Stocks have been on a complete tear since the Trump election. The Dow Jones Industrial Average closed at another milestone, ending last week above 22,000 for the first time in its history. Since the fall ballot the Dow Jones Average has added 20% to its value, with 12% coming in the first seven months of this year. The 15-51 strength indicator is also up 20% since the presidential vote with 15% coming in the current year. The S&P 500 has lagged those two portfolios, advancing just 15% since the Hillary loss and 10% this year.

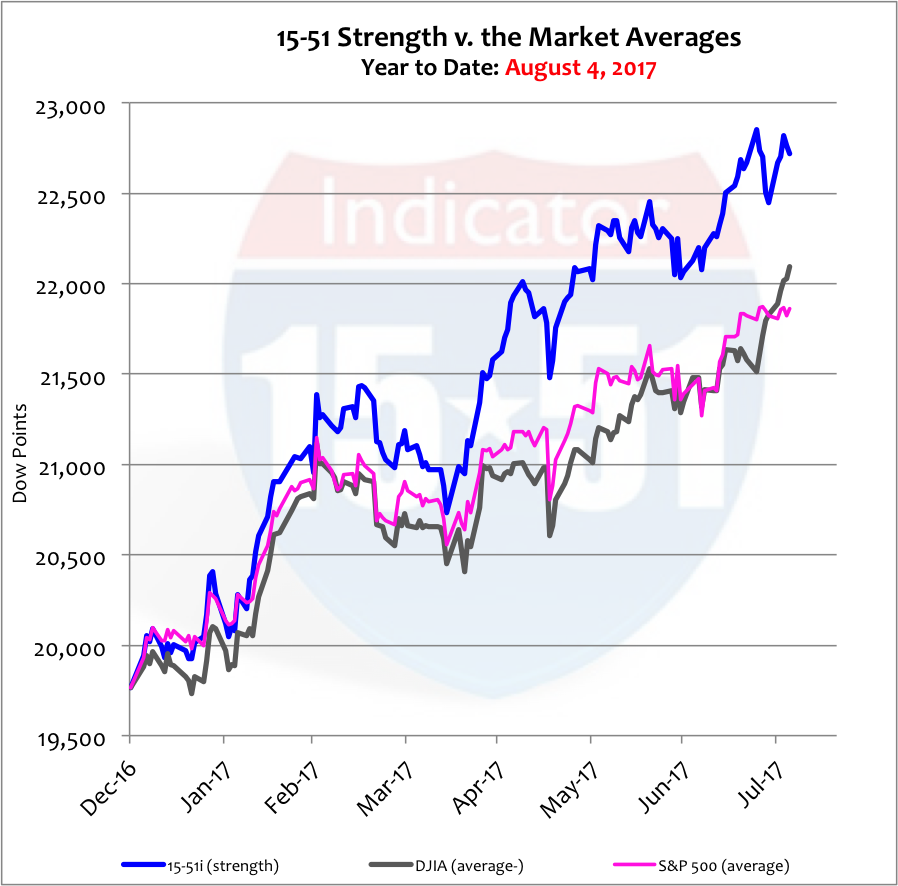

Below is a year-to-date chart of the market indexes. Take careful note of how each portfolio acts at the tail end of its trend line.

All three indexes are market-diversified portfolios comprised of stocks selected from the same pool. Their performance should vary due to their size and make-up, and for that reason the 15-51 Indicator should consistently outperform the averages over the long term. It should also be expected that all three portfolios move in concert, as if they shared the same heartbeat. This dynamic has held true until recently.

In the last two weeks the Dow Jones Industrial Average jumped 2.6% while the S&P 500 stayed flat. The 15-51 Indicator also experienced a leap but it started to move two weeks earlier than the Dow; it’s up 3.6% in the last month. But unlike the Dow Average the 15-51 Indicator has started to experience volatility and pullback — as has the S&P 500. It’s a weird market.

The recent rise in the Dow Jones Average has been widely attributed to the performance of Apple. But that is only one part of the story. Apple, also included in the 15-51 Indicator, has gained 35% so far this year, and 40% since Trump got the vote. But even more impressive is the contribution Boeing has made to the portfolios. The stock price for the airplane maker and defense contractor improved 53% for the year and 67% since the election. Even as gaudy as these results are, the move for just two stocks isn’t enough to lift the “the market” to this new height.

This stock market expansion is broad. Double-digit growth can be found in almost every corner of the stock market. In fact, far-reaching weakness can only be found at retail and in energy. This may help explain the S&P’s pause, as it has vast holdings in both underperforming segments.

Of the three trend-lines shown in the above chart only one doesn’t make any sense. The Dow Jones Average seems to be viewing the recently released economic data as strictly positive. If not, its trend-line would have shown some volatility or flattening like the 15-51 Indicator and S&P 500 have.

Second quarter 2017 GDP numbers were released last week and it’s the same old story. GDP grew at a 2.6% clip in Q2, which sounds good compared to last year’s 1.6% rate. But the average growth for the first half of 2017 was 1.9% compared to 1.4% in the first half of last year. Back in 2015 front-half growth was a solid 3%. It’s now two years later; and growth remains weak and uneven.

Unemployment data was also recently released and the headlines portrayed the rate dropping to a sixteen-year low (4.3%) as great news. But the last time the unemployment rate was at this level was May 2001 when labor participation was 66.7, a large half-point off its March 2000 high (67.3). The labor participation rate today remains at a pathetic 62.9 – a consistent level for more than three years now.

Not enough people are working.

And wage growth for the working class remains meager (2.4%) – about half the required rate to produce solid long-term growth. In May 2001 when unemployment was this low U.S. wage growth was 5.1%. To compare today’s labor condition to 2001 is to compare a crisp apple to a rotten banana.

At the peak of that economic boom, call it March 2000 from a labor perspective, the economy was growing at a Real rate of 4.1%, and “the market” was valued at 1.13 times GDP. Today, the economy is experiencing one-third of that growth and the stock market is trading at a multiple that is 53% greater than it was in 2000. In other words, growth is a fraction of the rate and valuations are almost twice as rich.

Trusting this market blindly is the first step to misfortune.

This, not to mention, that the Trump Administration has yet to pass any legislation that would fundamentally improve the long-term health and vitality of the American economy. And then there’s this…

The Federal Reserve has finally announced that it would begin unwinding its quantitative easing (QE) program – and that is a game changer. The tightening of monetary supply will cause inflation and interest rates to rise and that will inflict great pain on the world economy. This is the impetus of the next corrective cycle.

The Fed’s unwinding effort should have begun several years ago when the economy recovered from recession and the unemployment rate had dropped to a reasonable level. But governors don’t relinquish power easily – especially when there is so much money involved.

President Obama had ambitious plans for the remainder of his tenure and a puppet Congress too scared to go against him in fear of being labeled racist. And so he spent more money and accumulated more national debt than any other president in history, making FDR look like a fiscal conservative in the process.

Without a check and balance from Congress the American people had one more opportunity to thwart such fiscal imprudence. But during the ‘08 market crash the Federal Reserve expanded its power structure by unofficially changing its stated mission from “promoting the public interest” to accommodating government policy and spending. Big government proponents, on both the Left and the Right, silently endorsed the shift during the noise following the ’08 crash (a.k.a. “the financial crisis.”)

And so the QE epidemic began.

The Federal Reserve printed trillions of dollars of new money and laundered it through the Wall Street establishment, who under mandate from the U.S. central bank used 50% of the new money to purchase U.S. Treasury debt (to fund Obama’s frivolous spending agenda). The other half went somewhere other than its intended purpose, which was to support lending to American businesses to help the economy recover.

The reason for that is simple: interest rates were too low. There wasn’t enough incentive for banks to lend money to the American cause. So that money was exported overseas where interest rates were higher and provided bigger returns on investment. They are investment banks, after all. They chase ROI all over the globe, in every market. That is to say QE stifled U.S. growth and fueled a massive sovereign debt balloon that reaches every corner of the globe.

How does that serve the “public interest” and achieve the Federal Reserve’s stated goal?

Real GDP grew at 2.5% in 2010; a case could be made that QE unwinding should have begun then. But unemployment was still 9%. Okay, don’t unwind then – but at least stop printing money!

But no, the Fed kept printing money and handing it to Wall Street until the program’s end in 2014, when the unemployment rate was 6.2%, and thus way too late.

So why did the Fed print too much money for way too long?

Because President Obama was still in office and funding government deficits had become the Federal Reserve’s newly adopted mission. Under this direction the Fed works for the government’s interest, not the People’s interest.

Crisis conditions begin when establishments expand their power and control over people. The Federal Reserve gave birth to the QE technique in the wake of the ‘08 market crash and it was instantly lauded as the savior to the Great Recession; with it the Federal Reserve gained incredible power within government circles because it was they who would invent and deploy the mechanism (QE) to provide the president and congress a way to expand spending and borrowing without immediate consequence, and to do so off balance sheet and without transparency.

With QE the establishment created a time bomb that could be set to ignite at some future point when conditions were “right.” Economic activity, of course, had nothing to do with the decision to activate. Fundamentals have warranted unwinding QE for several years now. Instead, the Fed and their big government cohorts needed time to find a scapegoat to blame for the collateral damage caused by unwinding the QE effort.

Enter Trump.

According to our Federal Reserve – yes, the Nation’s Bank, and yes, the same one that didn’t see the last fiscal crisis coming – according to them, the “right” time to begin unwinding (igniting) the dreadfully abused QE program (the fuel to the time bomb) is in the first six months of a chaotic new anti-establishment administration with no legislative victories to improve economic standing or condition.

That is an example of the establishment protecting itself against invaders, which is exactly how many Democrats and Republicans view President Trump. Obama was one of them. Trump is the antithesis.

There are many on the Right who think former President Obama was inept, stupid, or something far less smart than what he actually is. That is an ignorant position. In fact, I don’t think there has ever been a “stupid” American president, certainly not one in my lifetime. And Obama was no exception.

Obama was a big government central planner who governed like a tyrant. But that doesn’t make him stupid. In fact, just a week or so ago he made an incredibly astute and profound comment regarding the Republican Party, saying something to the effect that ‘all of the sudden conservatives woke up and realized that they weren’t as conservative as they thought.’

Right on Mr. President. You have never been more right!

There are only a handful of truly free-market people serving in Congress, and many of those lack the real world experience needed to enact legislative policy that will create economic vitality. They just don’t get it. They’re lawyers, not business owners.

They need real world guidance and leadership.

Trump knows what to do but he cannot articulate it. He cannot convince people who disagree, and he cannot sway people who are unsure. That – not his stupid tweets – is the reason for his lack of Republican and moderate Democrat support.

Trump needs to put forth an argument that posers like Mitch McConnell cannot dispute in fear of exposing himself as the socialist that he is. Trump cannot dictate to him as Obama did to his Congress. For better or for worse, the Democrats always tow the Party line. Not so with Republicans. They always disagree with each other. Only strong leadership can unite them.

This is new territory for Donald Trump. He can’t fire Mitch McConnell or reassign him. The only way to deal with him is to have better ideas and a better advertising and communications operation. And I’m shocked that Trump doesn’t have a better marketing department than he has. People like Scaramucci can make it in private industry – but there is no rightful place for that kind in Washington DC. Putting people like that into important positions is, quite frankly, embarrassing.

The Trump chaos could almost have been expected. He has never operated an organization with 535 executives that have more power and control than he does. He probably feels like a caged beast, feverishly finding his way through a blind maze in search of a morsel of rotten meat. The job is probably more frustrating than anything he ever imagined.

The good thing is Trump is very competitive. He wants to win. He wants to succeed. He wants to be great, perhaps the greatest president in history. Trump has that kind of ego, like late New York Yankee owner George Steinbrenner had. People like them hate to lose, it kills them, and money is of no consequence. Winning is all that matters.

That kind of person is hard to beat. But still, the Yankees weren’t perfect, and Trump has lost his share. However, both the New York Yankee and Trump International organizations are expert marketeers. The Trump Administration, much to the contrary, is inept.

Hard to believe.

Trump must move beyond the investigations and ignore them completely. He should act as if they don’t exist and are of no consequence. He shouldn’t even answer questions about them anymore. Out of sight out of mind. Inconsequential.

Next he should drop the effort to repeal Obamacare and instead destroy as much of it as possible; Democrats are willing to discuss changes. Walk from the table if Democrats aren’t serious. But get something done if possible. If a bill signing event were to occur Trump should use it to promise the American people that the fight to fix healthcare isn’t over. It was just beginning, and would be taken up again after the mid-term elections.

And then move swiftly to tax reform.

G. W. Bush, another businessman that served the presidency, was much better at messaging and marketing than Trump has been thus far. Bush marketed his tax cut effort with an enticing angle: I want you to keep more of your money. You’re on a budget. The government should be on one too. The Bush plan was to reduce the rates of all tax brackets; therefore, all taxpayers would realize a tax break. That’s good positioning, good marketing.

And then Bush travelled all around the country beating the drum of his mantra to many different kinds of groups and associations in varying venues. That’s good advertising, good salesmanship.

Trump’s sales process is terrible. Now six months into his tenure I still don’t know where he stands on healthcare, what he wants to do, how, and why. I also don’t know what his specific tax policy is – and I closely follow the news and events of the day. That’s bad marketing and advertising. There’s no other way to put it.

The President needs a good message and a robust campaign to rally mass public support to push Republicans like Mitch McConnell and moderate Democrats into his fold. An army of We the People is the only way to defeat establishment politics.

Trump is in a street fight and the bad guys are winning. To win he must articulate positions and policies that would make the majority look foolish to deny. This can easily be done.

For instance, we know that the Federal Reserve is beginning to unwind its quantitative easing (QE) program and that it will cause interest rates and inflation to rise. That will cause a global slowdown that at some point will reach America’s shores. The Trump tax cuts have to be in effect before that happens otherwise tax cuts won’t happen. This Congress will never enact tax cuts at a time when tax revenues to the government are decreasing during a recession and stock market meltdown. Not happening.

The time to act is now.

Leaders must lead and therefore be out in front. Trump needs to inspire the necessity of tax cuts by explaining the Federal Reserve’s effort to unwind QE and its downstream effects. Variable rate mortgage rates will rise and homeowners will need the ability to pay for the increase. Higher interest rates will cause inflation (a.k.a. the price of goods) to also rise. Steep tax cuts across the board are required to cover the rising costs consumers will face – sooner rather than later. Time is short. The Fed’s unwinding effort is already underway.

To make things simple and speedy Trump should re-introduce the Reagan tax plan. It worked then, and it’ll work again. Besides, why recreate the wheel with an establishment Congress hell-bent on not getting anything done? For goodness sake, let Mitch McConnell – or any other Republican for that matter – vote against the Reagan tax plan. Go ahead, let me see it.

That’s the way Trump needs to play ball.

The president knows he has issues and he’s making changes. Great. The guy’s competitive. But time is slipping away. He needs some victories before the mid-term elections otherwise it could be a whitewash. And that would be bad. A Democrat controlled congress will produce five times the investigations and then even less will get done.

So that’s what investors face today: weak economic fundamentals, a stock market with valuations that make irrational exuberance seem mild, a president who can’t get anything done because he can’t articulate and market a winning message, and a completely corrupt government establishment (including the Federal Reserve) that is hell-bent on protecting their big government ideology at any cost – even if it comes at great expense to the American People and every investor located at every corner the world.

Caution: unwinding QE is the beginning of the beginning of the QE-boom going bust.

Stay tuned…