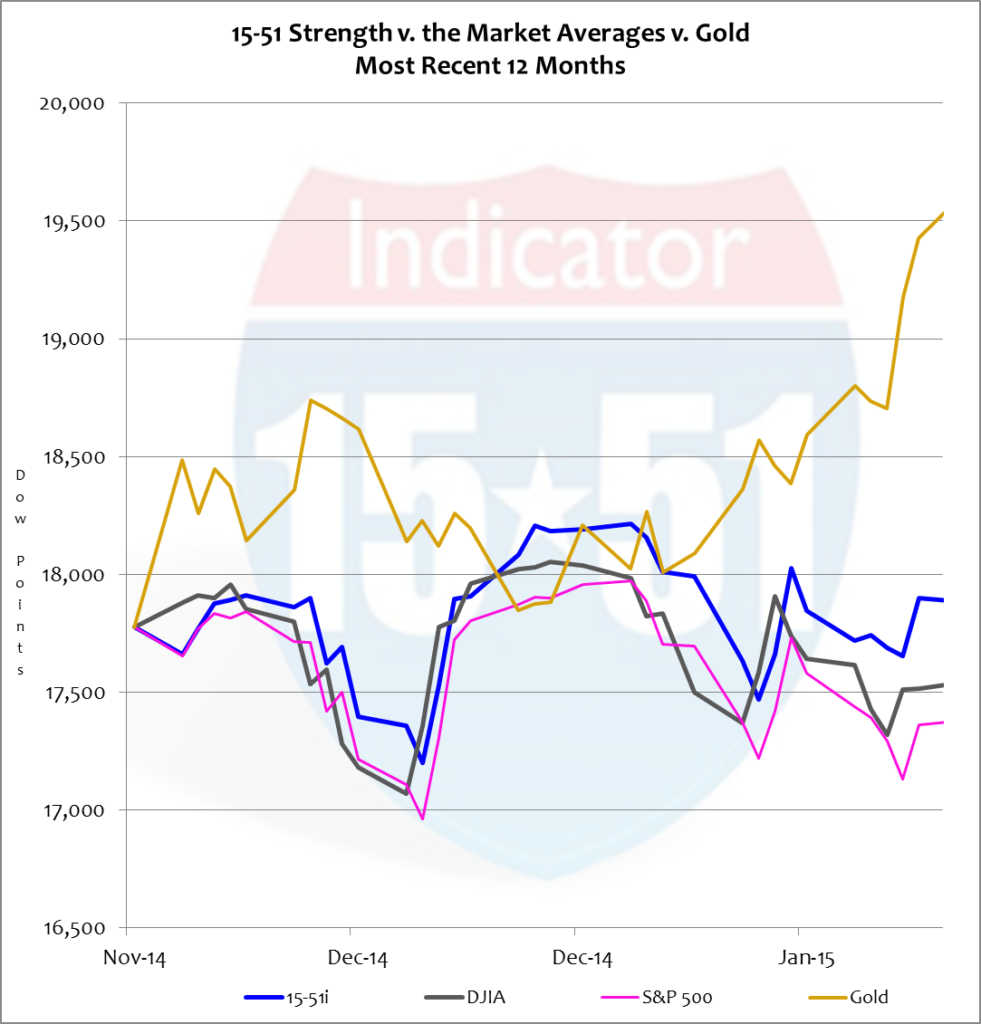

Gold has quietly risen 12% from its 52-week low reached just a few months ago, on November 5, 2014. In that time yields have dropped a whopping 24%, also with little fanfare. But stocks, again, stole the headlines. Volatility is the theme.

The Dow Average has been up a point or down a point more than a dozen times in the past few months. In the end it has gone nowhere. The 15-51 strength indicator, also traveling a rocky road, had managed to eke out a small gain. See below.

Stock market volatility can easily be attributed to lofty valuations in an increasingly suspect Market. Sure there has been a recent surge in U.S. market activity, but it has little to do with positive Market changes and more to do with the welcomed drop in oil and gas prices. That’s why stocks are having hard time holding onto gains.

The drop in yields is the most dramatic move of all the trend lines shown above.

Capital, both foreign and domestic, is pouring into the U.S. Treasury market even though the 10 year T-Note is 1.8% and heading lower. Return clearly doesn’t matter to institutional investors. And it doesn’t matter because investors are scared to death about current conditions and looking for safety. What they’re scared about is the value of money; hence the recent pop in gold.

And while the U.S. economy appears to be on the mend, escalating trouble continues to brew in Europe. Pressure is rising for the ECB to engage in a quantitative easing (QE) program to thwart another regional crisis.

QE is a monetary technique used to devalue currency, consolidate loss at the federal level, and expand central government spending.

In America, QE was used to relieve banks from toxic assets accumulated during the housing bubble. In Europe, QE will be used to relieve failed nation states from debt they cannot afford to pay back – a.k.a. toxic sovereign debt. The U.S. bailed out banks with QE; Europe will bail out member countries with QE. And just as QE did not correct systemic problems in the U.S. financial system, QE will not correct the fiscal problems in Europe.

In America QE didn’t produce one legitimate economic plus and put American solvency at greater risk. It did nothing to remove the deflationary threat and spur economic growth. Instead QE inflated the stock market, lined the gambling pockets of rich Wall Street bankers, and facilitated an irresponsible increase in government debt that produced nothing but an inflated stock market and terrible economic returns.

Consider this. In the final year of the Bush administration and the first six years of Obama’s administration the federal deficit average 10%+ of GDP. During that time economic growth averaged just 2%. Only in government can spending 10% to get 2% be called a worthwhile investment. In reality, it’s a terrible return on investment – all facilitated by QE.

Central governments routinely use fear to advance their big government policies – a.k.a. government expansion. Fear of recession, deflation, financial crisis, and war, are all major weapons in the arsenal of big government advocates. Central bankers make monetary moves and tinker with the value of money to advance the desires and goals of governments – not the goals and desires of People. QE, for instance, is bad for people and good for big governments, as it facilitates excessive government spending and diminishes the value of wages people earn (see Their Side for more information.)

Take Switzerland as an example. Switzerland is a fiscally conservative small government country. Their debt-to-GDP ratio is a miniscule 20% – five times lower than the norms in this day and age – their unemployment rate is just 3.4%, and only 3.3% of the people receive welfare benefits. The Swiss is a model of fiscal conservatism surrounded by a world of undisciplined social liberalism. And the world is their major problem.

More than 70% of the Swiss economy is related directly to exports – and the socialist Euro-Zone is its biggest customer. A strong Franc (the Swiss currency) makes their products more expensive in Europe, who is again teetering on insolvency – hence the big push for them to engage in a QE program. To combat their strong currency and to make their goods more price competitive in the E-Zone, the Swiss had a money policy to peg the value of the Franc to the Euro by a ratio of 1.2 to 1. In other words, 1.2 Francs would be equal to 1 Euro.

But in a sudden and unannounced move on Thursday, January 15, the Swiss central bank removed its exchange rate peg to the Euro. The move caused the Franc’s value to immediately jump 30% against the Euro – an outcome contrary to the Swiss bank’s objective.

The spike in the Franc shows how little faith traders have in Europe and the Euro, and how fiscal conservatism raises the value of money. Europe is a mess and can barely afford itself; debt-to-GDP ratios of 100%+ are commonplace, unemployment is 11.5%, and taxes are outrageous. While it is true that neither the Swiss nor the Euro-Zone economies are growing, one is fiscally stable and the other is fragile.

To put it simply: the value of the Franc is rising because there is less downside risk in the Switzerland government than there is in the European Union.

Perhaps the most disturbing problem in the world today is the consensus among central bankers that they can fix Markets through monetary shell games like QE or exchange rate policy. Hence the pronouncement of Swiss central banker, Thomas Jordan, who announced he was ready to intervene in the markets again to weaken the Franc. Indeed, a weaker currency would help Swiss products remain more competitive with other European countries, but is it worth the cost of depreciation?

For instance, the only way to devalue a currency for a country like Switzerland is to devalue its underlying government. In order for Switzerland to do this to a level that would be more competitive with the Euro Zone it would have to take-on massive new central government debt – at least 70% of its GDP, or another $435 billion. (Their total debt right now is just $127 billion.) That’d be stupid.

The problem with Switzerland is complex. Interest rates are negative and taxes are somewhat reasonable, and because it’s so small (only 9 million people live there) it is extremely difficult to boost domestic consumption to offset lower European demand spawned by a stronger currency. And because Switzerland is essentially fully employed, it’s difficult to increase production capable of supplying a wider and more expansive market than the Euro Zone.

Central banking tricks can’t alleviate that dilemma, which is the reason the Swiss central bank should do nothing and let the market – and its central government – address the issue.

Even though its taxes are relatively reasonable, the Swiss government should cut Market taxes to incentivize domestic spending and business investment to increase capacity. Lowering corporate taxes will also help competitive pricing abroad. A government grant program can be initiated to encourage manufacturers to increase efficiency and capacity. Such an effort will help lower future prices. The Swiss will also need to address their immigration policy to bolster their workforce (an unemployment rate of 3% is just too low.)

Monetary tactics like exchange rate pegs and currency trading don’t solve market problems. They just put perfume on a smelly situation.

And it’s only a matter of time until that smell turns rancid.

Caution to investors with investments (debt or equity) in Europe.

Stay tuned…