New wave trading app Robinhood is the latest example of Wall Street’s corruption and it should alarm all of us. GameStop, both victim and beneficiary of bad policy, is not an isolated instance nor is it limited to the Davey and Goliath plotline. The only way to appreciate how it affects each and every one of us is to dig deeper into what happened to GameStop’s stock (GME), why it happened, and how it was made possible. Perhaps then we can finally stop banks from operating like casinos who cater to the institutional class while screwing the rest of us.

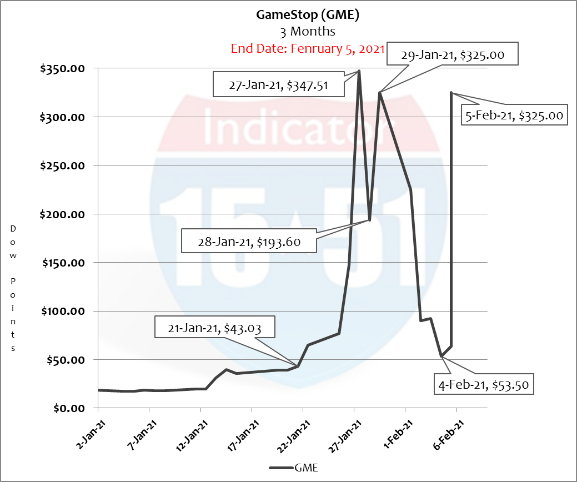

Below is a chart showing what stock market corruption looks like. It is for GameStop’s stock activity for 2021, now just a few weeks in.

That is the picture of market dysfunction, a logo of corruption, an emblem of bad policy, and evidence of a crime from an industry that remains reckless and out of control since the ’08 financial crisis. The driving forces behind GameStop’s radical behavior is what they call a “short squeeze,” and the despicable fact Congress never enacted the Volker Rule.

First some basics…

A short-sale is the complete opposite of an investment transaction. Investing is buying low and then selling high, in that specific order, to make profit. Investment is a wager on future success.

Short-selling is selling first and then buying low, in that sequence, in order to make profit. The thought here is that the underlying security is over-valued, and thus, a condition ripe for a falling price. Short-sales are bets against future success.

But how can you sell shares without first owning them?

To transact a short-sale an investor must borrow shares from someone else in order to sell them. The brokerage house or market maker, a.k.a. the Wall Street establishment, effectuates the transaction. The short-seller pays the lender of shares an interest rate, along with the promise to someday return the borrowed shares. To make that happen and “close the short position”, the short-seller must buy shares on the open market at some future date and return them to the lender, which therefore completes the sell-high buy-low transaction.

Buying, borrowing, and selling shares should be a finite transaction capped, at the very most, by the total number of shares outstanding. In other words, it should never be possible to borrow more than 100% of a company’s shares outstanding, nor should it be possible to sell more than 100% of a company’s total shares outstanding. Sound reasonable?

Not to the bookies on Wall Street.

Options, both puts and calls, are not securities but rights to buy or sell shares of a security. Calls are rights to buy a certain number of shares at a certain price, called the strike price, by a certain date. Puts are rights to sell a certain number of shares at the strike price by a specific date. Both kinds of options (rights) can be bought or sold-short. For instance, shorting a call option is the same as short-selling a stock – it is selling first with the intentions to buy back later a lower price.

Options require much less capital than buying or selling the actual stock because only a right is being purchased. Two things to know about options. First, options can place investors in untenable positions because their lower cost of wager inspires the gambler-mentality to take larger than prudent risks. And second, options expand the market for any given security by as much as Wall Street – the House to the casino that the stock market is – is willing to take.

In GameStop’s case it was a criminal 140% of total shares outstanding. In other words, 140% of GameStop’s total shares outstanding were already sold – an economic impossibility. That kind of sales pressure had no choice but to force GME’s stock price lower (the short-sellers bet) and create the potential for a short-squeeze. The Volker Rule, a post-crisis regulation included in Dodd-Frank and signed into law by Obama in 2010, would halt such behavior.

In a fair and honest world short-positions should never exceed 50% of total shares outstanding.

GameStop’s stock price was around $4 just one year ago. That low price made it possible for the Reddit investor group, along with allies, to accumulate enough shares to force the stock price higher (thanks to tight share liquidity from abundant short-selling).

Soon the surge in GME triggered strike price transactions and/or margin calls that produced even more buying activity, and then in a blink of an eye GameStop went to $400 per share, an amazing 8,300% increase. The result, once again, placed the Wall Street establishment – a.k.a. critical money center banks – on the wrong side of a big short, something the Volker Rule aimed to eliminate.

So Wall Street finds itself on the wrong side of another big short and what do they do?

They shut down one-half of the market, the buy-side, for stocks like GameStop in order to force prices lower and protect their institutional customers – thereby screwing retail investors (individuals) to benefit the establishment and their bookmakers (hedge funds and broker-dealers). The irony of a firm named Robinhood doing so made it the logo for this most recent debauchery, although it wasn’t the only to do so. The problem is systemic.

Restricting trading like this can’t be constitutional, and if so should be illegal. Let’s be fair.

In fact, the action was so egregious it united firebrands from both sides of the political aisle, as Republican Senator Ted Cruz and Democrat Alexandria Ocasio-Cortez joined forces in condemnation of the flagrant sleaze – something an incompetent Biden administration appeared not to appreciate, who when asked about the Robinhood scam responded with how happy they were to have appointed the first female Treasury Secretary in U.S. history.

This from a Party who no longer recognizes sex genders.

Can I get an Awomen to that?

Ridiculous.

The most significant problem facing Americans today has nothing to do with Covid-19 and all to do with the U.S. banking system, which is owned by a casino named Wall Street and is financed by a hedge fund called the Federal Reserve, all of whom operate with limitless impunity and immunity. (Non-implementation of the Volker Rule is a case in point.)

Let’s take a look at the issue from another angle…the Wall Street establishment (a.k.a. the casino) sees massive short-side demand for stocks like GameStop from their preferred customers (hedge fund people and bookmakers like Robinhood). But instead of being responsible and shying away from reckless overbooking they jeopardize the entire system and take every bet.

Why?

Two reasons. First, the Casino (Wall Street) is flush with cash thanks to the Federal Reserve’s continued abuse of cheap and easy money policies like quantitative easing (QE). And second, the Casino knows that if they excessively overbook (with options) to the extent that it jeopardizes their solvency the Federal Reserve will once again step in and bail them out by printing more new money (chips) via QE.

Those two conditions create the environment, possibility, and probability of multi-billion-dollar short-squeezes like GameStop because Wall Street has no fear of the trade going bad.

So long as the central government continues to run multi-trillion-dollar deficits the Federal Reserve will continue to abuse the scourge that QE is because that is how the Fed launders U.S. debt and deficit (bonds) while at the same covering the bad bets made by Wall Street bookies.

With GameStop hedge funds got beat big and a small number of individuals like the Reddit group won big. The rest of us lost big-time because every time the Federal Reserve prints new money it decreases the value of every dollar in circulation, most notably the dollars in your wallet.

Sooner or later we need to fix the very big problem surrounding our banking system and the value of our money, or it will lead to our collective ruin.

In May 2012 I posted a blog entitled, Step 1: Deinstitutionalize, which is a worthwhile read and still very relevant today. The crux of the matter is to remove the American taxpayers’ obligation to cover losses incurred from bad gambles and irresponsible business practices made by the Wall Street establishment. The easiest way to do that is by separating the investment business from the banking business, i.e. to split JP Morgan Chase into two operating units, JP Morgan Investment Company and Chase Manhattan Bank – radical, I know. But effective.

Banks could be eligible to receive temporary taxpayer bailouts because the banking system is an asset to everyone.

Investment banks should never receive any kind of taxpayer bailout because only those who knowingly take the risk of the casino’s bad management, their equity investors, should carry those costs.

Big business needs to get smaller as does big government. Both are getting too powerful and intrusive into our everyday lives. Let’s start by downsizing Wall Street and the Federal Reserve, and halting the abusive practice of QE.

Together they will shrink business and the governmental swamp while at the same time making the stock market more honest and fair – something we so desperately need.

Amen.