I have struggled with this blog ever since STORM SEASON was posted back in September. Since the hurricanes blew in a few months ago media coverage has been a whirlwind of nonsensical misgivings about tax reform and a flurry of sexual harassment claims.

It’s easy to get lost in the bluster.

Tax relief is easy to understand: those who earn money to fund their lifestyles (a.k.a. workers and taxpayers) get to keep more of what they work all week to produce. Tax cuts utilize the same tax code system, but with lower rates.

Tax decreases = Increases in income

Tax reform is a completely different ball of wax – and can be a whole lot scarier. After all, the Affordable Care Act (ACA) was billed as “healthcare reform.” For those who haven’t read the ACA, it is a law designed to take control of the healthcare industry via the tax code. It was a tax law, and was confirmed as such by the U.S. Supreme Court[1] in July 2012. That is how the law was passed with less than 60 Senatorial votes. That “reform” package threw the entire healthcare industry and its insurers into chaos and sent prices sharply higher.

The GOP’s “tax reform” agenda has the potential to have that same kind of effect.

Only the corrupt call something what it is not. Corruption is a failure of society and of government, the legal representatives of society.

These sorts of tax schemes recently put forth by the Republicans are something to be expected from Democrats – not conservatives or small government proponents. To compare these plans to Reagan’s 1980’s tax reform is to admit to knowing absolutely nothing about American history and Ronnie’s inspiration – Calvin Coolidge and the roaring ‘20’s.

The definition of reform is to make changes in order to improve the item being changed.

Neither GOP proposal makes the current tax code better.

Even so, I hate to say that I wouldn’t be shocked if something actually got passed here. I also wouldn’t be surprised if it was a select few Democrats that pushed the bill over the line and into law. Truth be told, Democrats secretly want something like this, as the long-term trajectory of both bills embolden central government, weaken states, and diminish the rights of individuals.

It is right up the alley of power hungry politicians.

But the Democrats are torn. Passing a bill places their strong desire to seize more power and control in direct conflict with making Trump the worst kind of failure history has ever experienced. They don’t want him to enact one new law – even if it were destined for failure. He’s an outsider and Washington is their ballpark. They don’t even want him to step into the batter’s box.

Add to this the fact that most Republicans don’t like Trump either and it is quite sensible to project that this legislative effort may also die on the vine. It’s anyone’s guess. However, one thing is for sure, if a bill actually does get passed it will be bad for We the People. In such a case Congress will have sent a broadcast message to the American populous: screw Trump and all those who voted for him; it will serve as their warning to never elect an outsider again.

Bank on that.

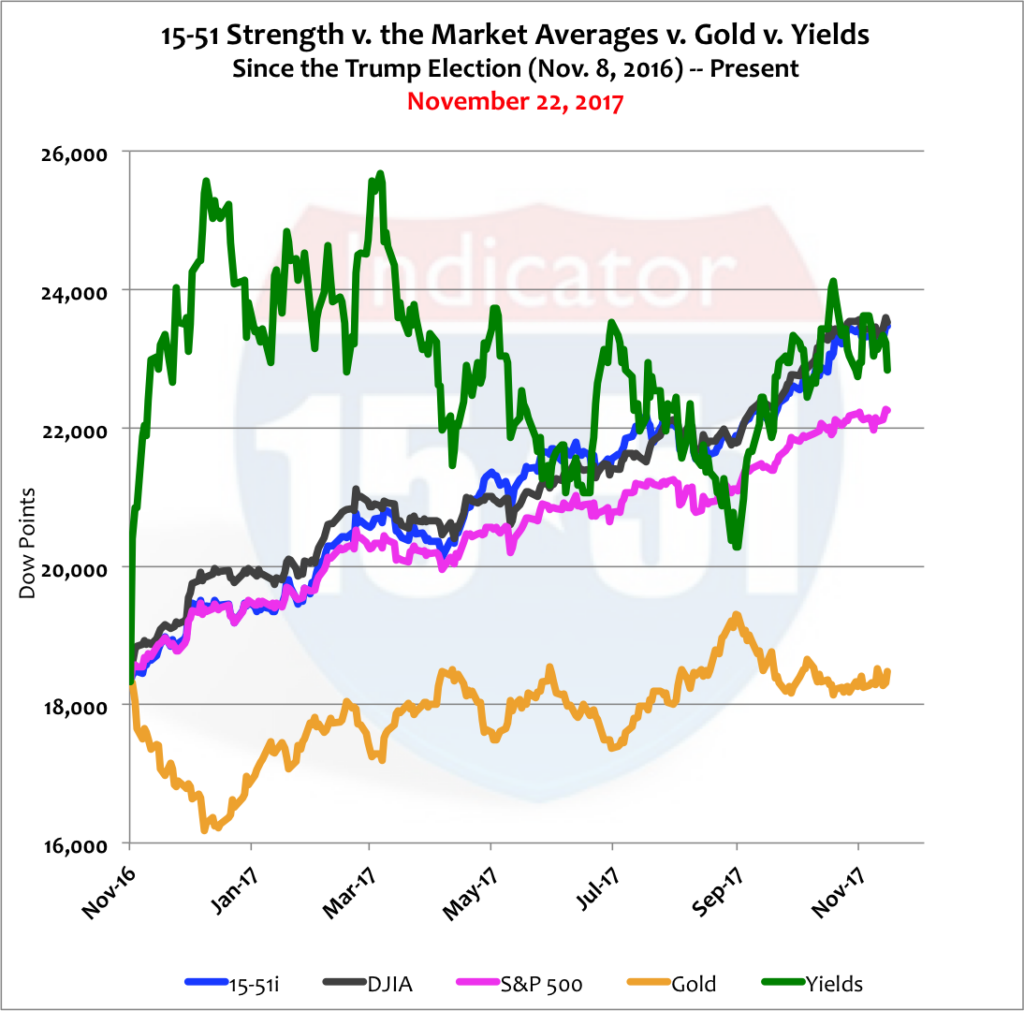

It seems like a lifetime ago that I blogged in favor of Trump’s tax agenda[2]. But that was six months ago when details were short of campaign promises. It was that economic platform – tax cuts, repeal and replace Obamacare, secure the border, and renegotiate bad trade deals – that sent stocks flying. Since the fall election stock market strength via the 15-51 Indicator has gained 28% which is in lock-step with the Dow Jones Average; the S&P 500 has returned seven points shy of them (21%). Gold is flat but has been both up and down in the year, and yields jumped to greet Trump before landing 25% ahead. See below.

It’s hard to take anything as true in these corrupted investment markets, but an unsure gold seems to be the most accurate. After all, Trump has gotten absolutely nothing passed since taking the oath of office — not to mention every proposal his Party puts forth has been terrible and far from his campaign platform.

Recall that Trump campaigned on cutting the highest tax bracket to 25% (Reagan’s was 28%), and corporate income taxes were to be reduced to 15%. Both GOP plans are way off that and either maintains the current highest tax rate (39.6%) or increases it; and they eliminate a host of deductions that will inflict a major tax increase onto many lower and middle class taxpayers. The GOP’s plan also calls to reduce corporate income taxes to 20% (from 35%), a-third higher than Trump’s pitch when he won the vote.

If either bill or some combination thereof is enacted this campaign breach would be as bad as, “If you like your healthcare plan you can keep it.”

Perhaps the most frightening thing about the “tax reform debate” is how eerily similar it is to how Democrats sold “healthcare reform.”

The Republican prognosis for their tax plan (to boost economic growth and employment and increase middle class income by $1,000 per year) is as baseless as “Healthcare premiums will go down and families will save $2,500 per year.” Both GOP tax proposals are higher tax-and-spend models that would make any power-hungry spendthrift socialist proud. Neither bill addresses the critical issues required to change the tax code for the better.

Yet stocks have moved like Trump’s campaign has become a reality even though it isn’t even possible. Nothing of what he pitched is on the negotiating table.

Many of my prior blogs have highlighted key points that true tax reform must address – to modernize the definitions of the classes (upper, middle, lower, and poverty) and reconstruct the tax brackets to fit them accordingly; to dramatically reduce all tax rates including, and most importantly, the highest rate; to significantly cut central government spending and therefore the central government’s presence and intrusion in the markets; and to protect the sanctity of national entitlement programs (Social Security, Medicare, and Veterans Affairs) by eliminating all waste and fraud and increasing funding[3]. So I won’t dive into those points again here.

Instead I will take an unconventional approach to the tax reform debate. Know upfront that the current dialogue in Washington DC has less to do with how much money taxpayers will gain or lose from this legislation and more to do with how much liberty We the People will continue to lose.

Everything is at stake.

The problem with the media today is that they distort facts and cloud important debates with politically charged propaganda that they use to pressure viewers into agreeing with one Party or the other, regardless of facts, outcomes, and possible unintended consequences. Media mayhem ensures only one thing: a confused and divided populace — a condition that paves the way to despotism.

In the 70th year of his Hall of Fame life, singer/songwriter Van Morrison created perhaps the greatest album in a most impressive and legendary career. His album, Born to Sing: No Plan B, is as creative as it is profound, and as entertaining as it is thought provoking. With lines like, “Sartre said hell is other people,” and “When God is dead, and money’s not enough, in what do you trust,” Van the Man paints the picture of the modern American dilemma and today’s social mishaps in quick and succinct lyrical bursts surrounded by soulful instrumentation. The album, which debuted in October 2012, has never been more appropriate than it is today.

Sure the political environment was hostile five years ago when the album was released – but nothing like it is today. Born to Sing is an album that poignantly encapsulates the feelings of so many freedom loving, God-fearing Americans today – those who are irritated, frustrated, and even depressed about the diminishing American ideal playing out in Washington DC.

Music is more than just entertainment. Like writing or painting there is purpose to every stroke – the title, lyrics, song layout, the message and the beat. Where does the title track appear on the album? Why? And what is the message? Everything means something.

On Born to Sing the title track is placed third on the album. The opening track on this politically motivated album is a song entitled, Open the Door to Your Heart.

And can’t we all do a little better job at that in this politically stoked environment?

Morrison’s provocative line on the second track: “Sartre said hell is other people,” refers to French philosopher Jean-Paul Sartre’s play No Exit. Sartre was a key figure in existentialism thought, where freedom and individualism were predominant core values. In the play three characters arrive in hell and struggle to determine what sin had led them to the abyss, and what the according punishment might be. Soon they realize that in hell there is no executioner, no punishment, and no burning flames. Just the three men trapped in a room – for eternity. The “hell” was the other two persons in the room. Hence, “Hell is other people.”

And doesn’t that feel like the hell the two political Parties have inflicted on We the People of late? They are the hell. What sin did we commit to deserve it?

Of all the great songs on this recent Morrison collection one stands out as the most fitting today. It is the last song on the album – the message the artist wishes to leave you with – that captures Van’s existentialist influence and the modern American condition in one fine tune. Educating Archie is not just for today, but for the ages.

Educating Archie, Van Morrison, on Born to Sing: No Plan B

You’re a slave to the capitalist system

Which is ruled by the global elite

What happened to, the individual

What happened to, the working class white

They filled his head with so much propaganda

Entertainment on TV and all kinds of shite[4]

What happened to the individual

When he gave up all of his rights

Tell you up is down and wrong is right

Nothing to hang your hat on, can’t even get uptight

You’re controlled by the media

Everything you say and do

What happened to, the individual

Tell me what happened to you

Tell you up is down, not able to fight

Keep you docile and complacent, can’t even get uptight

Controlled by the media and you don’t know what you can do

They took away your constitution you don’t even know what happened to you

Waffle[5] is the language that they taught you, taught you to talk

But you can’t even get any angle because you forgot how. Keep on walking the walk

You’re a slave to the capitalist system and it’s controlled by the global elite

Double dealing with the banks, behind your back, just can’t fight

*

And that’s how he earned the nickname, Van the Man.

To begin…slavery is not a free market tenet. Free markets require freedom and slavery is the antithesis of that. Monarchs and oligarchs can believe slavery is a right. Freedom abhors it.

Next, a capitalist system that is ruled by global elites is not capitalism at all. It is socialism at its best, and communism at its worst. Instead, Morrison’s reference to slavery and capitalism is in jest, a vicious condemnation of a more perfect society gone horribly wrong.

And that is America today.

When government gets bigger so does big business – and the global elites get stronger because they control big business. The global elites are the donor class – those who fund political candidates and campaigns. They always get legislative carve-outs in tax deals because they always double-deal behind closed doors with those that they put in office.

That’s socialism.

Over the last twenty years U.S. central government has taken-over several huge sections of the American economy – education, banking, and healthcare, to name a few. Government intrusion into these markets has forced prices to rise so dramatically that they are becoming unaffordable to most people. Think of this for a moment…both GOP tax proposals have eliminated deductions for healthcare and student loans. In other words, they have ruined the pricing models in these two markets through regulation and subsidies and their answer to the problem is to impose higher taxes (by eliminating deductions) AND NOT by cutting subsidies and regulation – the origin of the problem. Such a policy raises the cost of these items to taxpayers.

That’s your government working for you.

Before you know it these markets become so expensive that nobody can afford them. And what happens next? The government must step in and provide it “free” for everyone.

That’s communism.

State solutions are communist. Market solutions are capitalist.

American government, both Democrat and Republican alike, pose as advocates of freedom and free markets but govern to an extreme contrary. They spend recklessly and beyond their means – and it’s never enough. They use the Nation’s bank (the Federal Reserve) to double-deal with the Wall Street establishment to launder money through the financial markets to fund their political ambition and power structure, while they bankrupt the nation and diminish the American ideal through regulations and a confiscatory tax code.

For eight years we heard Republican concern about debt and deficits while Democrats had no issue with them. But now that the Republicans are in power tax cuts must be near “revenue neutral” and Democrats are deficit hawks. Make no mistake; Democrats want to continue massive spending programs.—They just don’t want to lessen the tax burden for any person or group.

Why is it that government never has to live on less but taxpayers always do?

The current GOP tax proposals are expected to add $1.5 Trillion to the national debt over ten years, or $150 Billion per year. That’s nothing and no big deal.

Consider that in 2017 the U.S. federal budget is a massive $4 Trillion with “T” and incurs a $600 Billion with a “B” deficit without the estimated tax cut factored in. To put it another way, today’s “conservative” position is to return taxpayers just 4% of an overinflated budget, while “liberals” believe the tax cut – not their $600 Billion deficit – is the problem.

And from a different angle, consider that today’s “conservatives” believe it is prudent to continue crisis level spending programs nine years after the crisis took place. Spending escalated during Obama’s administration to a point of absurdity, and has never returned to pre-crisis levels. Republicans intend to maintain that same dreadful course.

Further consider that for eight straight years the 535 members of U.S. Congress spent more money each and every year than the entire GDP of the Eurozone’s economic powerhouse, Germany ($3.5 Trillion per year).—But unlike Congress, Germany has a budget surplus.

Forget about draining the swamp. Trump ought to start gutting the farm; what a bunch of pigs they are.

No American should have to pay one extra dollar to fund such reckless government spending. Tax cuts should be much steeper than what Republicans propose and the debate should center around cutting spending by one trillion dollars per year.

That’s conservative.

Republicans are not.

Let’s take a look at taxes, rates, and deductions, from an entirely different perspective. Let’s forget about the tax brackets in the conventional sense, and forget about arbitrary labels of rich and poor, and middle class…

Small business is the backbone of American industry and the economy – and no one pays more taxes than small business owners. No one. And it’s not even close. So let’s talk about the small business owner and place them in a high tax state, as both GOP proposals include reducing or eliminating the deductions for State And Local Taxes (a.k.a. SALTs). Let’s also make the person in our example “rich” as defined by the central government; and let’s make them a family, two life-partners and two children.

Forget about politics.

Both parents work full-time; their average workweek is five days long; hours worked has nothing to do with the equation. Small business owners work way more hours than the standard 40 hours per week – because that’s what it takes to run a successful business. Nevertheless, each working day represents 20% of their total workweek (1 of 5 work days). Right now, those in the highest tax bracket, the “rich”, must work 2 full days just to pay their federal income tax liability (39.6%).

Only three days pay remains to cover their cost of living, i.e. groceries, gas, rent, utilities, car payments, etc.

Then there is Social Security and Medicare. These entitlement taxes amount to an additional 7.62% tax on gross income – UNLESS of course, the taxpayer is a self-employed business owner. In such a case the small business owner must pay both sides of that tax, or 15.2% of gross earnings.

That’s another ¾ day’s pay.

This, of course, is not to mention the 7.62% payroll tax business owners must pay on the wages they pay all of their employees. But to make matters simple let’s make believe this tax liability doesn’t exist or factor into the tax equation for “rich” people. Even at this tempered point, the “rich” small business owner has just two day’s pay-and-a-quarter to cover their entire nut, which also includes education, healthcare, savings and retirement, etc.

Add to that burden their state and local tax liabilities. To keep matters simple let’s also forget about sales and excise taxes, the gasoline tax, and the many other fees and licensing required to simply live in most states. We’ll make believe those taxes don’t exist either. My home state of Connecticut will serve as the featured high tax state. Connecticut has a 7% income tax.

That’s another 1/3 of a day’s pay.

At this juncture the “rich” guy has just 1.9 day’s pay left to spend for their entire household expenses and savings after paying a whopping 61.8% total income tax, a three-plus day tax rate.

But wait there’s more. The local tax burden in my middle class area (Newtown, CT) averages $15,000 per year for real and personal property levies – but those are in after-tax dollars. In order to calculate the effective tax rate the after-tax amount must be grossed up. When doing so that fifteen-grand translates into $40,000 gross dollars – a 10%-20% tax to gross income depending on income level.

That’s another half-day to a day’s pay.

That said, the “rich” Connecticut small business owner has little more than a day’s pay left to live, save, and invest – which places that taxpayer just one day’s pay away from being dependent on government. Put another way, America right now is just one day’s pay away from State dependency, a day away from communism.

Another important deduction Republicans propose to eliminate is the healthcare deduction.—So let me get this straight, government intrudes on this market and throws it into a hellacious state of chaos that caused prices and premiums to skyrocket – and instead of repealing that legislative disaster, Republicans instead choose to make healthcare more expensive by removing their tax deductibility.

Isn’t that just ducky?

When deductions are eliminated they never return. Yet tax rates rise all the time. And it is that combination that threatens our constitution, our individual rights, and our ability to operate in a free market.

SALTs allow taxpayers to deduct state and local income and property taxes from their taxable income. Their federal rate, therefore, is applied to net income (gross income after deductions). Taxpayers in high-tax states, like my home state of Connecticut, would be hurt most by eliminating this deduction.

Republicans are positioning SALTs as a socialist policy of the worst kind – one where low tax states unfairly subsidize high tax states.

That is a great misnomer.

Blue states are less dependent on federal funding dollars than their lower taxed cousins, the Red states[6]. South Carolina, the greatest beneficiary of federal funding, receives almost $8 back for every $1 their residents send to Washington DC[7]. Another low tax state, Florida, gets back $4.50 per every dollar their residents send to the Nation’s Capitol; and Texas gets $1.50 back for every buck[8] paid by their workers.

This is in stark contrast to a sample of notoriously high-taxed states; New York gets back $.75 for every dollar sent to Washington DC, New Jersey gets $.90, and California receives $.95. My home state of Connecticut receives $1.25 for every dollar their constituents send to DC.

So to say that low tax states subsidize higher tax states is not only wrong but also a gross injustice to the tax reform debate. In fact, high tax states subsidize low tax states. Eliminating SALTs makes the condition worse. It is tax deform.

It is most important to understand the purpose SALTs serves in the tax code – they exist to ensure states have the ability to fund themselves without federal government interference. Consider without SALTs how easy it would be for the central government to raise taxes by an amount so high that it would make it impossible for states to levy and collect taxes of their own. Without the ability to raise required funding through local taxes, states would be forced into central government dependency – then say good-bye to the 10th Amendment.

The practice of quid-pro-quo was invented in politics. Want highway money? Raise the legal drinking age to 21.

There are always strings attached to the money coming out of Washington DC – and that’s the big problem. Too much money is flowing through the Nation’s capital which allows them to control too much of the economy that will soon expand to controlling states. This intrusion threatens the solvency of the individual, the rights of man, and the constitution.

Central government budgets must be cut — and must be cut dramatically.

Think of this, the “rich” family in our example is just one day’s pay away from being dependent on the government. Should the federal government eliminate SALTs and raise the highest tax bracket by just ten percentage points it would be enough to steal the rich man’s last day’s pay.

And then where are We?

The only way to justify something so drastic as the elimination of SALTs – let alone the deductions for healthcare, education, and mortgage interest – would be to dramatically reduce the top federal rate.

I’m sorry, the central government doesn’t deserve anything more than a day’s pay from any one person’s earnings – high earner or poor, middle class or “rich.” That said the top tier tax bracket should be no more than 20%.

Add to this entitlement taxes (Social Security and Medicare), which shall be no more than one-half day’s pay – 10%. Total central government taxes therefore should be no higher than 30% of gross income for any one taxpayer.

Why should government get four days pay and the earner only gets one?

And why are corporations – who operate all over the world 24/7/365, and are run by global elites – proposed to be taxed at only one day’s pay (20%) while individual earnings are taxed four times that?

And why do the global elites, who own and control those large corporations, and therefore accumulate vast wealth and income via their stock ownership, only pay one day’s pay for capital gains taxes (20%)?

Why does the little guy – the individual – always have to pick-up the tab for the establishment and its global elites?

All of that said, the fundamental reason these two GOP tax plans are doomed to failure is because they fail to incentivize job creators (a.k.a. high earners) to create jobs – and nothing can correct fully until job creators correct fully. Incentive is required for that – and neither of these proposals provides it.

This, not to mention, that the proposed reduction in the corporate tax rate is ill-conceived and won’t produce the kind of strong hiring the economy so desperately needs. Think about it, if Congress raises taxes on individuals (a.k.a. “the rich”) and lowers corporate tax rates then executive management will simply increase compensation to “rich” persons working for them. Why wouldn’t they do this when everyone who works for them just got some of their money as a tax break?

Additionally, I’m not so sure the corporate tax “reduction” is actually a reduction. Right now the highest corporate tax rate is 35%. My small company pays a 34% effective tax rate while General Electric pays 0%. If companies run by the global elites actually end up paying 20% under the new law it would amount to a huge tax increase. That may cause mass layoffs and unemployment to rise.

Ever wonder why there are seven individual tax rates and only one corporate tax rate? I mean, are all corporations “rich?”

Just as there should be four individual tax rates (upper, lower, middle, and poverty), there should be four corporate tax rates – 0%, 5%, 10% and 15%. Remember, businesses don’t pay taxes; they collect them. Taxes are included in the price of goods.

Republicans are so misguided and inept it’s hard to believe that they’re not failing intentionally. I mean, could they really be this corrupt?

Where is Sam Adams when you need him?

Trump is better off not signing one new law than signing only one new bad law. He needs to be a long-term thinker and stop selling-out to the Party establishment. He should govern as he campaigned and let the GOP die on the vine of socialism by themselves. If he doesn’t, the failure will be his – and his alone.

And it will be him who squandered our last day’s pay.

What gives him the right?

The low-income earner must bond with the middle class cause, and those classes must unite with the higher earning class – the job creators. The tax debate should not be about brackets and faceless rates. It should be about a day’s pay and who gets it.

A day for you, or a day for them?

Like Van Morrison said in Educating Archie, “They took away your constitution and you don’t even know what happened to you.”

That’s because it was probably stolen in a tax law, whether it was Obamacare or these new GOP proposals, that had “unintended consequences” that were never raised or debated at the time of passage — thanks to an ignorant and corrupt media.

Liberty will never die in direct conflict. It must be slyly stolen.

And that’s what is happening today.

Stay tuned…