It was recently announced that the last remaining original member of the Dow Jones Industrial Average, General Electric (GE), would finally be eliminated from the iconic stock market index.

It’s about time.

Market junkies like me have been calling for a Dow makeover for years. In fact, WHAT’S WRONG WITH THE DOW – AND HOW TO FIX IT was posted way back in 2015. That blog cited structural deficiencies that were causing the Dow to consistently underperform the S&P 500 – and there is no good reason for that. A 500 stock portfolio should never outperform one comprised of just 30 stocks on a regular basis. In that blog I highlighted the reason for the Dow’s misfortune this way, “The Dow has become a pitiful collection of mediocrity, and the proverbial cherry on top is General Electric, the only original Dow component still remaining in the portfolio, which hasn’t sniffed a reasonable return since Jeff Immelt took office. He is clearly no Jack Welch.”

Few things in life are that obvious. Here’s another…

Small things are easier to manage than large ones.

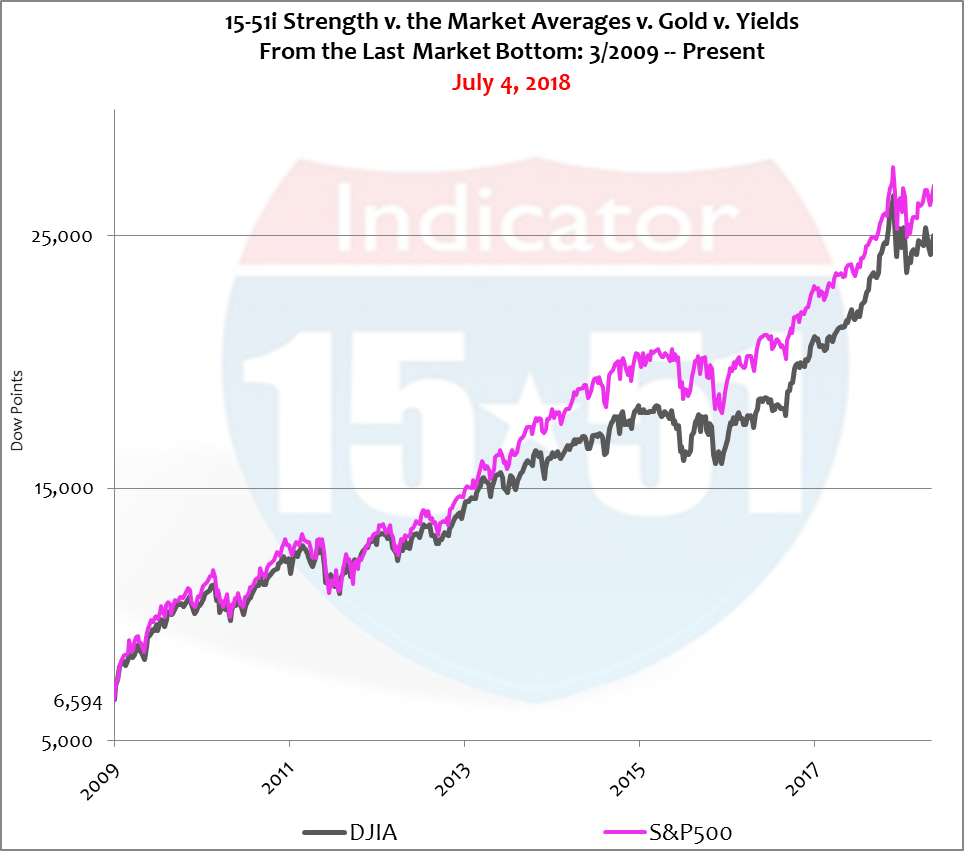

One of the best characteristics of small portfolios like the Dow Average is that they’re easy to fix (see the aforementioned blog.) Below is a chart that compares the two market averages since the last market bottom (March 2009).

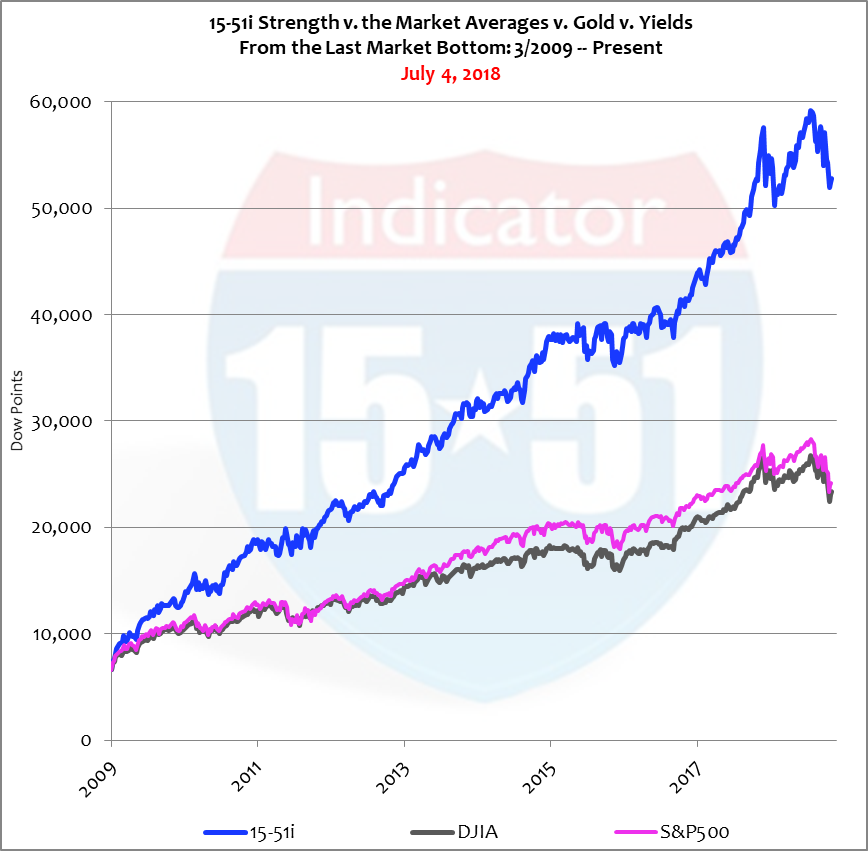

It’s been nine years since the stock market bottomed after the “financial crisis.” During that time the S&P has outperformed the Dow by 30 points, 297% versus 267%, or just over 3% per year. This dynamic (500 stocks outperforming 30) should never persist for this long of a duration – especially when the period begins at the pricing bottom, where it’s so much easier for smaller portfolios to rebound with a faster pace of growth. The 15-51 strength indicator proves this fact consistently over the very long-term. Below is another example.

Again, the Dow’s performance should be somewhere between the S&P 500 and the 15-51 Indicator. Its sub-par long-term performance trend is a complete and utter breakdown of basic investment fundamentals and logic. It is an outright embarrassment, and the guardians of the legendary portfolio should be ashamed of themselves.

In fact, it is becoming increasingly more difficult to see any kind of reason or sense in what the managers are doing with the most followed portfolio. They look incompetent or corrupt – and those with long-held respect and admiration for what the Dow Average is and stands for have every right to be offended by what they have done to it. The caretakers of the DJIA, like GE, should be replaced.

But not with a selection as stupid as the Walgreens choice.

Consider the move in this light…replacing GE with Walgreens reduces the number of Industrial stocks in the Average to one: 3M (Minnesota Mining & Manufacturing), or just 5% of the total portfolio. We’re talking about the Dow Jones Industrial Average here. One stock out of 30 is way too few.

Consider also that the S&P 500 and the economy (GDP) have an allocation triple that (15%), and the 15-51 Indicator has twice the amount (10%.)

What’s the Dow trying to indicate with a 5% Industrial allocation that relates to nothing — not the economy, not the S&P 500?

Adding Walgreens to the portfolio is just as perplexing as having one industrial stock in the Industrial Average. Take a look at the Dow’s allocation for the Consumer Service and Staple industries after the international pharmacy was added to the equation. See below.

| Services | Staples |

| UnitedHealth Group | Johnson & Johnson |

| The Home Depot | Procter & Gamble |

| McDonald’s | Nike |

| Walt Disney | Merck |

| Wal-Mart | Coca-Cola |

| Walgreens | Pfizer |

| Verizon |

So let’s talk about the Dow’s drug allocation…UnitedHealth provides drug insurance coverage; Walgreens sell drugs and Wal-Mart has a pharmacy too – and then there’s the drug makers JNJ, Merck, and Pfizer. That’s a lot of exposure to drugs, too much in fact – especially when considering how light the portfolio’s allocation is in the Industrial industry.

The move just doesn’t make any sense.

And even though the Dow’s allocation to Financials (19%) is close to the economy’s (20%), the portfolio still has too many financial stocks that cover the industry too narrowly. See below.

| Financial |

| Goldman Sachs |

| Travelers |

| Visa |

| JPMorgan Chase |

| American Express |

To have five financial stocks and only one industrial stock in a portfolio of 30 named the Dow Jones Industrial Average is misleading. To have an Industrial allocation one-third the size of the economy’s allocation is malpractice. And to consistently underperform a 500 stock index is blasphemy.

Replacing GE with Walgreens is idiotic.

Coincidentally, in Walgreens’ first week of trading in the Dow Average online retailer amazon.com announced they were getting into pharmaceutical retail with the purchase of pillpack.com. Walgreens swiftly lost 12% of its value.

I have always been a skeptic but have become increasingly so with age. I hate the fact that the guardian of the Dow Jones portfolio is S&P Global. Hate it.—And by the way, the amazon purchase of pillpack had been rumored for more than a year’s time, maybe two – yet the announcement arrives within days of Walgreens being added to the world’s most famous stock market index. It’s like S&P management is sabotaging the Dow brand in order to elevate the S&P 500 – to make it “the market” – and to aid Wall Street’s mantra that more is better, bigger is better, and that more stocks bring about more profit.

So not true.

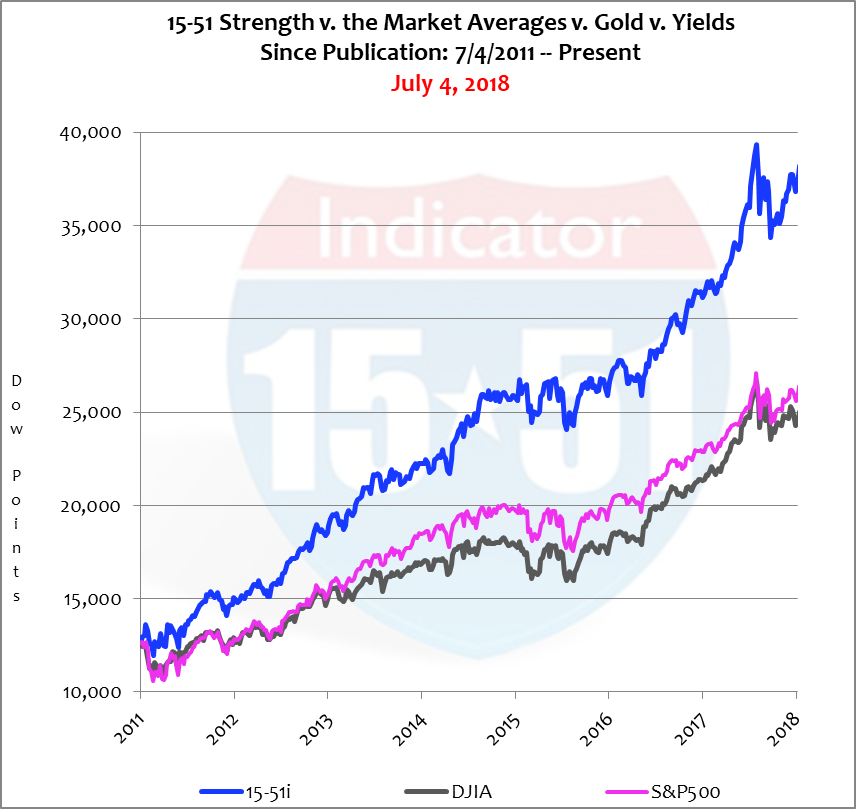

Proof of this can be seen in the 7 years since my award winning book LOSE YOUR BROKER NOT YOUR MONEY hit the streets. In that time my 15-51 portfolio has produced a league-leading 191% gain, or 27% per year. The S&P 500 posted a 103% advance, or 15% per year. The below-average Dow Jones Average added 91% in the same time, or 13% per year. See below.

My 15-51 method is designed and constructed to produce above-average investment returns using just 15 stocks. It does so consistently and reliably, over any long-term timeframe compared to any sized portfolio, be it the Dow’s 30, the S&P’s 500, or any mutual funds’ 1,000+.

So why invest in anything different?

Happy 4th of July!