One of the most paralyzing conditions for investors is when they’re scared of making a move – afraid of what might unexpectedly happen. How often things don’t go as planned — and so they sometimes decide to leave well enough alone and hope issues magically disappear and/or correct, and that robust gains will automatically incubate out of thin air. Indecisiveness – that is, not taking action when a different outcome is desired – is an ingredient to failure.

Another tenant to failure is making changes to your portfolio simply for the sake of change. This will only produce change – and it will be luck that determines the outcome, be it good or bad. Gambling requires good luck. Investment requires no such thing.

Positive, long-lasting change comes most easily from logical, calculated reasoning, and superior 15-51 construction.

Confidence begins with an understanding of how your portfolio is built.

As you know, the Dow Jones Industrial Average recently made a component change, replacing perennial underperformer AT&T with consummate highflier Apple. The change was announced on March 6, 2015, two weeks prior to the move taking effect. The announcement, on March 6, caused me to reconsider my portfolio.

Because I know the Dow Jones Industrial Average and the 15-51 strength indicator like the backs of my hands, I instantly knew the impact the Apple change would have on both portfolios. This isn’t because I’m so smart, but because both portfolios are so easy to understand.

For instance, you don’t have to be a rocket scientist to figure that replacing a dog with a dynamo has no choice but to bolster performance. The Dow is comprised of just 30 stocks, after all. A one stock change represents 3% of the entire bunch – until you consider price.

The Dow is a price weighted average. So at $120 per share, Apple will have about four times the weight as the stock it replaced, AT&T, which is currently trading around $30 per share. That puts Apple at fifth position from the top in Dow Jones ranking – a significant move from AT&T.

The Apple change has no choice but to dramatically affect the trajectory of the Dow Jones Average.

Knowing this, and that one of my core objectives for the 15-51 strength indicator is to move in a market-like way as defined by the Dow, I knew instantly that the 15-51 indicator had to change when Dow Jones made their announcement. (For more information see: Today’s Paradox: Success with Less Money).

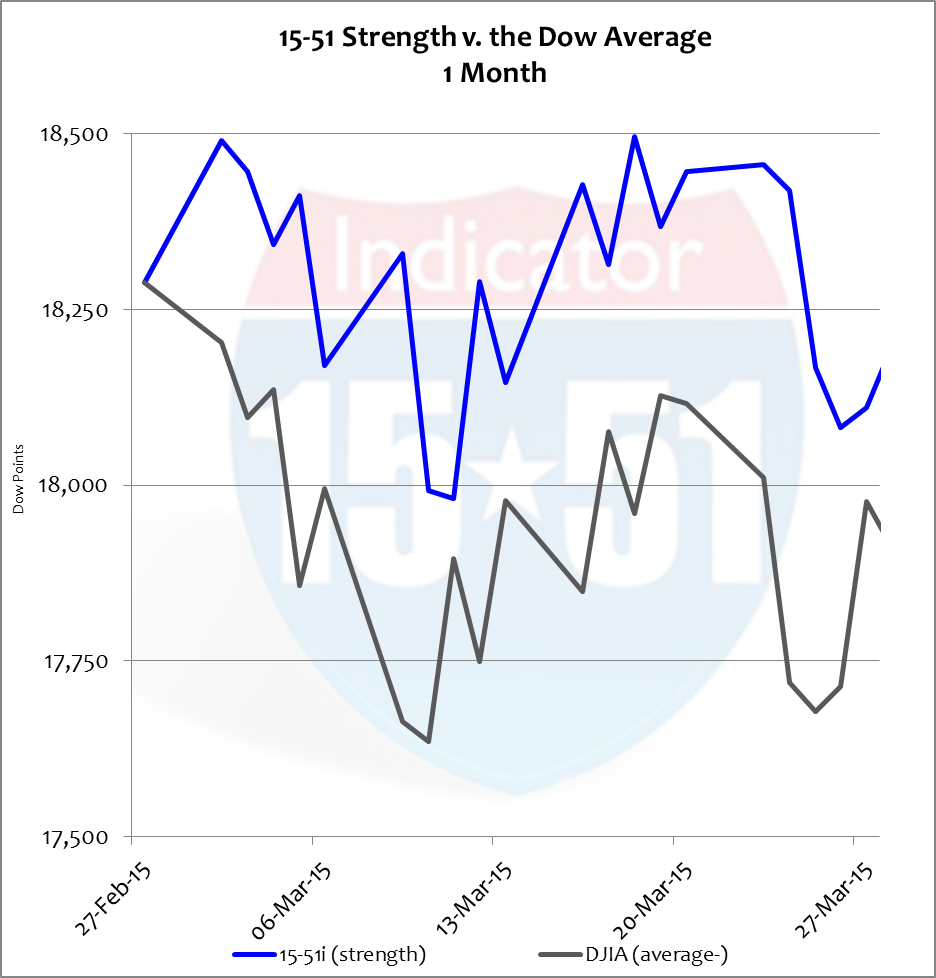

The objective for my 15-51 move was to keep that portfolio on the same trajectory as the Dow Jones Average. Below is a one month chart of comparing the Dow and 15-51.

As you can see, 15-51 continues to move in a “market-like” way. It is also plain to see that it operates in an above-average way. That, by definition, is what it is supposed to do. In other words, my 15-51 portfolio does reliably what it is expected to do.

Nothing breeds confidence and comfort more than executing objectives.

That’s a key benefit of the 15-51 system. Because it’s so easy to understand and use, desired results are more easily achieved.

Smaller portfolios are easier to understand, manage, and predict.

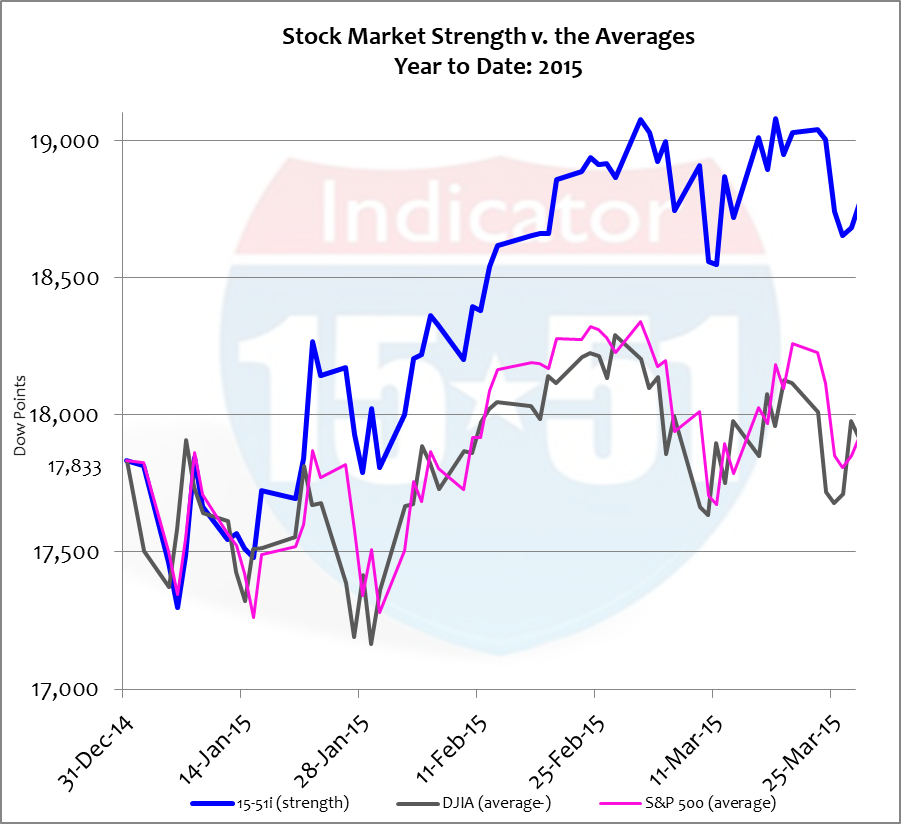

To prove that point, let’s once again turn to the S&P 500. The S&P is a much larger and more complex portfolio than the two previously mentioned, and because of that, has to change more to achieve its market objective. For instance, the S&P 500 has changed eight times so far this year – and six of those changes were made in the month of March 2015, with four coming on March 23 alone. The chart below includes S&P 500 activity .

Remember, both the Dow and S&P have the same exact objective – to indicate the market average of stock market activity. The 15-51 objective is to indicate stock market strength. All three portfolios should move in a similar “market-like” way.

As you can see, the S&P 500 is struggling to achieve this core objective with its most recent moves. But that’s not because the people who manage it aren’t smart investment managers, or because they are trying to make the portfolio move in a contradictory way as the Dow. That’s not it at all. It’s because the portfolio is too big.

Managing a portfolio the size of the S&P 500 or bigger is so much harder than tending to the Dow or 15-51. That’s the reason S&P trends sometimes get away from what their management team wants. Its size makes it too easy to fall short of expectations.

Smaller portfolios also produce greater investment returns.

This is also the reason teams of skilled fund managers consistently fail to achieve market returns while I routinely kill every mutual fund and market index from here to Shanghai, all by myself.

And you can do it too.

Easy to understand. Simple to use. Superior results.

Stay tuned…