23% – and still pathetically low by any reasonable standard. Since Powell’s fist major blunder yields have fallen off the cliff, diving 46% and now rest 3% lower than when Trump won the vote.

Investors should expect yields to continue moving lower because that’s the way the game is being played.

Gold is a currency hedge, often called an inflation hedge (or a hedge against the general rise in prices.) That is also to say that the value of gold generally trades in an opposite direction as the value of money.

Price inflation is not strength but monetary weakness because it takes more dollars to purchase the same good. When money is strong, gold is weak, and vice versa.

Gold is up 17% so far this year and 25% in the last twelve months. Its recent price resurgence indicates future monetary weakness due to inflation (the general rise in prices). It is a trend that should continue based on the new course chairman Powell just charted.

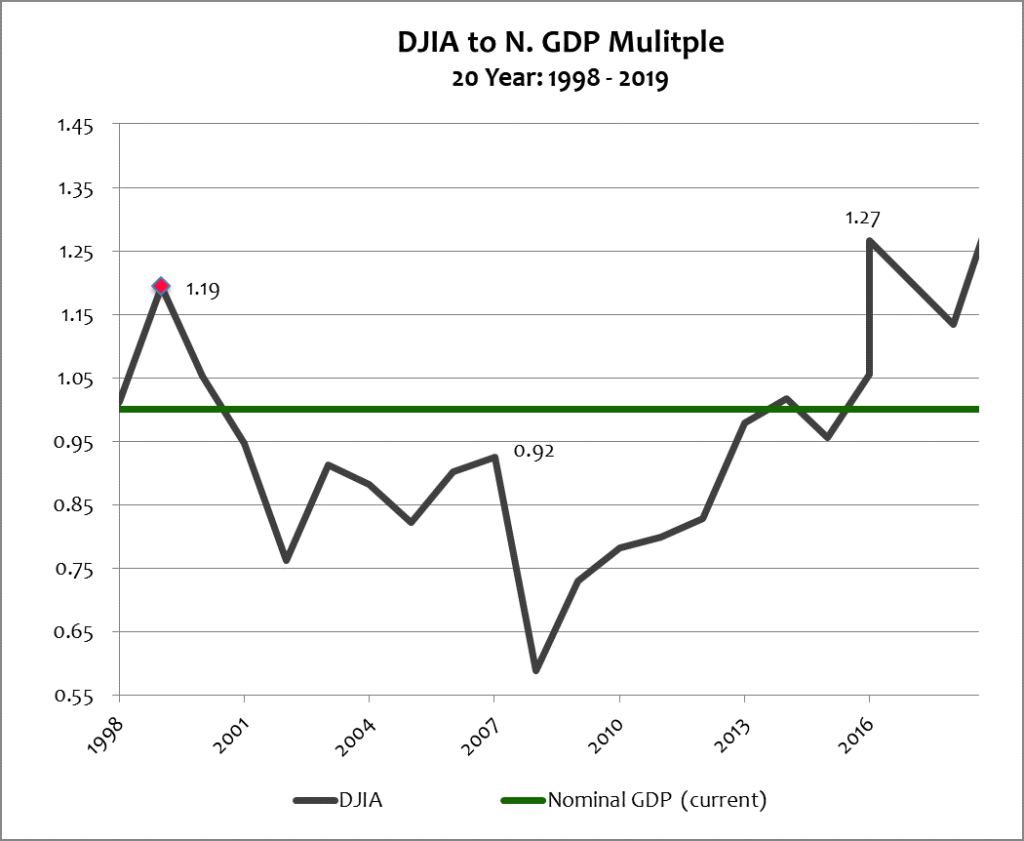

Stocks still indicate a booming economy (which it is not), averaging a 44% return and 16% per year during the Trump surge (the gray and pink lines in the chart above). Stock market strength (blue line) added 52% or 19% per year, in what has been a wild and crazy stock market ride. However, whatever the moment, peak or trough, stock market prices remain very richly valued. Their pricing multiple to GDP remains near all-time highs. See below.

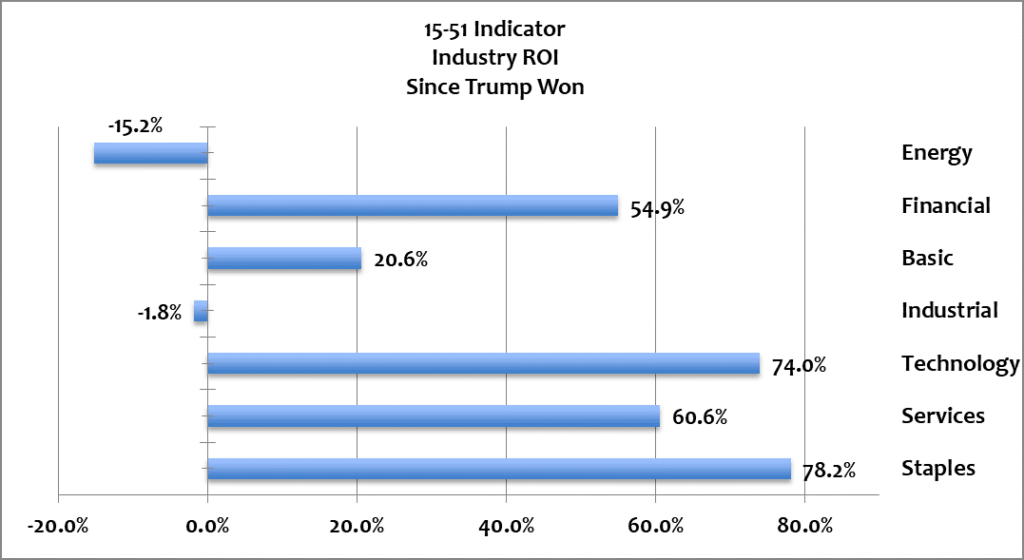

Despite the stock market’s gaudy returns it is not firing on all cylinders. Two industries have not performed well since the market drifted away from Obama’s control. Energy has taken an absolute beating during the Trump era (-15%, an indication of widespread global weakness), and Industrials (heavily reliant on sales to developing nations) are off fractionally (-2%) but well below-average in this trade war environment. The performance of all industries since Trump won the vote is shown in the chart below.

That is a very robust spread of returns in less than three years. The collection indicates an economy much stronger than the one we are experiencing, perhaps a 4% grower in Real terms. Today’s economy is well off that pace.

That is inflation by definition, a two-percent grower priced as a four-percenter.

So in a nutshell the economy is marginally stronger now than it was under Obama, but still uneven; stocks continue to price its underperforming economy at the highest valuations of any boom in history; yields have been volatile but haven’t moved since Trump won the vote; and gold hasn’t showed any life until recently, when Powell revived it in the fall of 2018.

Yields are indicating dollar weakness (a lower value of money); gold is indicating higher prices to consumer goods (inflation), and stocks are priced high.

So why in the world would the Fed cut rates at this point in time, seemingly caving to the demands of a president they despise?

First some facts about the game being played, stay with me…

Currencies are weakest during times of recession and stock market correction. They are strongest during economic expansion and stock market booms.

Bond values usually decrease (and yields increase) during economic expansions to lure capital from booming stock markets into bonds. Lack of demand for bonds forces yields higher (to incentivize their purchase); abundant demand pushes them lower.

Interest rates (yields) are normally guided higher during economic expansions to tighten spending and control inflation (the general rise in prices.) Logic expects inflation to spike during times of low interest rates, economic expansion, and full employment because money is cheap and abundant to most people, who are mostly working, earning higher wages, and spending it.

But that didn’t happen during the entire QE-boom, spanning more than a decade.

Higher interest rates, like higher taxes, constrain consumer spending (66% of economic activity) which reduces demand-side pressure that could force prices higher. Consider interest a tax on money. When the central bank wants to alleviate inflationary pressures in the economy it raises the tax on money (a.k.a. interest rates) so that less circulates due to its higher price/cost. This follows Ronald Reagan’s accurate assessment, “If you want less of something, tax it.”

When the Federal Reserve cuts the tax on money (interest rates) they want more money to circulate through the system so that it will spur spending and cause prices to rise. But quantitative easing (QE) doesn’t bring about the general rise in prices because it pumps money into the financial establishment (a.k.a. Wall Street) where little, if any, trickles down to individual Americans.

Another thing to know about interest rates is that rock bottom rates – heck, zero-percent interest rates – cannot and will not stop a recession from happening or add employment to a flagging economy, just as QE cannot bring about a general rise in prices.

Of course, Powell and his dove-like flock at the Federal Reserve know this. They just don’t care. Their policies have been misguided for a very long time (see: THE FED’S MISPLACED PRIORITY, for more.) The true reason the Fed cut rates at the present time has nothing to do with inflation.

Here’s the game…

Trump is in a trade war and his adversaries are devaluing their currencies to combat his tariffs. Tariffs are a tax on trade. Interest rates are a tax on money. Trump wants to be the one to levy a tax on his hostile trading partners; and he wants the Fed to level the playing field by neutralizing the easy money policies of foreign nations, like China.

In short, they are devaluing and Trump wants Powell to devalue to the same level. He wants a level playing field from which to tariff.

Trump also knows that higher U.S. interest rates will cause rates to rise indiscriminately across the globe – and that that will cause world havoc and speed the onset of the next major crisis. And he doesn’t want to be responsible for that.

Instead Trump would rather inflict targeted pain via tariffs to specific trade violators than to cause wide scale damage that would affect countries with whom he has no issue. China is the focus now.

Trump is in the game, make no mistake. And he’s playing it his way, like it or not.

And while the establishment is never one to rush to his aid, Trump is a spendthrift like his two predecessors. He just signed a mega-spending bill that will produce another trillion-dollar deficit this year. Big government proponents love that kind of action because trillion-dollar deficits increase Congressional influence over the economy and strengthen their powerbase.

Congress, too, is in the game. The Trump spending deal is proof positive.

And, of course, let us not forget that quantitative easing (QE) will be required to fund those government deficits; there is no other way to do so and keep interest rates low – which is a requirement because the rest of the world are devaluing their currencies and posting negative interest rates. As history has taught, QE increases the size and worth of the Federal Reserve’s balance sheet and thus gives them more power, influence and control over the economy.

The Fed is back in the game. The rate cut along with the promise of more QE are proof positive.—They have to be…

The President is fighting a war, Congress wants to continue spending at twice the level before the ’08 crash, and the only way to fund both and keep interest rates low is to print new money and launder it through the Wall Street establishment via QE.

The last few rounds of QE have been a 50-50 split between government and the financial establishment (Wall Street and the Federal Reserve), each got half of the money, between five and ten trillion each.

Can you think of anything more corrupt?

And with that freshly printed money central governance will takeover another slice of the free-market at the same time Wall Street manipulates the financial markets to steal another significant portion of investor capital.

They will do so by choreographing the most dramatic investment sell-off anyone has ever imagined, this to scare investors into a panic-selling frenzy to save whatever they can of their retirement accounts. Wall Street firms will be all too willing to settle those trades – you know, to buy low. They make the market, after all.–And they will use QE money gifted to them from the Federal Reserve to fund it.

So the Federal Reserve is actually funding and facilitating Wall Street’s ability to manipulate markets in order to steal investor capital via QE.

Make no mistake, Wall Street is in the game. They broker the deal.

The need for QE grows exponentially because as logic predicts foreign trade adversaries very active in the U.S. bond market – like China – will slow or stop their purchases of U.S. bonds to force U.S. yields higher and to make the American dollar stronger. Such action would make U.S. goods more expensive in their respective countries and lower demand for them. It’s a trade war, after all.

The Fed will try to combat foreign actions by printing demand for U.S. bonds via QE to fill their void.

QE is a ponzi scheme built to grow two things: government and the financial establishment (Wall Street and the Federal Reserve) at the expense of liberty and the free market.

The game is to make it seem like anything but that.

The Trade War has now morphed into a full-fledged currency war and at the center of it is QE – the seed of the next major correction – which is the reason gold has rallied, yields have fallen, and stocks look panicked.

Governments are printing too much money and too much debt, and someday it will come to an inflationary head. A massive devaluation is in the cards.

Investors must be attentive spectators to the game and how it’s being played.

Asset allocation is key; cash and gold are safe with massive upside, stocks and bonds hold the most inflation, and the most risk.

Stay alert…