If the first two hurricanes of the season are any indication the 2017 storm season is going to be nature’s version of Armageddon. Harvey and Irma have destroyed billions in property value, a priceless amount of life, and displaced millions of people from their homes and businesses. And a third hurricane, Jose, is on the way. Only Mother Nature knows how many more will develop in the season.

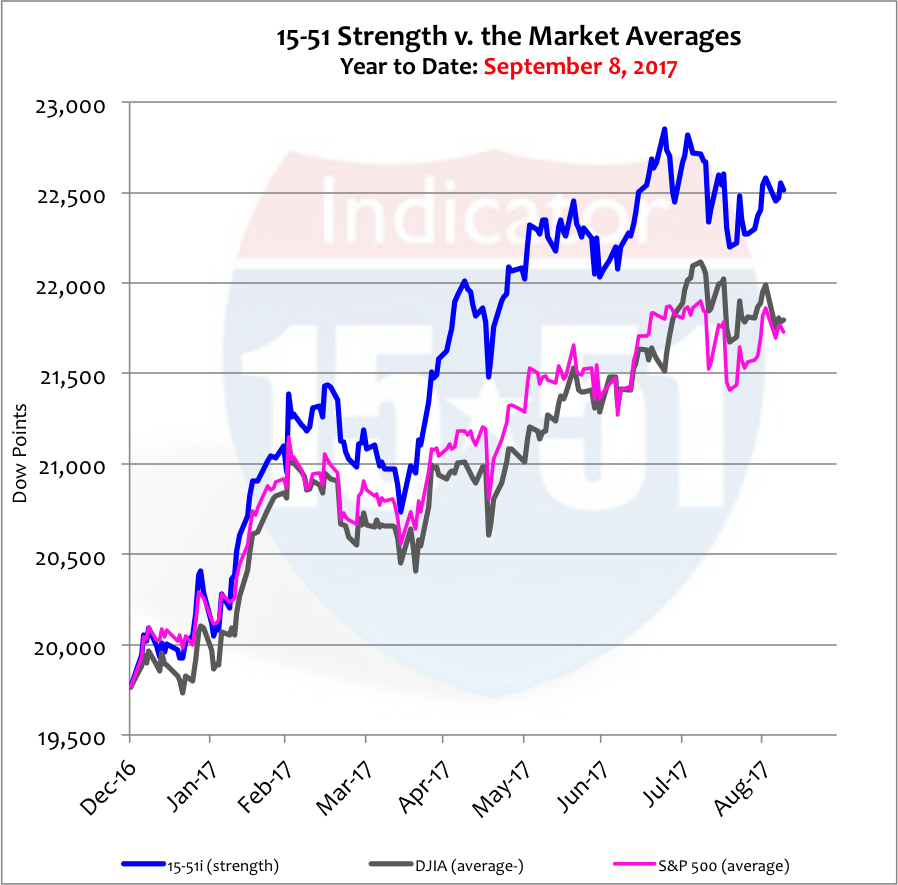

There is little doubt that this year’s storms will greatly affect 3rd and 4th quarter Gross Domestic Product (GDP), tarnishing results for the entire year in the process. Yet stocks have essentially shrugged off their impact. The stock market averages have gained 10% so far this year, and stock market strength via the 15-51 Indicator has added 14%. See below.

It is important to highlight that hurricanes Harvey and Irma struck the American economy in two of her largest markets, Texas (ranked 2nd) and Florida (ranked 4th). The devastation is massive but incalculable at the present time, and it could take several months to figure. Whatever the actual impact turns out to be investors can be assured of two things: it is negative, and gigantic.

Markets have been destroyed. Manufacturers have been decimated. Consumers have lost their homes and workers have lost their jobs, and in some instances, have lost their businesses too.

When will they all recover?

Displaced families worried about their cost to rebuild and replace, and faced with the uncertainty of when they will return to work, will rightfully tighten their belts. Those with rainy day funds and investment accounts will judiciously deplete them. Survival trumps retirement.

The significant loss in earnings and earnings power has no choice but to constrain market activity (GDP) and pressure stock prices. The drain on savings and retirement assets will apply additional downward force to valuations.

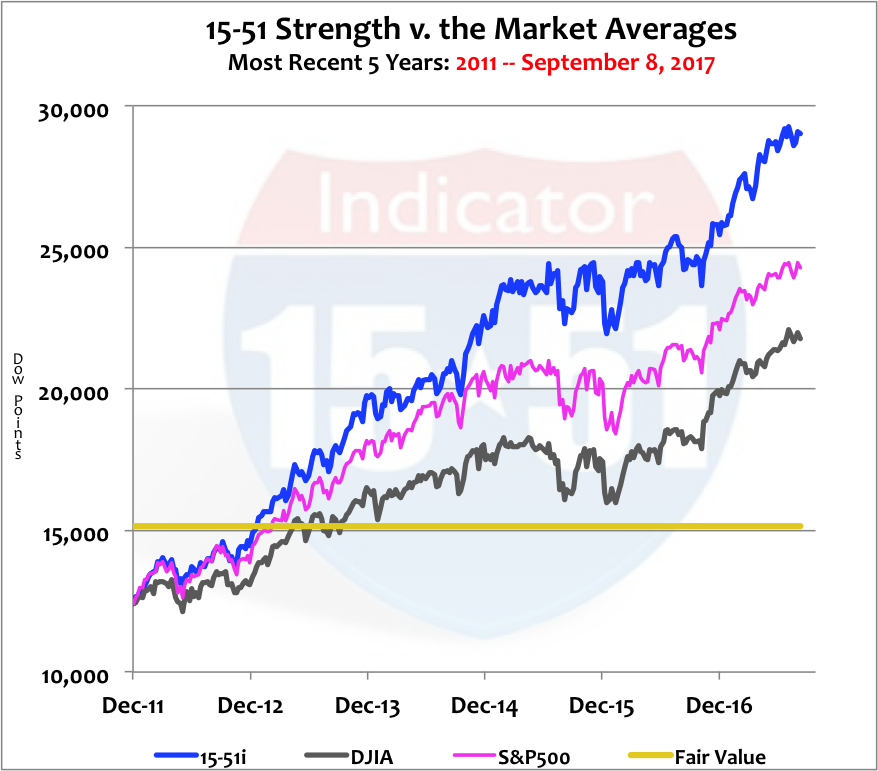

Unbelievably this has had no bearing on stocks, which have continued their strong upward trend since the economy recovered from recession. And while short-term movements look volatile and to be building lower bases, a longer-term view shows those moves to be inconsequential. During the last five years the 15-51 Indicator™ has gained 23% per year; the S&P 500 has added 17% per annum, and the Dow has posted 13% annual gains. See below.

Short-term volatility and downward trends look mute in this wider view. Fair value (15,156) as indicated by the yellow line in the chart above represents the stock market’s average trading multiple to GDP. In other words, it is the value in which the Dow normally trades to market activity. Trading some 50% over “the market’s” normal multiple at the present time, stock valuations remain extremely expensive.

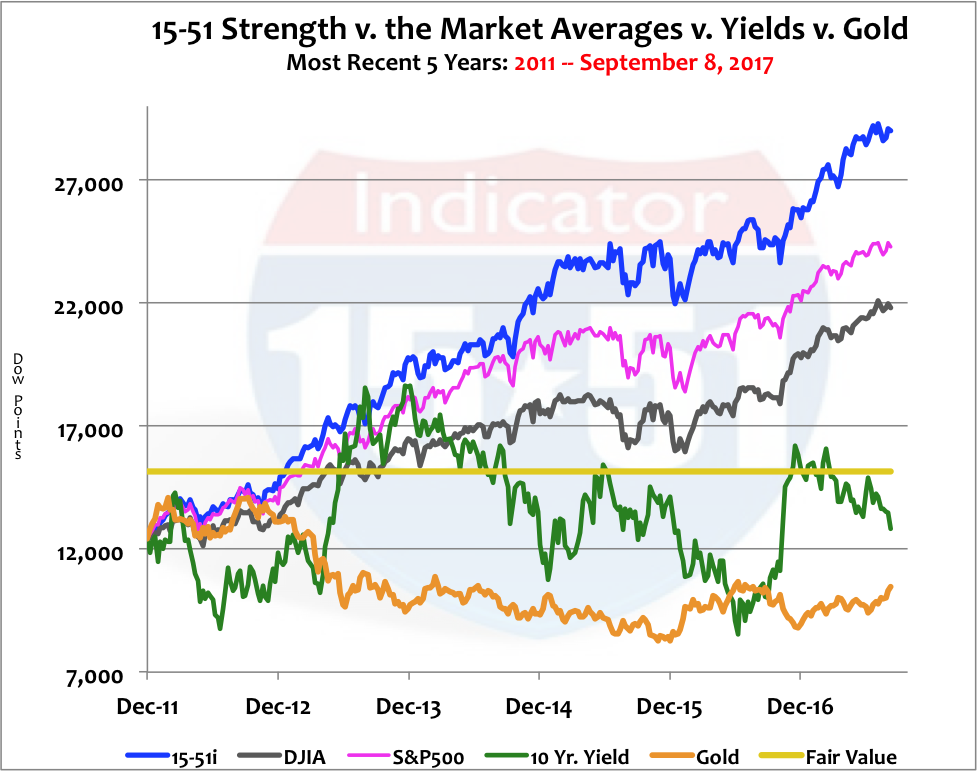

Gold and bonds have jumped recently (both have gained 17% so far this year) but both started their upward moves long before the storm season began (the first week of July 2017). Harvey didn’t hit until the last week of August and since then all three asset classes (stocks, bonds, and gold) have gained in value. In other words, the effects of the storms haven’t yet been factored into current market prices.

This is not to mention that the recent moves in gold and bonds are as insignificant on a long-term basis as recent stock market activity. See the five-year chart below. Remember, bond values and yields move in opposite directions.

We have experienced short-term volatility and slightly lower stock prices of late, and some recent gains in gold and bonds – none of which were caused by the tragic early storm season.

So stocks remain high and gold and yields are still low. One would think that dynamic was all due to a vivacious underlying economy.

No doubt, there are some positive elements to this economy: manufacturing activity is up to its highest level in six years, job gains are steady, and wages are increasing. Great.

But the problem is the economy is still limping along at less than 3% growth, with many economists projecting annual growth to be around 2% – without the ill effects of the hurricane season factored in. Production gains mean much less when market activity is timid and markets are under duress. And there’s more…

The labor participation rate has remained persistently low (62.9) with the current level of job growth, which means that the current average of job additions (150,000) isn’t nearly enough to change the market dynamic. And yes, wages are growing but only at a 2.5% clip. Wage growth needs to be more like 4% to add any kind of real impact to the economy. This dreaded duo (low participation and weak wage growth) is the reason GDP growth remains weak and inflation mute (less than 2%).

It has been widely reported that the low inflation condition has given the Federal Reserve pause with regards to unwinding its quantitative easing program (QE) and raising interest rates. Short-term trends for gold and bonds are indicating this as well. If not gold would be falling and rates would be rising in anticipation of a stronger dollar.

The Fed’s logic is hard to understand. Many businesses borrow money to operate. An increase to interest rates therefore raises the cost to operate and produce. Such a move invariably raises the price of goods – a.k.a. inflation.

Higher interest rates provide more profit potential for banks. Put another way, higher rates incentivize banks to lend. More lending expands the economic base and boosts growth. Such a condition causes inflation to naturally return to the marketplace through higher employment and wages.

The Fed is misguided. Central banks cannot solve the economy’s problems. Instead they must incentivize the Market to correct economic disorder. Higher interest rates have been overdue for way too long. The longer the Fed keeps rates artificially low the longer correction will take.

The answer to the economy’s woes is to fix it at its core – the market’s most basic level – the consumer and worker level.

Tax cuts for businesses and taxpayers are just the remedy. Simplifying the tax code will also help, as will provisions for accelerated depreciation for fixed asset purchases. Businesses need capital and incentive to make investments in productivity, development and distribution. They need incentive (more profit) to place capital (borrowed or not) at risk to expand operations, replace and rebuild, and to invest in the future.

People need the same thing.

The economy is starved and under pressure. It needs energy to boost lending and borrowing, investment and job growth, and consumer income (a.k.a. spending/demand). Higher interest rates and lower taxes are the most efficient and effective way to add the necessary incentive.

All of this falls on the shoulders of a completely dysfunctional and corrupt central government and Two Party System, where neither represents core American ideals.

Trump needs to forget about healthcare. That is a fight for another day. It’s time to turnaround the economy. Tax cuts are the surest way there and the most certain way to force the Federal Reserve into raising interest rates. That should be the President’s top priority; because the longer it takes to realize tax cuts the less likely they will happen.

Not shockingly Mitch McConnell and the establishment Republicans are in his way. Trump is destined to deal with Democrats to get almost anything he wants done. And they have some common ground, both believe in a single payer healthcare system, and both want to spend heavily. Add to this the fact that Democrats like to eat their own and it is quite easy to imagine that they and Trump might actually strike an accord.

One thing about Democrats, they have a long-term strategic plan and a ton of conviction. They will gladly trade tax cuts today to gain control over the entire U.S. healthcare system in perpetuity. Tax cuts get repealed all the time. Government control over an entire industry almost never goes away – especially if they could survive the first opposition administration.

It is easy to forget that in 2001 the best that could be had by G.W. Bush and both Republican controlled chambers of Congress was an auto-expiring tax cut plan.

Have you ever noticed when Republicans are in power they are impotent and when Democrats are in the minority they gain power?

The sad truth is that Republicans also want higher taxes and more control over the economy (i.e. the heath care market.) And neither Party likes Trump.

So Democrats will give something (tax reform) to get something (a permanent stranglehold on healthcare). Add to this Trump’s ambitious infrastructure spending plan, hurricane relief, and upgrades to the military and defense, and budget deficits will most certainly widen. It will only be a matter of time (the next election cycle) until Democrat’s make the argument that the Trump tax cuts didn’t work and must be repealed.

And Republicans will reluctantly acquiesce – especially if they remain in power. If they fall out of power during the next election cycle they will fight the tax hikes in public and submit in private – as always.

Republicans are a bunch of cowards and malcontents with no principle. They’re either scared or lost. They have no unified message. No ultimate goal. No coalition. And no faith in the free market system. They hate their leader (Trump) and want nothing more than to stonewall his success – despite the will, need, and desire of the People.

Trump was elected in part because he had no core ideology. He wasn’t one of them. And that is the beginning of his demise. His own Party is sabotaging his presidency – and he knows it.

As a consequence, his deal with Democrats on hurricane aid and the debt ceiling should be no big surprise. Nor should it make Americans trust the Republican Party any more. McConnell and Ryan were in the room when Trump, Schumer, and Pelosi, cut the deal. They were unable to persuade him not to do the deal. As usual they had no better alternative. The deal therefore is not an indictment on Trump. It is an indictment of the Republican Party, Ryan and McConnell.

And when Trump does strike a larger deal with Democrats the Republicans will blame everything on him. Trump is the problem. Not Republicans. He’s a Democrat, they will say. Democrats will say they “had” to negotiate with Trump to save Obamacare. Repealing the tax cuts will be first on their 2018 election platform.

The problem with American government today is that there is little understanding, support, and advocacy of free market principals. Libertarians like Rand Paul and Trey Gowdy are notable exceptions. But they are just too few diamonds in a very deep and thick rough.

All eyes must remain on the President and Congress. What, if anything, will they do – and how will it affect markets and investments?

Stock valuations remain pricy and will be even more so after third and fourth quarter GDP figures are released. Expect more volatility and downward pressure. It’s storm season – on the Atlantic and in Washington DC.

Stay tuned…