In the old days stock market trends were somewhat connected to the condition of the market economy and its activity. When the economy was booming stocks were rising. When the economy was in recession stocks would fall. That is no longer the case.

Today there is literally no connection between the two. Stocks are at all-time highs while the Real economy remains 10% lower than it was before all this Covid nonsense began – nonsense meaning the unconstitutional lockdowns, constraints and restrictions imposed on individuals and free-market activity for something as common as a novel flu virus.

Ironically Nominal GDP is little changed year-over-year, signaling a 10% inflationary rise in prices – something that can be appreciated quite easily in the stock market, which like economic activity, is greatly inflated due to the excess supply of money circulating throughout the system. Significant inflation can also be vividly seen in the real estate market where prices have risen well beyond the peak of the housing-boom – and we all know how that ended.

But right now the Federal Reserve is not alarmed or concerned that the average price for a gallon of gas is up a buck since Joe Biden took office. Indeed, the economy has handled higher gas prices before without causing severe economic pressure. But that was then, a different time, a different day and age.

The governments’ response to Covid-19 wreaked havoc on the entire supply chain and essentially changed every business model and cost structure – action that has no choice but to produce wide-scale inflation. Have you seen the cost of lumber these days? Ten dollars for a two-by-four and $60 for a half-inch sheet of plywood?! Been to the grocery store lately?

It’s hard to imagine what level of inflation would actually concern the Fed.

Yet there are some calling this environment a post-Covid-boom and see no end in sight for the raging stock market. They see all our economic woes to be behind and nothing but smooth sailing in front. They rest easy in the belief that should we encounter a wrench in their grand scheme it wouldn’t be anything more stimulus and QE couldn’t fix – especially because inflation is considered to be no threat. Along with that naiveté is the expectation that yields will remain low and tightly in check.

That mindset fails to appreciate the actual condition of stock values and the underlying Market.

Stocks remain richly valued.

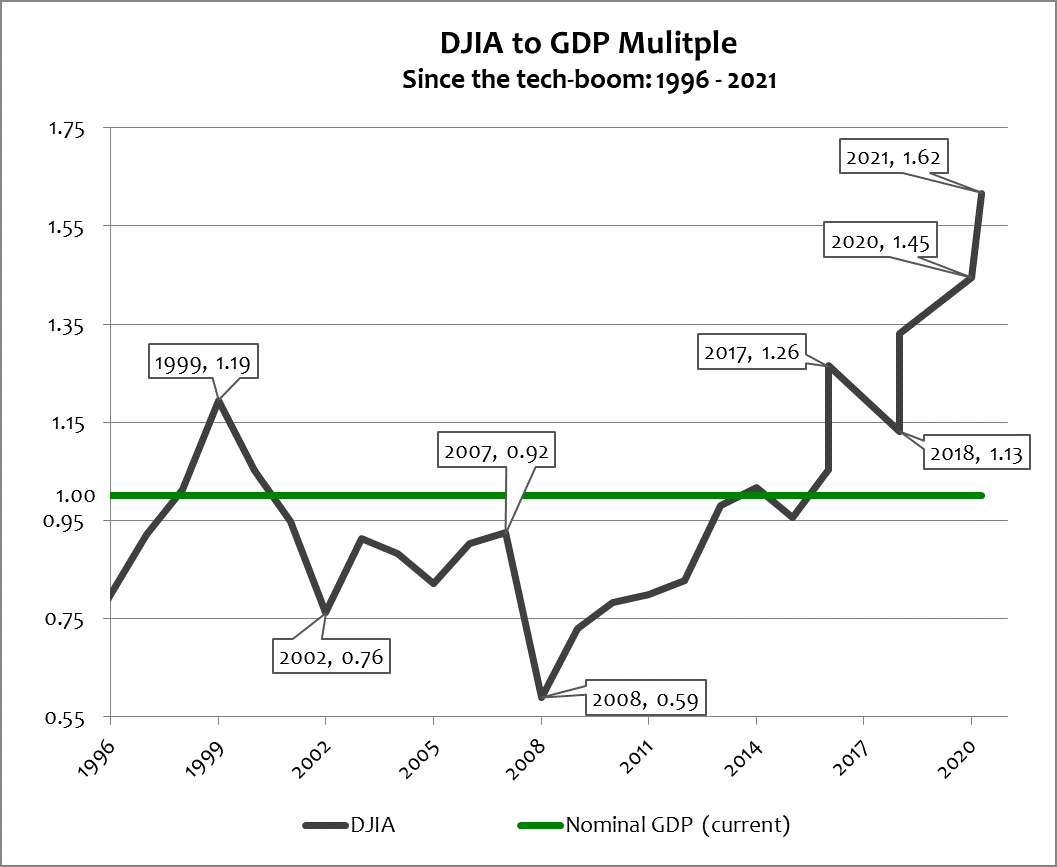

In the old days the actual Market – the economy and its condition as represented by territorial Gross Domestic Product (GDP) – was fairly indicated by the Dow Jones Industrial Average (a.k.a. “the market”). And while that is no longer true, connecting the two still offers useful insight into appreciating current value and having appropriate expectations.

Earnings and growth are backstops to stock prices. Companies with none and little are worth less than those with plenty of each. The weighted-average Price/Earnings (P/E) ratio for my 15-51i portfolio is currently 31, against revenue growth of 4% and net income growth of 8%. The simple average P/E is 37, and 40% of my stocks have P/E’s greater than 30. Twenty-percent have P/E’s greater than 50.

Rich.

As you know, the 15-51 Strength Indicator is not intended to be a great portfolio but simply an above-average one. Its purpose is to indicate stock market strength, not stock market greatness. The Dow Jones Industrial Average (DJIA) tries to be average but has been underperforming the S&P 500 for more than 15 years now. The Dow is a weak, below-average portfolio, regardless of its current point value. It is heavily inflated.

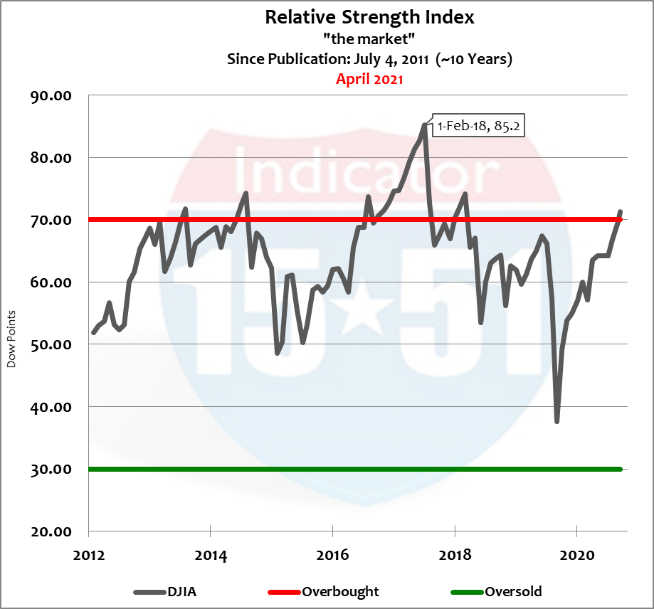

Relative Strength is perhaps the most useful valuation tool outside of P/E. An index value (RSI) of 70 or greater indicates an overbought condition (overvalued), and a value of 30 or less indicates an oversold condition (undervalued). As we know, stocks have been consistently trading at high valuations for most of the last decade. During that time the DJIA, a.k.a. “the market”, has spent most of the time well below the overbought condition as defined by RSI – and each time it reached that level it wasn’t long before it corrected. Its current RSI is 71. See below.

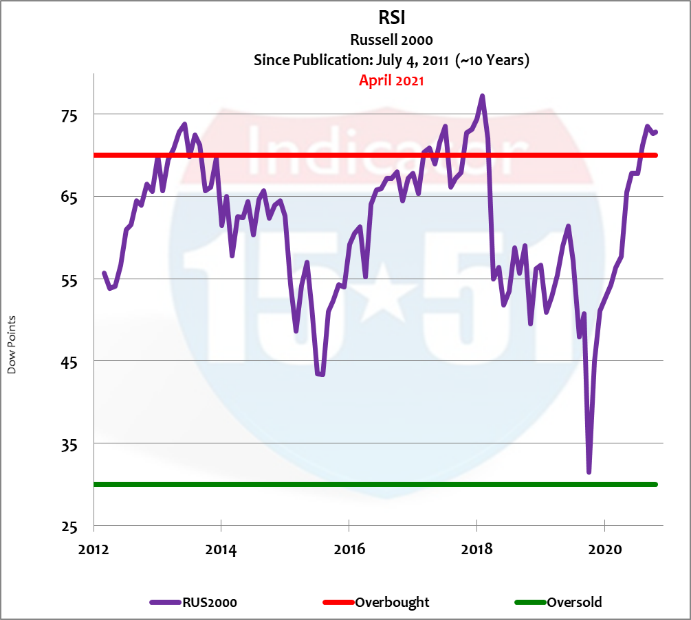

Even the lowly Russell 2000, an index comprised mostly of small capitalization stocks billed as tomorrow’s blue chips, which has spent more time underperforming the Dow than anything else, has soared to an overbought condition since the Covid correction in March 2020. Its RSI is currently 73. See below.

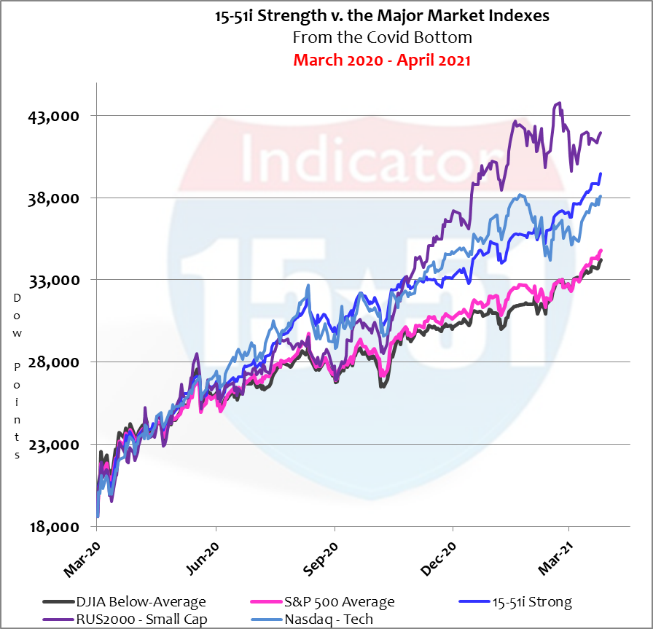

In fact, the Russell 2000 has trended so strongly since the Covid-19 bottom that it has outperformed every other major market index – besting two stronger portfolios with greater RSI’s, the Nasdaq (77) and my 15-51 strength indicator (76). See the performance of all those portfolios below.

In the last year Russell posted an amazing 126% gain while 15-51 Strength produced 112%, the tech-heavy Nasdaq added 104%, and the Market Average was 86%. Those are tremendous returns to say the least – which occurred during a period of steep economic recession, a 10% shrinkage in Real terms.

That dynamic (excessive growth in stock values and economic recession) is inherently inflationary, and therefore pushed “the market” multiple to GDP to its highest level in history, reaching a never before seen 1.62, which is 36% higher than peak valuations during Clinton’s tech-boom in the roaring 1990’s. See below.

The underlying economy is weak and highly inflationary, making stocks incredibly overvalued – especially when considering the assault on the free-market.

Allow me to digress for a moment…

Ever notice how bombs loaded during Democrat presidencies always explode during Republican administrations, who then jerk the country harder to the Left and away from freedom and free markets?

The roots of the big government takeover of the free-market can be traced back to a president who once claimed “the era of big government is over” while embarking on his re-election campaign in 1996, William Jefferson Clinton.

A centerpiece to Clinton’s re-election effort that year was an initiative to make housing more affordable to low-income people by expanding Jimmy Carter’s legislative effort, the Community Reinvestment Act (CRA), to make borrowing easier to obtain through low interest rates, federal guarantees and bank incentives, zero down payments, and no job or income verifications. Bill Clinton started the housing-boom with his amendments to the CRA in the mid-to-late 1990’s.

In Clinton’s second term Osama bin Laden officially declared war on American airwaves in 1997. The jihad, of course, began much earlier with the first World Trade Center bombing in 1993. That event was followed by coordinated attacks on U.S. embassies in Tanzania and Nairobi in 1998, followed by a direct hit on the USS Cole in Yemen in 2000. And while Clinton had several opportunities to snatch or kill bin Laden in response to these acts of war well before September 11th, he turned them all down.

On the morning of that fateful day in September 2001 George W. Bush was at a school in Florida rallying support for his first signature piece of legislation called No Child Left Behind – a bipartisan bill he was championing with Ted Kennedy – which promised to be “the most sweeping education-reform legislation since LBJ’s Elementary and Secondary Education Act in 1964.” That big government proposal was ultimately signed into law in January 2002.

No Child Left Behind created a generation of socialist loving communists who do not appreciate American history or value the guaranteed and God-given rights outlined in the Declaration of Independence, as codified in the framework of limited government outlined in the U.S. Constitution. Anti-American sentiment in today’s youth is proof of that pudding.

The Patriot Act – Bush’s knee-jerk response to a tragedy caused by Clinton’s inaction – single-handedly destroyed every Americans’ right to privacy, empowered big-tech companies, and completely corrupted the FBI. And today censorship is commonplace.

Bush also amended and continued to abuse the CRA, doubling and tripling down on easier credit for those with little ability to cover their monthly nut. Bush, of course, warned for years about irresponsible credit expansion but continued to sign bills into law that only made matters worse because he needed war funding; it was a quid-pro-quo. And by the time he left office the balloon that started twelve years earlier under Clinton had finally burst.

From the 2008 financial crisis came the practice of quantitative easing (QE) – the printing of money to be used to bailout losses incurred by the Wall Street establishment and reckless central government deficits – a.k.a. poor business practices and bad policies. It is the tool big government now uses to influence behavior and take control of major segments of the economy – i.e. banking, education, and now healthcare.

The Affordable Care Act (ACA), a.k.a. Obamacare, was signed into law in 2010. One only has to read the law to know its problem is that it had nothing to do with health, care, or making services affordable. Instead, Obamacare was designed to arrest the healthcare industry from the private sector, and due to all its bailout provisions, had little choice but to end with government “calling all the healthcare shots – who gets what care, when, what it will cost the patient, and what the provider will get paid for it.” Though advertised much differently, it wasn’t until a few years later that the law’s chief architect, Jonathon Gruber, pronounced the bill could only be passed with “the stupidity of the American voter,” and then gloated that the bill was written in a “tortured” way so as to confuse the court system. It certainly confused Chief Justice John Roberts, whose incoherent opinion is proof positive the strategy worked.

Covid-19 originated near a lab in Wuhan China that Obama’s administration funded during a period of heavy central government deficits and spending programs advertised as required to overcome economic fallout from the collapse of the Clinton-Bush housing-boom.—In other words, the Federal Reserve printed money via QE to fund the Wuhan laboratory where Covid-19 originated.

The virus was then served like cheese to a mousetrap that Trump took. His response to the invented crisis known as the Covid-19 pandemic was an unprecedented assault on free-markets and individual Liberty by greatly expanding the powers of government using public health and safety – and the ACA – as legal standing and authority to do so. They used the inner workings of the ACA to ration care (“non-essential” versus Covid-related) and promote nonsensical policies that strip individual rights and freedoms (behavioral mandates for masks and the like), while using freshly printed QE money to bribe, coerce, and extort healthcare providers into advancing their political agenda.

Obamacare was a law Trump campaigned the first time to repeal-and-replace for this very danger. But he totally dropped the issue in his re-election effort, and rightfully lost an easily winnable election to an intellectually inferior opponent, a communist puppet to say the least.

Communists believe government is the answer to everything and the only way to make life fair and equitable is for government to centrally plan and control the vast majority of economic activity. By design, therefore, the Affordable Care Act is a communist law, a dishonest takeover of a private-sector industry by central government planners. Which then confirms the namesake of that law, Barak Hussein Obama, to also be a communist (something Obama acknowledged in his book, The Audacity of Hope). Biden is also a communist, as are the vast majority of Democrats today. They are big government central planners. To call them socialists is inaccurate and fraudulent.

And that’s the reason the U.S. capitol is surrounded by a fence and 5,000 troops. The communists have taken control of American government and are now advancing to rig the court system in a blatant attempt to railroad the system of checks and balances imbedded in our Founding – and they are waiting for freedom loving people to rise up, reject, and rebel. Why else would the barricade be there?

But until that time they will keep printing money to spend towards advancing their big government cause. Consider it a leveraged-buyout of the free-market system by a tyrannical government regime, that is being financed by a once crisis measure now turned Ponzi scheme called QE, orchestrated by a corrupt private bank called the Federal Reserve.

The only threat to their mojo is inflation – and it’s on the way.

All bubbles burst. And the next one will be so big it will become another “crisis” – which will once again be used by government to seize more power and control over people, property, and enterprise.

Because remember, at some point the Federal Reserve will have to remove some of the excess currency that is causing inflation in so many market segments. And don’t think for one second they won’t take it from your retirement account, a.k.a. the stock market. It’s too easy of a target, and too simple to do.

That will be the time when the huge disparity between stock values and the condition of the American Market narrows. Because that’s what happens to over-inflated markets like the stock market. They correct, and become more in line with economic fundamentals, because markets are where profits are generated.

Stay tuned…

Dan

Well, I am not well versed with the markets and at my age I stay away from them. I believe that there is going to be a major correction and a lot of people will get hurt.

Your comment that communism is growing in the US (and Canada for that matter) is very true. Unless the people become more aware we are doomed by a bunch of lackey, corrupt, rich rulers of our “democracy”. Democracy today is a farce as there is very little of it. Biden/Harris are and have been commies for years. Harris comes from the commie state of California. The whole west coast, including British Columbia in Canada, are commie states and that is a major problem. California is actually losing some of their population.

Thanks for including me in your blog.

I actually have your book “Lose Your Broker” near me at all times.

Best wishes/

Stan

Sad but true, Stan. Thanks for following!

[…] to the contrary, and as mentioned in my prior blog, the NASDAQ and Russell 2000 only loosely attempt to market diversify, as the NASDAQ is heavily […]