Both are pretty scary in their own right but for me it’s the virus because I’m not a doctor or virologist and only know what’s in the news – and I know how unreliable that is. But what is happening in the financial markets was bound to happen, and quite frankly, long overdue.

Those who follow money, credit and banking have been waiting for something like this for a long time. The question was never whether or not another major stock market correction would materialize, but what would inspire it. This year’s coronavirus is just that motivation. Once identified it didn’t take Covid-19 long to choke supply, quarantine demand, and drain liquidity. It is the proverbial nail to the QE balloon.

Make no mistake, the QE-boom is bursting.

Corrections this big develop over time and take months to fully materialize. Still in its early stages, the QE-bust will haunt financial markets for the next year or so with increased turmoil surrounding Election Day 2020. Investors still have time to act – but their plans should be fully prepared and intimately known.

Perspective is key to proper action.

First of all things weren’t that great before the global economy was infected with this year’s coronavirus. In fact, many of the world’s economies have been buckling under the same dismal policies the U.S. implemented after the last financial crisis, some ten-plus years ago. Easy money and low interest rates – and most notably the scourge of QE – made it too easy to produce ungodly fiscal debt and deficits that generated little long-lasting return and economies more fragile than what preceded the ’08 debacle.

One such example is Japan, the world’s third largest economy, which posted an economic contraction of 6% in the 4th quarter – the quarter before we heard anything about this year’s corona plague. It’s a move no one is yet calling a recession because the contraction was incurred for just one quarter. Two consecutive quarters, or six months of economic contraction is the conventional definition of a recession.

Technicalities.

Those who have read my book know that Honda Motor Corporation, a Japanese company, is in my 15-51 Indicator™ portfolio. It is a stock that has frustrated me incredibly, and is on the hit-list to be replaced once this correction settles. Until then I will continue to follow it, as painful as it may be.

Indeed, Honda isn’t the only Japanese company to experience shutdowns in both production and supply chain due to the Wuhan flu, the manufacturing hub in Hubei province where the virus originated. China is a major supplier to much of the world, so in that regard Honda has the same short-term problems as many other global manufacturers.

Japan is a unique case because it has been hit with a rash of natural disasters that have greatly affected its market – tsunamis and typhoons have tortured the country, one of which caused a nuclear disaster. No doubt, they have had their share of unfortunate bad luck. But some they have created for themselves.

For instance, Japan is a country of savers whose economy hasn’t moved in more than two decades. In fact, its GDP is around the same level today as it was in 1995. Its economy is stagnant.

Interest rates there have been near zero or negative for years now. Low interest rates provide no incentive to save and negative interest rates are a tax on savings, both are monetary techniques used to discourage savings and encourage spending (or if a bank negative rates encourage lending). These easy money policies (called easy because it makes money cheap and credit easy) are meant to spark spending and grow the economy (GDP).

If monetary policy alone could change the economic landscape and fix all its ills then why has Japan’s economy been so flat for so long?

There are three ways to change economic direction: 1) monetary policy, 2) regulatory policy, and 3) fiscal policy. They can be either good for the economy or bad.

In that terrible 4th quarter of last year Japan instituted a national sales tax increase from 8% to 10%, a regressive fiscal policy. If Ronald Reagan taught us anything – tax spending in a country of savers and savers will spend less and save more, especially when sales taxes are far greater than the punitive effect of negative interest rates, which is the case in Japan.

In the Japanese market monetary and fiscal policies are fighting each other and the people are caught in the middle and not sure what to do. So they save, which is natural to them, and will continue long after the coronavirus disappears. That is to say Honda’s problems are systemic and market driven, and therefore, impossible to be here today and gone tomorrow.

So let me ask – What are the odds that Japan pulls through and posts an extremely strong first quarter economic report to avert the classic definition of “recession” despite the pain inflicted by the coronavirus?

To be ahead of the game consider Japan to already be in recession, which should be confirmed once the first quarter is over and economic numbers are released in late April – a key date for all investors. It’s also a safe bet to expect that China, the world’s second largest economy, will continue its trend of contracting growth but at an accelerated pace. That’s 2 of the top 3 world economies that will be reporting recessionary conditions in late April.

Unfortunately the economic news doesn’t get much better from there.

Europe, the next largest economy in the world, is a continent littered with mediocre countries on the brink of insolvency and/or political mutiny. Their economies are weaker and more fragile than ours, and operate under much tighter socialist rule. Most are leveraged to hilt, and ready to fall. Italy, for one, is crumbling as the clock ticks.—And now, with the suddenness of an unexpected sneeze, this whole open-border and free-roaming thing that made the Union so revered doesn’t look so smart in a coronavirus world. Many have sent their militaries to their borders to stop unlawful, non-citizen entry.

Will the EU and European Central Bank (a.k.a. Germany) continue to fund fiscal losses for the likes of Italy, Greece, and Portugal, to name a few?

Staring a severe recession or depression squarely in the face – Will austerity measures agreed to prior remain intact or will they be postponed, or waived entirely?

How long before member countries demand control of their own destiny – their own borders, their own laws and regulations, their own currency?

How long before another country follows the Brits out of the European Union?—And then what happens?

These are big questions that will be answered in real-time by real-life – and each time markets will react.

Investors should be prepared for a steady stream of negative news that continues to inflame volatility and drive valuations lower.

The European Union, their currency and their debt, are high-risk positions. Keep that in mind if you own international equities and/or high-yield fixed income funds.

To think that dire economic conditions in 3 of the 4 largest economies won’t significantly affect the largest economy in the world, the U.S., is a fatal error in judgement. The world is connected like never before. Supply chains are strained everywhere. Liquidity is tight, everywhere. And demand is quarantined – everywhere. This is a major economic event that will take several quarters to fully shakeout – just like all prior corrections.

There is much debate as to whether or not this is another ’08. The answer is yes and no. Yes, this is another financial crisis. And no, they are not exactly the same.

One major difference between this crisis and the last is that central banks have acted much earlier in the cycle to address tight liquidity. Most have loosened monetary policy by cutting interest rates and injecting hundreds of billions into their banking systems. The Federal Reserve was customarily late to the game last time and didn’t start printing money until liquidity actually went dry. This time they jumped in early as things started to dry up.

Similar, but not exactly the same.

However the housing-boom economy was built on the same foundation as the QE-boom – prolonged cheap and easy money policies that made credit too easy to get too much, for too many high-risk borrowers. Both booms required steady economic growth without any hiccup or novel flu virus.

Both ended when all of the sudden things slowed down.

Last time (’08) it was the surging price of oil (then $140/barrel) that ignited recessionary pain. Spiking gasoline prices was the last straw for an extraordinary number of subprime borrowers that were all leveraged to the hilt – mortgages, car loans, credit cards, and home equity lines of credit – making their debts impossible to pay or service. Defaults caused liquidity to run dry, which caused banks to fail.

This time (’20) it was the coronavirus that exposed the pain crashing oil prices (now $20/barrel) was having on the highly-levered shale oil industry, while it infected supply chains and quarantined demand. Liquidity started to run dry due to the pressure, prompting central bankers – who with 20-20 hindsight from ’08 – jumped in early to relieve bank stress by injecting trillions in a matter of a few weeks.

Lack of liquidity and the theatrics of bank failures drove panic and hysteria last time (’08). Recession, sensationalized by this year’s coronavirus, is driving panic and hysteria this time.—And oil was at the forefront of both corrections.

So yes, this market meltdown is not the same as the last. But they’re close – at least at this stage of the game.

In 2008 Bush addressed the crisis with a historic bailout program billed as “big enough to handle the very big problem.” Troubled Asset Relief Program, or TARP, was historic for two reasons. It was the first trillion-dollar bailout package ever passed and it gave birth to quantitative easing (QE). TARP, once thought to be the entire solution turned out to be only the beginning. More than $10 trillion of QE followed TARP on top of another $10 trillion in government debt and deficit, of which part still remains in the monetary system.

According to the Wall Street Journal the Federal Reserve injected $1.5 Trillion into the banking system two weeks ago and said they were ready to add another trillion on a weekly basis, explaining that their action was to “address highly unusual disruptions in Treasury financing markets associated with the coronavirus outbreak .”

The problem this time is way bigger than the last.

QE allows the Federal Reserve to bailout private industry outside of Congress and the U.S. president – an intolerable violation of the Constitutional checks and balance system. The Fed markets themselves as an intellectual body of apolitical experts that are beyond reproach. They are smug and condescending, as if they’re telling the hard line truth from an intellectually superior position. They say QE is the answer and savior to everything, it’s infallible, free and safe, and doesn’t cause inflation. Yet they print trillions of dollars and give it to the Wall Street establishment and fail to see the raging condition of hyperinflation so clearly evident in the stock market.

Fact: It is impossible to print money and/or credit in such large scale and not cause inflation, as the stock market plainly proves.

Yet the Federal Reserve disagrees, on the grounds I suppose, that stocks are not “products.”

Then how about this angle…

Every college student taking student loan debt is a subprime mortgage borrower. They have borrowed more than they could rightfully pay back. Student loans are now a government program that lends to anyone, without regard to price or ability to pay back, so not to discriminate (political correctness at its worst.) The resulting student loan program is an example of easy money policy because it makes credit so easy – like printing money with a signed agreement to repay even though repayment in not feasible or possible. So let me ask: Have you seen the price of college these days? It’s called hyperinflation.

QE made that credit easy.

And caused that inflation.

By making it cheap and easy to finance government debt and deficit.

Yet the Federal Reserve fails to see inflation and bad policy caused by QE – even though they’re so smart. And while they may not be an actual government agency they certainly act like one to the highest degree. They do everything they can to support the central government’s desires whether it is good for money or not, good for the American people or not. They are all economists but often implement policies that run contrary to sound economic principles. They are all bankers but seldom implement policies that are good for the value of money – so much so it’s hard to take them seriously sometimes, it really is.

For instance, not only does the Federal Reserve believe QE doesn’t cause inflation but they also must believe that there is currently little inflationary threat on the horizon, otherwise they wouldn’t be doing what they’re doing. Consider this…

Right now production and supply chains are strained all over a world that is now in shutdown, demand is contracting faster than supply is tightening. Normally when supply and demand are in a state of contraction central banks do the same with the money supply to eliminate the inflationary condition of too many dollars chasing too few goods. But right now central banks led by our Federal Reserve are easing monetary policy, printing money and expanding the monetary base under tight supply – a condition ripe for inflation.—But God forbid you challenge them on things like this because QE is their source of power, their cocaine, and they’re addicted to it, along with the rest of the ruling class (Congress).

The brewing inflationary condition is a major threat to economic health and stock market prices, here and around the world. It will make financing more expensive (higher interest rates and yields) which will bring Europe to its knees.

And then there’s this apparent spat between Russia and Saudi Arabia that crashed the price of oil; it’s down 73% since September ‘18 when it was $75 per barrel. Whether there is a true spat between the two is of no consequence to me. Both are adversaries, and their pricing policy proves it.

First, both countries are broke, they need the money, and are heavily reliant on crude oil revenues. Higher prices are good for producers because there’s more profit in them. Both countries see slowing global demand and, in fact, are experiencing it by way of lower volume. Lower demand causes prices to fall. So does over-supply. Yet both Russia and Saudi Arabia are promising to increase oil production despite falling demand.—In other words, to engage in activity that will continue to lower oil prices. Why?

The second part of the reason oil prices have been dropping worldwide is because of the dramatic amount of oil being produced and released to markets by the U.S. shale industry. Thanks to them we are less dependent on foreign sources of energy. But it’s not cheap – and it’s highly levered. They need and want higher crude prices for the same reasons as Russia and Saudi Arabia; all are competing to satisfy the same dwindling demand – a condition that causes prices to fall even further. At these price levels the shale industry must choose between operating at a loss and shutting down operations, which is more expensive to the market economy.

Make no mistake, our oil producing adversaries are trying to put the U.S. shale industry out of business – and Wall Street knows the risk of that. After all, it is they who placed and sold the debt, and perhaps service a great portion of it.

The pressure on the shale industry is part of the liquidity problem, which is why the steep drop in oil sent Wall Street into a panic that shifted massive amounts of capital from stocks and government bonds to cash in order to cover their short side – something the Fed tried to ease by injecting new money into the system – causing stocks to drop significantly.

“The market” is down 35% from its February 12, 2020 all-time high. And while stocks may look cheap now, they aren’t.

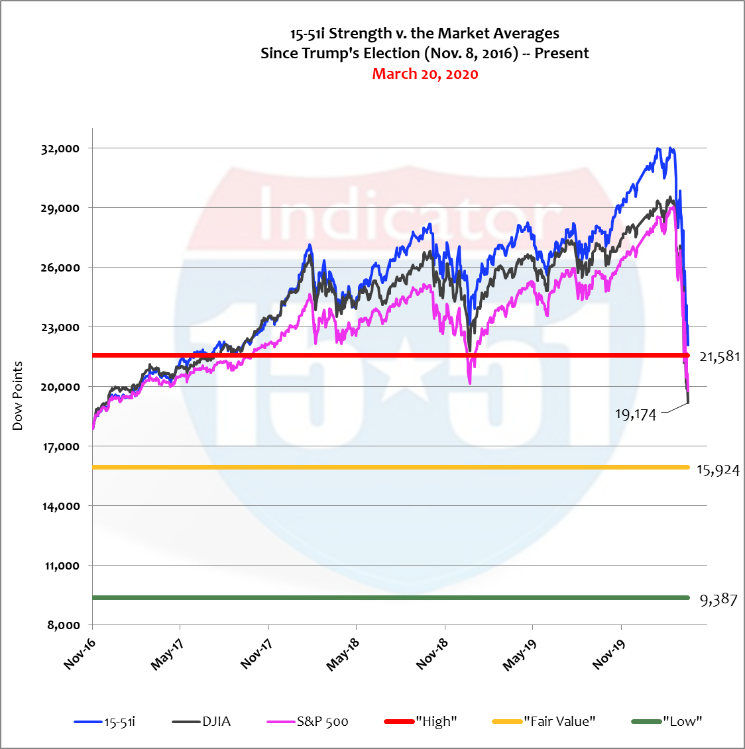

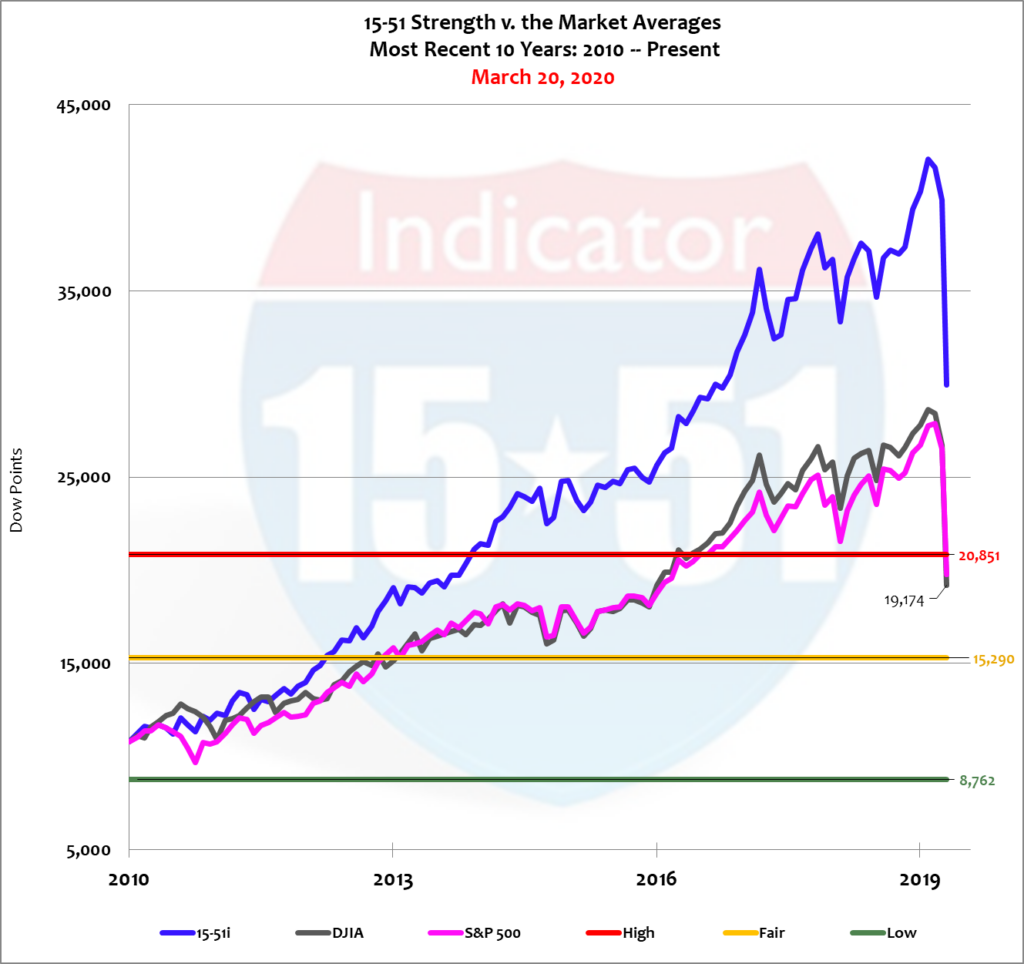

The action zone is a range I created to help investors gauge the pricing condition of stocks. It uses the Dow’s historical trading multiples during times of expansions (booms), recessions (busts), and their average to indicate whether stocks are “high,” “low,” or “fair.” The chart below places the Dow, S&P, and 15-51 strength indicator in the action zone .

As you can see Dow has been trading well above what can be considered “high” for a long time now. According to its historical average “high” starts at approximately 21,500. The Dow’s all-time high reached in February was 29,500. QE was the stimulus that made for the Dow’s consistent level of hyperinflation – until liquidity got tight.

The QE-boom required a steady and modestly growing underlying economy – a condition that has dramatically changed thanks to the coronavirus. That makes the Dow’s historical midpoint (16,000) “fair value” at this point in time – especially when considering that the global economy is now not just sliding into recession but diving into it. Multiples contract to their means during times these, and the Dow looks to be headed there.

The Dow’s “fair” midpoint is always a safe entrance point in the grand scheme of things, especially when viewed on a long-term horizon – but with the understanding that should this infection correction turn into a bona fide financial crisis (something I fully expect it to do) that the Dow Jones Industrial Average could easily fall to the “low” level of its range (9,000 points) before all is said and done. Put that probability into your investment calculus. Remember, with superior 15-51 construction there is never a good reason to be totally in, or 100% invested, in the financial markets.

Also know that it is equally prudent to ladder into stocks as it is to ladder out. In other words, it is okay to buy into stocks at 16,000, but not okay to have no investable capital if the Dow falls to 9,000.

This is one big ugly mess that will take months to shakeout. Guard yourself from overreacting.

In about six weeks’ time the world will begin announcing 1st quarter GDP results. Expect “the market” to move lower from wherever it is at the time on news that will undoubtedly be worse than anyone could have expected. Speculation about Q2 will swirl. And when those results come in weaker than expected in late July, together with a heated election campaign and some other kind of world strife, the stock market will make it appear as if the world is ending.

That’s the best time to buy.

Investors should expect continued downward pressure and volatility to grow with ferocity as news goes from bad to worse.

The QE-boom is bursting in the midst of a global Trade War, and the scariest part is yet to come.

Have your plan ready – and be ready. An opportunity of a lifetime is ahead.

Stay tuned…

PS:

I am a new investor studying Lose Your Broker. I have rated it very high 4 of 5 stars. Thank you for that. As a Californian, 73 years old, and unemployed I am becoming cash rich. I work for the Sac Kings and Sac. Convention Center. This means I will not work again until January 2021 at best.

I have not bought my portfolio yet but have pretty much narrowed the field to 5 industries an 15 stocks.

My question is centered around the bond market in a recession. I will not buy stock until the 2nd qtr. results or later. Is this a good time to pick up 5 yr. T bills or should I sit on my cash?

Thank you for the kind words, Lawrence. I will email you a private response. Cheers!

Thank you very much for the kind response. I will email you privately to answer your question. Cheers.