So it has been one year since the stock market first started acting crazy. Back then new Federal Reserve chairman, Jerome Powell, had yet to start his first day in office. And even though Powell was billed to arrive on the same long-term page as his predecessor, Janet Yellen, he has since ripped that page out and shredded it. In the fourth quarter of last year (2018) Powell completely reversed the Fed’s course in posture, policy, and rhetoric – and that is the big story in the investment markets today.

Powell came into office determined to implement a plan that Yellen devised but had no will to deploy. Advertised to be gradual and consistent, her plan called for a series of interest rate hikes over the course of years that were to be accompanied by an equally measured monetary tightening program to unravel the new currency injected into the system during the last crisis via quantitative easing (QE). Yellen, of course, never found the internal fortitude to unwind QE even though it was long overdue. And Wall Street loved her for it. (Bankers love easy money.)

But Powell appeared to be different. He spoke as if he was brave enough to actually do it. And so Wall Street sent him a huge message on his first day. You may recall that stocks tumbled a whopping 4.4% on that day, February 5, 2018. Wall Street’s statement to the Fed’s new leader was clear – Back off with monetary tightening (QT).

But Powell didn’t flinch. In the months that followed he displayed the nerve that Yellen didn’t have. He raised interest rates four times and drained some $600 billion of QE money ($50 billion per month) from the system in 2018 – a sizeable amount by any measure. Even so, and if not for investment market volatility, the effects of this monetary tightening have been impossible to notice.

But now, just one year into a long and overdue tightening program, Powell slammed the brakes and ended the effort indefinitely. Why?

The Fed acts not because it makes sound economic sense or because it is good for America, but to advance the establishment’s big government agenda – because they are part of it. They benefit from it, and gain more power from it. Sure they have tons of great rank and file workers there. But the Brass are nothing short of lifetime establishment operators. They serve and protect the establishment, not We the People. Make no mistake.

For example, contrary to everything Powell said for the prior ten months he halted the quantitative tightening (QT) program and placed the Fed on a “neutral” bias, which he defined as a pause until future data dictates action, which suggests that most of the work has been done and that market fundamentals did not warrant further tightening, and that the Federal Reserve’s balance sheet had returned to normal.

Nothing could be further from the truth and reality.

First, unemployment is the lowest in modern history and labor participation is finally starting to increase. A normalized unemployment rate was an objective of QE, which was satisfied 7 years ago, and remains low today (4%).

Second, the economy has fully recovered from recession, returning to growth almost 9 years ago (2010). It has grown steadily since and is now pacing at 3% per annum. Objective satisfied.

Third, yields remain historically low (2.6%) – even after interest rates were raised four times in the most recent year and $600 billion of bond liquidity was removed from the market – without negatively affecting the economy one iota. Satisfied.

And fourth, inflation finally reached the Fed’s target two years ago and remains near 2%. Of course, if the Fed had raised rates earlier in the cycle inflation would have returned earlier in the cycle. That epitomizes the farce of keeping QE alive better than any. (More on that in a bit.) Nevertheless, QE’s inflation objective has been met.

If not now then when shall the Federal Reserve remove the remaining $3.5 trillion of excess liquidity and return its balance sheet to pre-crisis levels?

The answer is never. When every objective has been met, no further action is required. That’s where Powell now stands.

By halting QT the Fed has just announced the new normal size of its balance sheet is 4½ times larger than it was 10 years ago, representing an amount equal to 25% of the entire U.S. economy. In other words the Federal Reserve grew by 450% in 10 years, or 45% per year for a decade.

Am I the only one alarmed by that?

But here’s the real danger…

Several Federal Reserve governors including chairman Powell have recently advocated using QE for non-crisis purposes in non-crisis environments. In other words, QE is no longer a mechanism to save banks or the monetary system (their one and only job). But now the Fed can use it for any reason it deems “important.” This is not a new concept, of course, Yellen first mentioned it two years ago, but it’s starting to gain widespread traction.

Put another way, should the Federal Reserve decide to employ QE in order to fund the Green New Deal then that would be okay.

What gives them that kind of authority, that kind of power?

Quantitative easing (QE) is emblematic of how corrupt the U.S. establishment is these days. It was originally devised to bail the banks out after the subprime mortgage debacle (’08). Once through that (‘09) QE became about keeping interest rates low until the economy exited from recession. When that objective was satisfied (’10) the purpose for QE became about correcting unemployment. When that corrected (’12) QE was now charged with doing something that it could never actually do – raise the inflation rate in the economy.

In other words, the Fed kept changing QE’s objective to substantiate keeping the program alive. Not because the economy needed it but because they wanted it to serve a larger big government agenda. That’s the real danger with today’s Federal Reserve. Like central government the Fed is too big, too powerful, and now they’re getting too bold, too radical, and too corrupt.

Four things to know about quantitative easing (QE):

1) QE was devised to keep yields low while the Federal Reserve funded central government deficits and Wall Street losses. Remember, banks were failing and the economy was shrinking when QE was invented. The Fed printed new money to bailout Wall Street banks and fund Obama’s big government agenda (the solution to the Great Recession). Keeping interest rates low was an objective to make it cheaper to fund trillions of the new debt that government deficit created. So the Federal Reserve printed trillions of new money and demanded Wall Street use 50% of if it to purchase U.S. Treasury securities (government debt & deficit). The Federal Reserve did this not because it was good for the American People, because it wasn’t, but instead to fund an irresponsible and feckless establishment government. Remember Solyndra?

2) QE did not cause inflation in the economy because the money never got to the consumer. Instead the money stayed at the institutional level, with most of it caught up in the wasteful bureaucracies of banks, governments, and unions. With QE the Fed didn’t just fund government deficits but also trillions of Wall Street losses fueled by the subprime mortgage debacle. Funding prior losses does nothing to benefit a current economy. These explain the modest inflation rate during the entire QE era (1.5%).

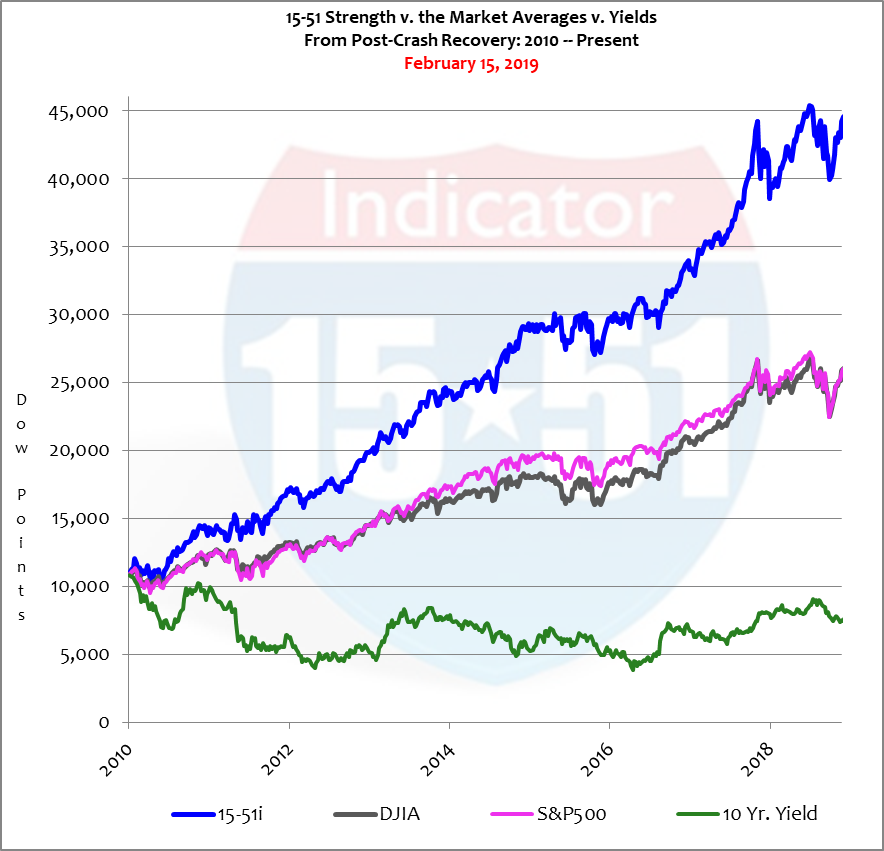

3) Wall Street had great leniency with the other half of QE money not earmarked for U.S. Treasuries, so it should be no surprise that a very nice chunk of it found its way into the stock market. That is where you can see the inflation that the new money created. The 15-51 Indicator gained 308% since economic recovery, while the economy gained just 22% in Real terms, and the 10-year yield fell 31%, from 3.9% to 2.7%. (Think about that for a moment: U.S. government issued $10 trillion of new bonds and rates actually went down by a-point-and-change.) See activity below.

4) QE produced three things: a) a massive and global sovereign debt balloon; b) a highly inflated stock market bubble; and c) a weak and uneven economy.

The reason the effect of the $600 billion in QT (quantitative tightening) was barely perceptible in the economy is because the money was removed at the institutional level – from the Wall Street establishment. And let me tell you they weren’t very happy about it. So they sold stocks off at the institutional level and caused havoc in “the market” to make it look as though the world was coming to an end so that Powell would take notice and hopefully change course.

And the weak-kneed Fed chairman caved.

Powell’s either a coward or just another corrupt establishment politician, or both. But forget about that for a second and take it from someone much more eloquent than me. Brilliant economist Ludwig von Mises said it this way back in 1973,

“There is no means of avoiding the final collapse of a boom brought about by credit [debt] expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion [QT], or later as a final and total catastrophe of the currency system involved.”

In an interview Powell once said that there was a period in his life that he was “obsessed with currency.” Surely he must have read Mises at some point in his career. Powell knows a catastrophe is coming, and he knows that tighter U.S. money was pushing it along. And isn’t it only natural to want to blame someone else for it, and if you’re an establishment guy, who better to blame than Trump?

Wasn’t it truly breathtaking to see how vulnerable China’s economy actually is, and how fragile we all knew Europe was. Growth was coming to a swift halt over there and both have huge political issues to deal with – not to mention their own QE situation to deal with, which is much worse than ours. Overseas markets were trembling and on their way to crumbling when Wall Street sent Powell a few 4th quarter flares. Hey dude, look over there, it’s time to back off.

And so he did. After all, why put himself through this kind of aggravation? If the next disaster is sure to come, and in fact was fast approaching, then why not slow it down a bit? Trump was very vocal about his desire for the Fed to stop hiking rates so fast. Powell could say he simply accommodated the president. So why not serve the next meltdown to Trump on a silver platter as he stands for re-election, where a corrupt media is sure to blame the anti-establishment candidate over anyone else?

Halting QE was purely a political move. Again, it had nothing to do with the domestic U.S. economy, which had long since recovered, and would have benefited greatly by higher yields and interest rates.

Foreign nation priority has long been a problem with Federal Reserve policy. They continued to employ QE and not reverse it because it was serving a bigger government global interest above any American interest. It wasn’t good for the American citizen or the cause of Liberty. It was globalism – socialism on a global scale.

Ronald Reagan once said, “Freedom is never more than a generation from extinction. We didn’t pass it to our children in the bloodstream. It must be fought for, protected, and handed to them to do the same.”

That fight is in full force right now. America needs to wake up because We the People are losing the battle.

Think of how corrupt the government and Deep State are today. What Obama and the FBI did to Trump during the 2016 campaign is much worse than anything Nixon did with Watergate. We should all reject that.

Fast and Furious would have sunk a Republican president but Obama and Holder didn’t even get a slap on the wrist. We all should reject that.

The real conspiracy with the Russians is with the Clintons but the FBI is falsely trying to use it to remove a duly elected president from an opposite Party. We all should reject that.

And now the Federal Reserve is using monetary policy to sink that same president, while destroying the American ideal in the process. We all should reject that.

Think about it this way… Banks were essentially nationalized when they were bailed-out in ’08. At the same time U.S. central government took title control of over $6 trillion of American land via the takeover of Fannie Mae and Freddie Mac. Obama began the takeover of the healthcare industry with the Affordable Care Act in 2010, and the next subprime mortgage disaster is brewing now with student loan debt, which now exceeds $1.5 trillion. It’s only a matter of time until defaults rise to a level that requires taxpayer-funded bailouts. And then it’s game, set, and match.

Any good communist will tell you that the easiest way to control people is by controlling money, housing, healthcare, and education. Their demise usually begins in earnest once they take control of energy, i.e. Russia and Venezuela. (hello, Green New Deal).

The cause for Freedom is losing because too many Americans are caught in a tizzy between Haters and Deplorables, and the politics of walls and tax cuts. Distracted by nonsense the American people fail to tackle important issues that greatly affect the future, like addressing the gross level of reckless spending that exists at every level of government, defining the appropriate role of government and how to reel in a runaway Federal Reserve, and addressing the failure of the U.S. educational system, which Alexandria Ocasio-Cortez (AOC) symbolizes so well.

Divide and conquer is an often used political tactic. The Two Party System employs it daily in America, and they use it effectively to divide the populous by incubating hatred between two schools of thought. And so we argue about a $5 billion wall when we have a $5 trillion problem with the Federal Reserve.

The establishment is winning because corrupt central governance is getting bigger and more economically domineering, and more powerful. Consider that Congress spends $4 trillion per year and the Federal Reserve’s net asset value is $5 trillion, together worth near 50% of the entire U.S. economy.

Scary.

Investors need to be patient and aware. The free market is shrinking and stocks and bonds are still high. There will be an opportunity to invest big in them but the Federal Reserve has just delayed it. Gold is getting into position to run.

Stay tuned…