So, the world’s largest economy shrank 3% in the first quarter and stocks everywhere rose in value; yet just one week later a single troubled Portuguese bank sent stocks reeling when news surfaced that it delayed interest payments on a portion of its short-term debt. That’s right, one struggling bank in Portugal caused bank stocks in Germany, France, and the U.K. to drop by more than two percent, and Spanish bank Popular to fall 5%, while prompting it to delay a bond offering.

Really?—one Portuguese bank did all that?

Of course not.

The world economy is approximately $75 trillion dollars; Portugal’s economy is just $250 billion. The fact of the matter is quite simple: Portugal is simply too small to cause world financial havoc. That is to say that the problem in Portugal isn’t an isolated condition. Europe is rife with government corruption and fiscal mismanagement. In fact, several Euro Zone members are teetering on the brink of collapse, like Greece, Italy, Cyprus, and Ireland – and by the way, larger member states like France and Spain aren’t in much better shape. The reason world markets shook on the Portugal news is because the Portugal condition is emblematic of the entire region. Plain and simple.

This was affirmed by the European central bank (ECB), who just one day before Portugal stole the news headlines, announced that it would begin a quantitative easing (QE) program for the entire Euro Zone. Remember, the goal of QE is to strengthen banks by injecting newly printed cash in exchange for toxic assets that were procured by banks. But as one senior European economist pointed out: just because “a banking system has been recapitalized, doesn’t necessarily mean that it doesn’t face problems.” That’s a clever way to say that QE is not a permanent long-term solution, but instead a temporary band-aid.

QE is another kind of cancer, not a cure.

The world financial system has been persistently inflated by central bankers since the ’08 crash. QE devalues the monetary base, forces yields lower, encourages irresponsible government spending, and inflates stock market indices beyond economic substantiation. That is why monetary threats like potential bank failures (like in Portugal) that can ultimately affect an underlying currency (like the Euro) negatively affect stock market values across the globe.

But like most other negative economic news of the modern day the stock markets quickly shrugged off the news of this failing Portuguese bank, Espirito Santo, after a good night’s sleep – even though accounting irregularities had been found which prompted them to file for creditor protection to make it easier for them to raise additional capital to remain solvent. In short, the Espirito Santo bank is in real trouble and is desperate to raise capital. But that seems to be yesterday’s news, and no longer a consideration for today’s stock markets.

U.S. corporate earnings have now stolen the news headlines and results have been mixed so far. Apple’s new iPhone delivered better than expected results; but Microsoft fell way short, prompting it to announce 18,000 job cuts. Harley Davidson disappointed – but Polaris surprised to the upside. McDonald’s is struggling, and gas prices are once again on the rise. But if anything is consistent with this quarter’s earnings season it is the performance of U.S. banks, who have led the markets higher. Of course, QE has made those profits happen – not economic vibrancy, and certainly not Dodd-Frank.

An excellent piece appeared recently in the Wall Street Journal on-line, entitled: Four Years of Dodd-Frank Damage. I have always said that this law was ill-conceived from the start, and those who have read my book know the true culprit of the ’08 crash. It was massive government intrusion into the lending marketplace that forced banks to take-on irresponsible and unnecessary risks that were facilitated by Fannie Mae and Freddie Mac – two government agencies omitted by Dodd-Frank regulation. Excluding Fannie and Freddie from responsibility and regulation is a travesty, and lays the groundwork for an incompetent and impotent law.

According to the aforementioned article, Dodd-Frank “has already overwhelmed the regulatory system, stifled the financial industry and impaired economic growth.” That can be validated by Wall Street darling, Jamie Dimon’s JP Morgan Chase, who in the last 18 months have hired 10,000 compliance officers and laid-off 5,000 loan officers. In other words, banks are replacing revenue generating employees in favor of regulatory administrators.

That’s not efficient or productive – but then again, major stock market participants have chosen to ignore this reality as well.

In fact, that’s how the stock market is choreographed to blindside investors. The Wall Street establishment, with its chief investment strategists and economists, often turn “the market” into its own being – an impossible to predict, irrational and independent actor. Comments like this one, made by chief European economist Riccardo Barbieri Hermitte, makes the point clear. When discussing the market sell-off in response to the troubled Portuguese bank, he said, “this shows that assumptions that the market was making were incorrect.”

Really – the market makes assumptions?

Markets are about people. Investment markets are about investors. Investors make assumptions, and investment markets reflect them. And when investors – especially those greedy institutional investors with the collateral power to manipulate markets – get so drunk on upward momentum and the possibility of maximum profit they forget to listen, look, and act rationally. That’s when Wall Street’s deaf ears produce the shocking sights of major market corrections.

You see, by transforming “the market” into some kind of third party beast, Wall Street players can blame it when disaster strikes. They do so to maximize their profits, secure their bonuses, and sidestep penalties and fiduciary responsibility when this unknown, unpredictable being called “the market” steals their customers’ wealth. They purport that their assumptions weren’t wrong, the market was. Their tactics weren’t faulty; the market did something it wasn’t supposed to do. That’s the mantra of the Wall Street establishment in a nutshell.

Successful investors need to be smarter than that. They must see the world dynamic for what it actually is, and make portfolio adjustments based on them – not hyped-up market indexes.

And for the record, “the market”, a.k.a. the Dow Jones Industrial Average, is easy to understand, easy to value, and easy to manipulate. It’s just 30 stocks, after all – and those same 30 stocks also drive the S&P 500. With the assistance of the Federal Reserve via QE, the Wall Street establishment is armed with the capital to inflate those values well beyond fair value. That’s what’s going on right now.

The question to independent investors is simple: Do you believe this is an economic boom or a choreographed rally?

Before you answer, look at these recent news headlines from the Wall Street Journal on-line: U.S. Corn Farmers Face Cash Crunch for the First Time in a Decade, New Home Slowdown Pressures Recovery, Ex-Banco Espirito Head Detained, Wall Street Takes a Shine to Argentine Bonds, and Options Show Rising Concern Over High-Yield Bond ETFs.

Food and energy prices are up, the housing market is still in a shambles, bank irregularities still exist to disastrous proportions, and sovereign debt is being accumulated way too fast, at ungodly levels, while sectors of the investment markets are showing signs of concern.

If you believe an economic boom is ongoing, albeit with no economic qualification, then cautiously invest in it – keeping in mind that stocks remain near all-time highs and unprecedented valuation in Real terms.

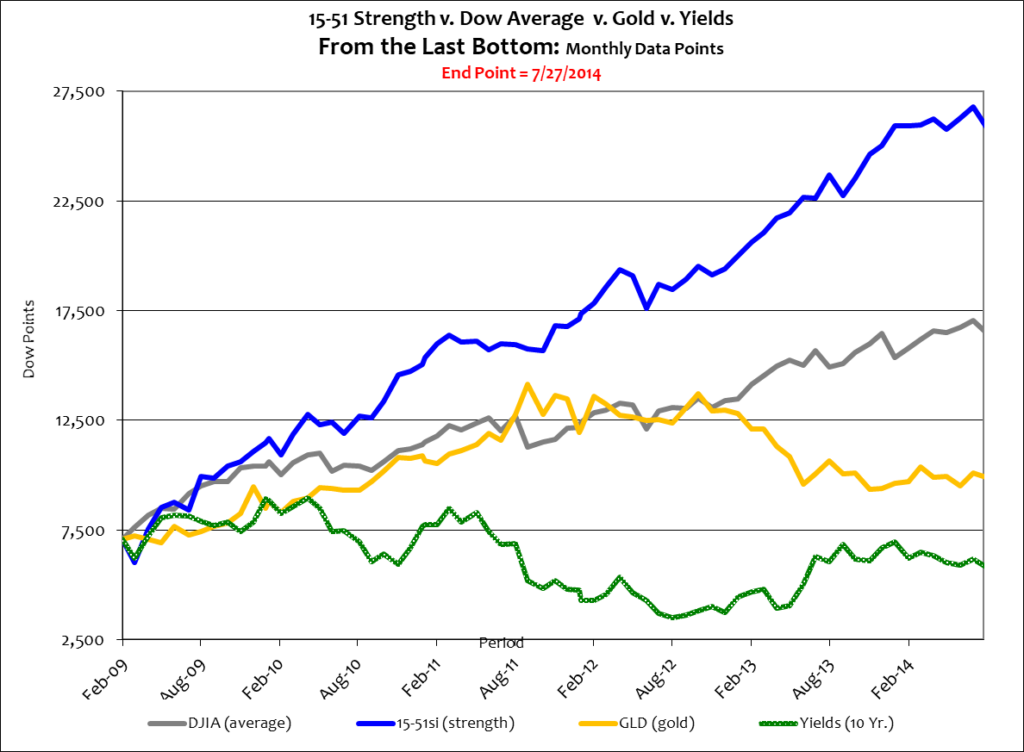

But if you see things as they actually are and believe this is a make-believe rally built on newly printed money with a blinds-eye towards reality – then wait for the correction to happen before you buy in and get aggressive. There’s much more money to be had (with less risk) by buying low than by chasing the next inflated record – especially with 15-51 strength. The chart below makes that point clear.

Since the bottom of the last correction (February 2009) the Dow Jones Average has gained 140%, or about 25% per year. Stock market strength nearly doubled that performance by gaining 276% in the five-plus year period, or 50% per annum. And you can see that the growth has slowed over the last year or so.

That’s what makes making money in the stock market so hard right now, and so risky. Valuations are too high – and there’s simply too little room for big-time growth.

That said, I have one more point to make before signing off. As you know the action zone is a dynamic range with a myriad of variables. One important array is the economy, Real and Nominal GDP, and their according growth ratios. If the economy was in a full-fledged boom – meaning inflation, taxes, and interest rates were moderately low while labor participation was rising (and the world wasn’t falling apart) – the action zone high would be 18,438. That’s just 1,500 points from where the Dow stands today.

STOCK MARKET VALUES ARE GROSSLY OUT OF WHACK TO THE UNDERLYING ECONOMY.

Discretion is the better part of valor.

Stay tuned…