Year-over-year inflation came in at 4.9% in the 4th quarter 2020, and Real Gross Domestic Product shrank by a significant -9.8%. Bad news indeed – but you would never know it by the way the stock market is behaving. More on that in a bit.

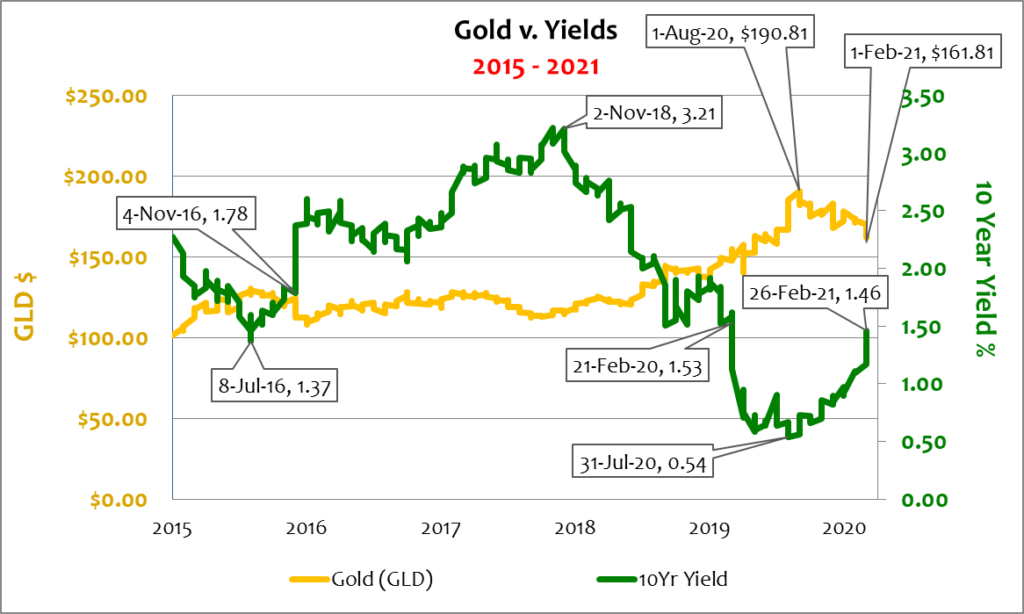

Inflation (a.k.a. the cost of money) has no choice but to raise interest rates (a.k.a. yields) because interest rates are the cost of debt, which is just borrowed money. When the cost of money increases it is only a matter of time until the cost of debt also rises. So it should be little surprise that yields have moved sharply higher of late. In fact, the 10-year Treasury yield has tripled since reaching its Covid-Crash bottom in July 2020, (.54%), just eight months ago (see below).

Some see the move in yields as no big deal because the 10-year yield is basically at the same level it was when Covid-19 swept into town one year ago (1.5%), which is still a historically low rate. Gold, the classic indicator of inflation, seems to corroborate that position by trading down 15% since its August 2020 high, thereby suggesting a return to pre-Covid norms – not inflation – as the reason for the spike in yields.

I disagree – for two reasons.

First, the economy was expanding when the Wuhan flu traveled to America last year. Unemployment was low and inflation hadn’t strung together two consecutive quarters greater than 3% since Q4 2005 – 15 years prior. It’s a rare thing to say the least. And bond traders took notice.

The last time yields were at today’s level (1.5%) was one year ago, before government shutdowns, economic restrictions and mask mandates. At that time the economy had been in a prolonged 10 year expansion before the novel coronavirus infected our system and way of life. Of course, the 10-year yield should have been closer to 6-7% at that time, but that doesn’t suit a corrupt Federal Reserve and overreaching central government. In crisis or out, the Fed continues to insist on low market interest rates (yields) that only makes government debt and deficit easier to service – an important point to remember when trying to understand stock market behavior.

Second, to think that the market has returned to pre-Covid normalcy is to believe that government action hasn’t drastically and permanently changed market dynamics and business economics. Many states remain strangled by big government restrictions and unconstitutional mandates limiting business and consumer behavior. Even “open” states like Georgia and Florida, while performing much better than captive blue states, are not yet running on full throttle. The American psyche is still shaken and many remain cautious – not to mention the federal government looks more incompetent than ever before, more corrupt than ever expected, and more communist than ever imagined. More regulation, greater spending, and higher taxes are on the way – all of which will lead to even higher consumer prices (a.k.a. inflation).

Yields don’t normally rise during recessions unless inflation is an issue – especially if the Federal Reserve is hell-bent on keeping them near zero as they currently do. And perhaps a 1.5% 10-year yield was no big deal the last time they there were at this level but now it is a very different world. This time around the economy is in shambles because abusive Covid-19 policies have choked the life out of it while substantially increasing the cost structure of all goods produced. The prospect of inflation, not economic growth or a return to pre-Covid norms, has pushed yields higher.

To make matters worse Joe Biden is set to sign another $1.9 trillion supplemental spending bill that Democrats will unilaterally force through Congress – this added to the $2.3 trillion authorization Trump signed just a few weeks before leaving office – which when added to the initial Covid relief payoff worth $2.2 trillion and the government’s current $3.8 trillion budget sums to a whopping $10 trillion spending in a calendar year (more than 50% of total GDP).

And the economy is still down 10% in Real terms (or $2 trillion) from pre-Covid levels.

Big government is a terrible investment.

Like all other free markets the bond market is driven by the concepts of supply and demand. When demand runs short, yields rise to incentivize investors to lend – to buy bonds over stocks and/or commodities, like gold.

Government deficit is financed with bonds. Should demand for bonds run dry yields will skyrocket, which is the reason the Federal Reserve prints new money out of thin air to create sufficient demand to keep yields at the low levels they subjectively determine. Of course, maintaining low yields is only possible for as long as inflationary pressure remains moot – a condition poised to change.

It is impossible to print as much currency as the Federal Reserve has printed over the last ten years without causing inflation, and/or what is called an asset bubble. Both conditions inspire major corrections.

Quantitative easing (QE) is the process where the Federal Reserve prints new money to buy U.S. Treasury bonds (government debt and deficit) for itself, and to exchange for toxic assets originated by the Wall Street establishment, who with half of the new money must also purchase Treasury securities; the other half could be used any which way.

QE is a modern day Ponzi scheme that encourages bad government and bad business while artificially inflating the stock market to dangerous levels (see: WHY THE GAMESTOP LESSON IS IMPORTANT TO ALL OF US). It is exactly what Thomas Jefferson warned us about – and the sole reason for the soaring stock market, as a significant amount of QE money has clearly found its way there. After all, stocks are Wall Street’s core business.

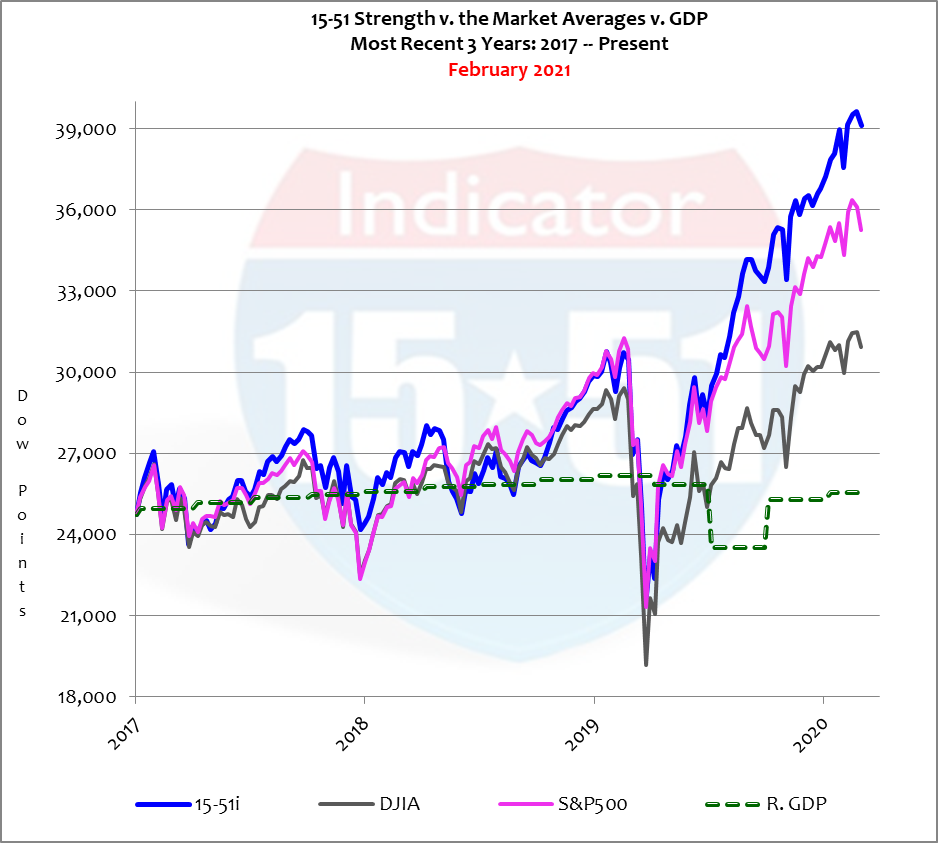

In the past year – a Covid infected travesty of government overreach and communist takeover of the free-market economy, with political strife and corruption on full display, in the worst recession and economic condition the country has experienced in a hundred years – the stock market has posted obnoxious gains. The below-average Dow Jones Industrial Average is up 22% in the most recent 12 months, the S&P 500 added 29%, and the 15-51 Strength Indicator™ gained a gaudy 45%. Those are boom-like advances once reserved for strong economies with solid stable growth. Not anymore. See below.

That is a classic illustration of an asset bubble – stock prices fueled not by substance (GDP) but by hot air (QE).

The stock market is up because Wall Street knows continued government deficits will require more QE (free money) which they will partially use to add support to high stock prices. They are living in a fantasy world, as usual, choosing to believe inflation is no big deal and rising yields are simply a return to pre-Covid norms. Using gold as a corroborating factor isn’t fair or prudent, as even with its most recent 16% correction the precious metal is up 9% in the past year and 34% in the last two, a 17% annual average. Gold’s current decline is a false flag.

QE is seen as the miracle cure for all our economic woes, a way to spur economic and employment growth without causing inflation. It isn’t any of that, of course, but rather a means to an end of bigger and more dominant government. The world has never experienced this much monetary and fiscal abuse, facilitated and financed by QE and the most corrupt central governance this country has ever experienced.

The stock market is one giant hot air balloon. Inflation is the pin. And Covid-19 policies are the energy forcing the two to collide.

Inflation is a serious issue this time around because of the government’s mishandling of a novel flu virus. And when it presents itself as a real and legitimate threat to economic recovery and the Fed’s low interest rate policy it will create another unexpected and severe crisis – one that throws kryptonite on the Superman QE is thought to be. At some point the Federal Reserve will have to stop printing money (QE) and actually remove currency from the system to combat inflation.

And where will they take it from?

Your retirement account, a.k.a. the stock market.

It’s only a matter of time.

Stay tuned…

[…] reason many consider the stock market to be scary is because they have no idea what to expect from “the market” or their portfolio. Indeed, stock market activity can surprise anyone. But […]

[…] Besides inflation the key metric to watch is the 10-year yield, which is still historically low around 1.5%. All hell will break loose when it starts to run higher. […]