The investment markets moved backwards like a rocket in the first week of 2016, prompting even the casual follower to consider: Is this a sign of things to come?

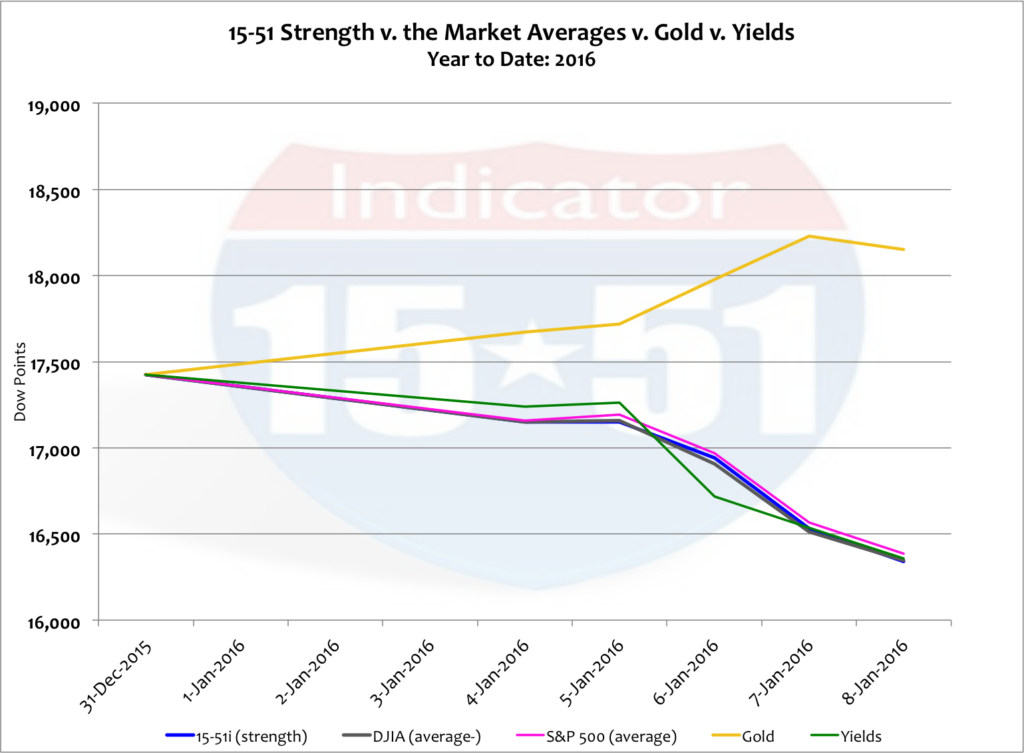

All major stock market indicators lost six percent in the week, and yields lost 7%. Gold gained 4%. See below.

Metaphor aside, the week’s activity sure looks like a sign to me.

Ironically, the week’s fallout mirrors the correction that occurred in August 2015 (stocks -6%, yields -7%, and gold +4%). And if you listen to the mass media we’re supposed to again believe that this week’s move was driven solely by China. (see, START SPREADING THE NEWS, for more info)

China is not the problem but instead a symbol of the problem at large. Since the ’08 crash almost every government on earth printed too much money, took on too much debt, and pissed it all away. The effort produced little more than weak-underlying economies that were over-leveraged.

Yet the global remedy became more monetary shell games — print even more, spend even more, and use the rest to inflate the stock market to put forth the facade that things have turned around and are now okay. To pay for it government raised taxes and manipulated interest and exchange rates to “help” exports remain price competitive.

Saudi Arabia is the most recent case in point. They are looking to break their longstanding peg to the U.S. dollar (to further devalue their currency) and initiate a domestic tax on gasoline to pay for central government spending programs. You know things are bad when Saudi Arabia has to tax its own people for, of all things, gasoline.

At some point institutional investors take reality into account — and that’s when markets correct.

Yet so many people still point to how “well” America is doing compared to the rest of the world, as if that is some kind of safeguard to another meltdown. And it should be doing better. America has the best operating model in the universe — even though the last two administrations have greatly altered that course. But just because it has a superior ideal doesn’t also mean that America is infallible, or immune to the global disease. After all, it was America who showed the world how to play the monetary shell game it invented, and how to inflate things to fleece markets and constituencies alike.

Truth be told, the global economy has never been solid since the housing market collapsed. That’s because strength in the Obama economy has never been driven by the consumer (the largest GDP component), which is the reason growth has been unreliable, weak and uneven. The reason for this is simple: labor participation is persistently low and wage growth is anemic — two characteristics that greatly hinder economic vigor and sustainability.

Instead, those ills are masked by the “feel good” part of this economy — lofty stock market valuations, which were driven by make believe demand created by quantitative easing (QE).

This has been a smoke and mirrors economy from the very beginning. And for those who don’t remember the real beginning of this crap game, it was a government program called TARP, which was launched during the “financial crisis” in 2008. That’s when easy money became in vogue.

In WHAT’S SCARING THE FED, many of the reasons the fractional raise in core interest rates took so much effort and deliberation were covered. But perhaps the most obvious issue wasn’t mentioned in that particular blog — the critical matter of unwinding QE.

The Federal Reserve printed trillions of dollars of new money over the last several years and handed it to the Wall Street establishment. Conventional wisdom dictates that the Fed will someday have to remove a large portion of that money — and that’s the real trick.

To do so the Fed can’t simply reverse the transaction it used to inject the new cash into the system (e.g. toxic assets for cash) because they don’t want banks to become more risky in the face of global crisis and recession (which would happen if toxic assets were transferred back to banks.) Instead, the Fed will have to sell U.S. Treasury securities to banks to remove the currency from bank balance sheets. In order to turn those securities back into cash, banks will have to sell those securities on the open market. And if there is insufficient demand for them market interest rates will move higher (to attract buyers) and banks will receive less cash for the securities that they just purchased from the Fed (because bond values fall when yields rise).

And this is how things will get away from the Fed.

Of course, they think they have it figured out. The Fed intends to unwind QE during the next crash, when the world is a mess and all major capital investors and governments around the world are looking for safety — a.k.a. U.S. Treasury securities. They’re betting that it will be this increase in demand that will keep interest rates from getting away from them.

But there will be too much pressure behind their finger in the dike.

A spike in U.S. interest rates will shock the world. Emerging markets will take a dive and fragile governments (like Greece) will be pushed over the edge. World currencies will plummet, and the Euro will most likely collapse. American banks will again be stressed, as stock values and bond portfolios spiral out of control. And before you know it, boom!

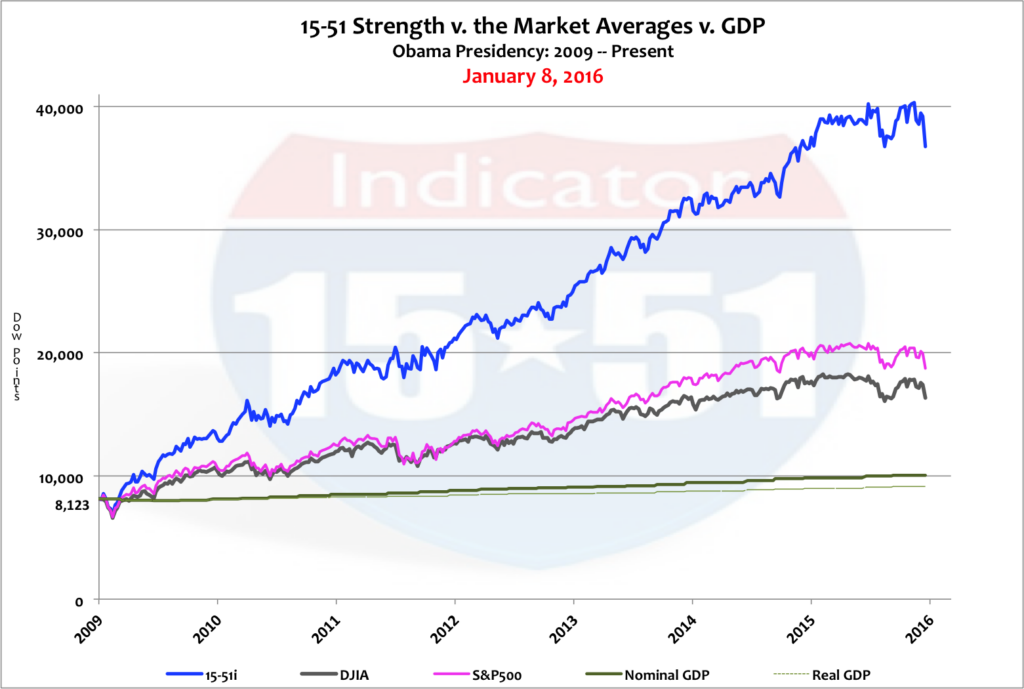

As mentioned in SURVIVING THE NEXT CRASH, major corrections generally occur at the end of presidencies when the chief executive has less control over fiscal and monetary policies. But it’s also usually because stock markets have risen so dramatically and unwarranted that valuations must be flushed out, and seemingly do so to clean the slate for the next presidential administration.

Let us not forget that the markets are way overdue for a good purging; the S&P 500 has averaged 19% gain per year since Obama took office. Nominal GDP has advanced just 3% per year under a new and expanded definition of market activity. Stock market strength via the 15-51 Indicator has gained 353%, or 51% per year, during the same time. That’s a crazy amount of inflation compared to GDP growth. Take a look below.

A friend said to me the other day, “Hey Dan, the stock market hasn’t gotten off to a start this bad since 1929.”

I replied, “Yeah, and it’ll probably end the same way too.”

Markets correct all the time, and sometimes the stars are aligned for a volatile year and one big APROPOS ENDING.

Expect it, plan for it, and capitalize on it.

Stay tuned…