Major market indexes have posted four consecutive weeks of gains, and are now more than seven percent above their February lows.

What inspired the turnaround – was it an economic reversal, or a sign that revival was in the air?

Truth be told, it was actually more bad news.

Weak global demand continued to plague global markets, as it again pulled the Eurozone back into a deflationary condition. While it is true that deflation isn’t always bad (the steep drop in computer prices during the 1990’s comes quickly to mind) the situation facing the Eurozone is the worst possible kind.

Unlike computers in the 1990’s, which paired robust market demand and greatly expanded supply to bring about lower prices, Eurozone deflation has been brought on by the dreadful combination of weakening demand and contracting supply, which has produced lower prices and persistently high unemployment. All of these have caused anemic monetary velocity in the Zone’s marketplace.

There are many reasons monetary circulation stalls in an economy – and at the root of it are consumers and their unwillingness or inability to spend. Perhaps credit is tight or unavailable, or maybe jobs and wage growth haven’t been positive for an extended period of time. Or it could also be that consumers are using what little disposable income they have to pay down debts previously incurred. In any event, consumers are not optimistic about their future and are therefore unwilling or unable to spend. Such a dynamic forces producers to lower their prices to incentivize consumers to spend.

And if this bad kind of deflation is not treated properly it could promulgate a vicious cycle of contracting supply and rising unemployment, which leads to even lower prices, and in the worst case scenario, economic depression.

So you would think, as logic dictates, that Eurozone governments would specifically address the root of the problem (consumers) when formulating their solution this time around. But no, the Eurozone didn’t do that. Instead they decided to do more of the same things that failed the last time deflation reared its ugly head there.

Last week the European Central Bank (ECB) drove its core interest rates further into negative territory, increased its quantitative easing (QE) effort by an additional 20 billion Euro, and announced a new cheap loan program that it “hopes” will be passed on to businesses and households.—Key word: hopes.

The reason they need hope is because those programs didn’t remedy the problem last time. Perhaps they didn’t have enough hope back then.

So sad.

The problem with big government programs is that they never get down to the individual – the main drivers of economic vitality. That’s why the stock market rallied since news of Eurozone deflation crossed the wire several weeks ago. The Wall Street establishment is a key benefactor of easy money policies like QE – so they bid “the market” higher to show their approval.

It’s interesting to note that this scheme is starting to wear thin in Germany, as their Central Bank finally disapproved of the ECB’s policy stance. They worry that persistent easy money efforts could ignite “a doom loop of expectations and disappointment.”

Right on.

Central banks and monetary shell games cannot transform economic malaise into vitality – especially at this point in the cycle. All that is left for them to do now is spray perfume on a mountain of dirty laundry. Any benefit will be short lived – and that includes the recent bounce in stock prices.

You may recall that America invented the QE fiasco. The effort here did nothing but facilitate an irresponsible level of central government debt and deficit, inflate the stock market beyond reason, and inserted an ungodly amount of waste, corruption, and deception beyond anything the civilized world has ever experienced.

Let’s take a look at some pictures to corroborate those points.

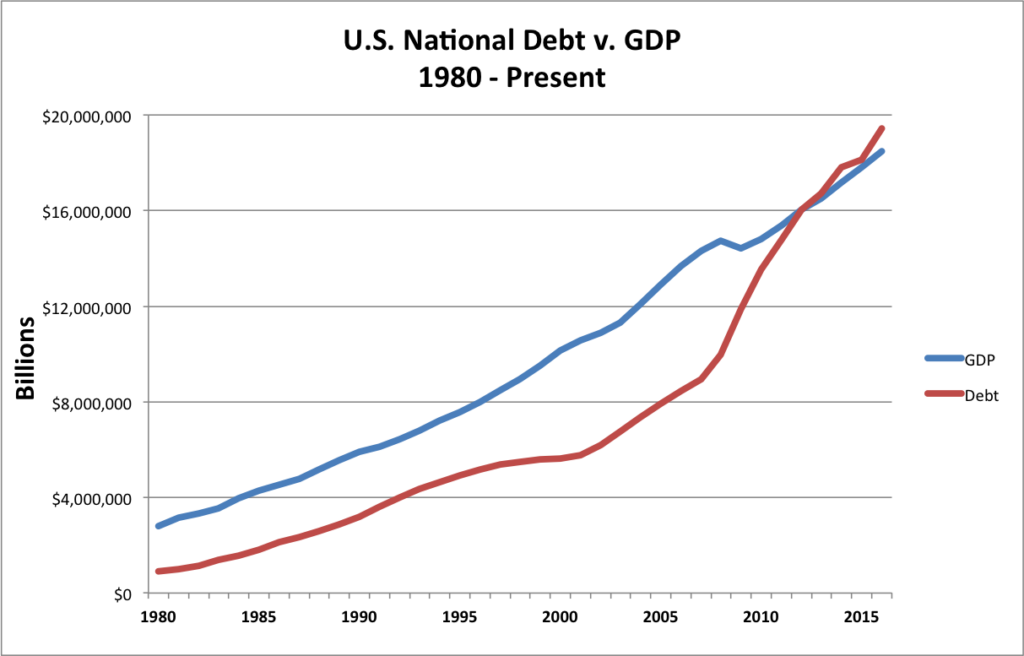

First, America has never experienced a persistently high level of national debt in her history. Yes, there have been big presidential spenders in our history; and yes, national debt was elevated to more than 100% of GDP during World War II; but that condition lasted just three years. Below is a chart of the national debt since 1980.

U.S. national debt has been greater than GDP for five consecutive years now, and according to President Obama’s most recent budget, that condition is projected to continue at least through 2021.

Since Obama took office national debt has increased 64%. Gross Domestic Product (GDP) increased just 28% during that same time. To put that dynamic another way, every $2.26 of new government debt produced only $1.00 of economic benefit.

Only in government can spending two bucks to get one be considered good or successful. And if President Obama had his way this nonsense would continue through 2021.

So where’s the other $1.26?

That’s your waste and corruption factor – can anyone say, Solyndra?

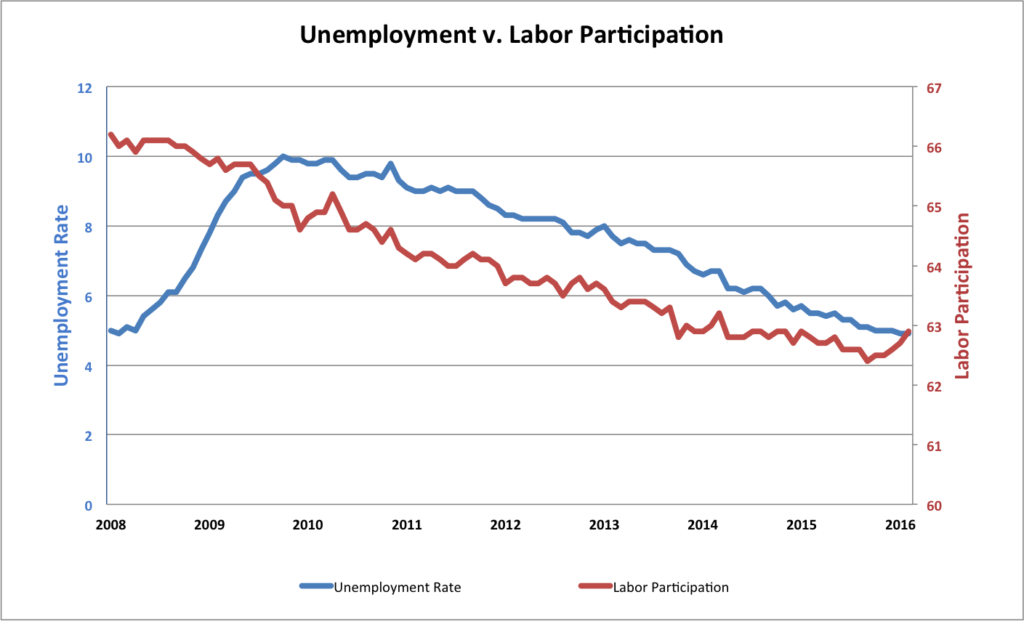

Speaking of fraud and deception, followers of this blog know that I often throw darts at the low unemployment rate, refuting it with the historically low labor participation rate. If the unemployment rate were truly low, labor participation would be high. But that isn’t the case. See below.

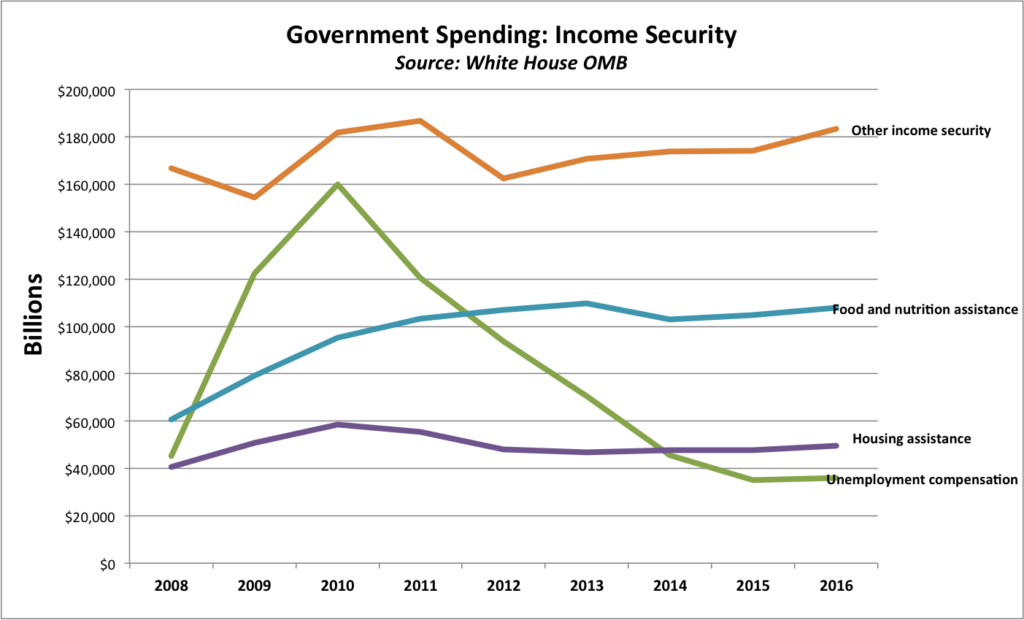

If the government were an honest broker then social programs for income assistance would have dropped along with unemployment compensation. But that hasn’t happened either. Take a look below.

As a side note, the above budget items do not include Social Security, Medicare, Medicaid, Veteran’s benefits, or government employee benefits. The trends above are simply supplemental income programs – and they are all higher now than they were before the recession began. And even though unemployment compensation has dropped (there is a mathematical formula for the elimination of those benefits) all other income security programs have remained elevated. Why?

Because the unemployment rate is a deceptive advertising metric that politicians use to put forth the notion of economic well-being and successful social engineering programs. But reality contradicts that notion. Obama’s social program agenda has actually discouraged employment and encouraged government dependence.

That’s not a recipe for prosperity. In fact, it’s the European model of socialism that has proven bankrupt time and again – just ask the Greeks.

So why would America and the entire Eurozone go so far down a path that can lead nowhere but to fiscal insolvency?

Two reasons.

First, that road emboldens the ruling class.

The largest threat to large government proponents – the socialists and communists – is a Free People. Free people reduce the power and scope of government. Free people insist that free markets pave the way to prosperity because they are the most efficient, effective, and equitable mechanism of wealth redistribution because free market activity is driven by the purity of consumer freewill.

Large government proponents disagree; they believe free markets are unfair and unjust, and that individual consumers cannot appropriately decide the best uses for their money. They believe governors like themselves are smarter than everyone else, and therefore can spend money more justly than individuals. So to succeed in their plight they must minimize the freedom of individuals and enterprise and embolden themselves – the ruling class – and the central planning abilities of government.

Second, the elitist mentality embodied by big government proponents precludes them from believing that they’re not smarter than every failed socialist before them. To put it another way, they fail to recognize that they can fail even though they are employing a failed socio-economic model – because they think that they can do it better, because they are smarter.

But let me ask, Do you think the Romans believed that they could fail before their empire actually collapsed?

Of course not. And the same is true with every empire in the history of man – none of them believed they could fail even though the socio-economic model they employed had a proven track record of failure. They thought they could do it better. And they were all wrong.

The solution in the Eurozone is not more central government interference. Printing more money to relieve more bad debts from failed states so that those same failed states can create more bad debts through more wasteful government spending and corruption won’t solve the problem again this time. It’d be stupid to think so.

The solutions for the Eurozone are the same for breaking America out of its funk. Stop the monetary ponzi schemes. Stop printing money and debt, and stop wasteful spending and corruption. And it’s also time to cut social welfare programs that inspire dependence on government.

It’s time to reverse course and incentivize people and enterprise to earn, spend, and invest. Cut taxes, shrink government, and eliminate all the bogus regulations that act as barriers to trade and business formation.

But today’s policies are the polar opposite of those throughout the world.

For example, a new set of economic numbers from China was released and they were worse than projected, but not as bad as they could have been. The numbers were helped by an increase in government stimulus spending – namely billions of dollars used to construct new production facilities.

How about that? China is building new production facilities even though their production is down significantly, and still declining, for several years running. That’s the big government central planning solution to falling production – build more production capacity to further lower prices in hopes that it will spur an increase in demand.

How foolish.

The answer there is the same as here and in Europe – liberate people, enterprise, and markets – but communist China can’t be expected to embrace that ideal. It’d be crazy to think so. But it does highlight the ideological difference between free market supporters and big government central planners.

One looks to empower people to solve market deficiencies, and the other hopes the ruling class inside government can do it. One relies on individual desire to fuel success and prosperity for all, and the other hopes that a manufactured equilibrium can achieve a stable mediocrity amongst all.

The world has never been so confused.

That’s why people like me are looking for someone on the world stage to make the winning argument – the free market argument – and one would think Trump to be that person. But all too often he comes across as a blathering idiot, repeating himself several times in a row while saying nothing of import or worth. It’s like he doesn’t understand what needs to be done and how to communicate it.

The same goes for Hillary Clinton.

But not so with Bernie Sanders. He knows exactly what he wants to do and is quite specific about it. And that’s the scary thing because he can’t possibly pay for his plan without a dramatic increase in taxes. Such a move would destroy the middle class and collapse the economy, and along with it, the American ideal.

Regardless of what politicians say, Middle Class workers always get screwed the worst. They don’t get QE money or income assistance, yet they always get stuck paying the tab for both.

That is not a positive environment for stocks.—But then again, that’s not what has been driving the recent rise in their valuations. It was the announcement of more free money that did it.

And QE will do it every time.

It is Wall Street’s cocaine.

Stay tuned…