Like business, investment is all about performance (making money) – and because of it, their ultimate success is measured in terms of profit, profit margins, and ROI – the more the merrier.

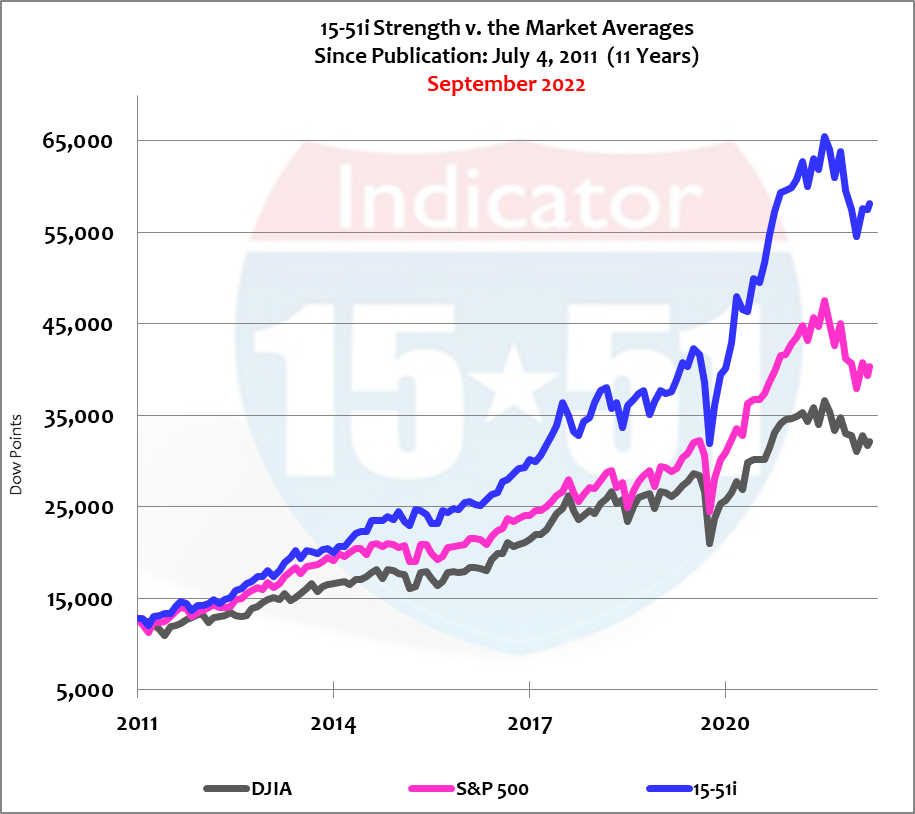

Stocks achieved record highs just a few days into this year. But since then, 2022 has been a rocky road to steady decline. Of the major market indices, the previously high-flying and tech-heavy NASAQ index has suffered the greatest loss, down a significant 23% so far this year. The S&P 500 has lost 15% since its January 4, 2022, all-time high, and stock market strength via the 15-51i Indicator™ once again bested the field, shedding just 10%. The Dow Jones Industrial Average is down 12% thus far.

The reason my 15-51i™ portfolio consistently outperforms the other market indexes is simple. It was designed and constructed to outperform them. And so it does.

Profit is the reward for doing things right – in business by profitably delivering products or services to markets that consumers in sufficient number demand, or by investing in companies that do it. My method is just one way of investing successfully.

Investment is the act of making money with money, and while there are an infinite number of ways to invest successfully, there is only one way to make money – to buy low and sell high, which is most easily done by buying when all stocks are selling at deep discounts – and the best time to do that is during sensational downside stock market corrections.

And as luck would have it, one such opportunity is on the way.

While many (like me) have been warning of a significant stock market correction for some time, the establishment has recently joined the chorus: with Wall Street darling Jamie Dimon of JP Morgan Chase sounding the alarm, joined by celebrity hedge fund players like Big Short protagonist, Michael Burry, Jeremy Grantham, and economists like Stephen Roach, who all warn of the coming tsunami – a great financial reset ignited by global inflation brought about by government policies surrounding Covid-19.

Inflation is an invisible tax that requires no tax return and destroys purchasing power. It is indiscriminate and affects everyone in the same way – yet not to the same extent. The rich can obviously absorb persistently higher inflation with much more grace than the middle-class, whose numbers shrink during prolonged periods of inflation, and creates a world where more get poor and the poor get poorer.

The American middle-class is, in fact, what separates America from the rest of the world. To shrink it is to marginalize the American ideal, its constituents, and its underlying economic might.

That is exactly what is happening today in America.

Two quick points to appreciate about today’s Market condition…

First, regardless of what the Biden administration and its establishment media partners say, the U.S. economy is already in recession. Measured by Gross Domestic Product (GDP), the U.S. economy has experienced two consecutive quarters of negative growth (shrinkage) on an annualized basis, which has long been held as the standard definition of recession. Those who attempt to change its definition are the same who renounced “transitory” to mean what it actually means.

Today’s America is more Orwellian than ever before. Investors must see through it.

Second, there is only one thing that causes inflation, an improper balance between growth in money supply and the growth in market activity (GDP). And so the only way to fix that problem is to bring them back into alignment with a combination of tighter money and vibrant economic growth – something much easier said than done. Especially with a Federal Reserve led by a guy like Jerome Powell, who at the present is calling for a “growth recession” to tame inflation.

Never heard it put in that way before, “growth recession”, and to be candid, is really quite stupid when one appreciates the economy was only growing 2% before recession hit. The term “growth recession” would imply a booming economy has been underway, say one growing at 4-6% per annum, that would moderate to a level of say, 2-3%. But America had been growing at a sluggish 2% annual rate since recovering from the Great Recession and has now averaged annualized shrinkage (-1.3%) for the last six months. The economy is in recession, plain and simple.

Instead, Powell’s “growth recession” is describing the plan for individuals, as government continues to expand by spending at rates that produce multi-trillion deficits year-after-year, while individual wealth and purchasing power are being raided by inflation, higher taxes, punitive regulations and market controls (i.e. energy; with the shutdown of pipelines, the cancellation of drilling leases, and the elimination of gas powered vehicles in California), and soon by a massive correction to retirement accounts.

According to Powell – individual growth – not government growth – will go into recession and cause pain to many. In other words, contrary to sound economic policy the Fed will continue its bias towards growth in big government at the expense of individuals.

It is important to note that the Federal Reserve’s balance sheet (comprised mostly of U.S Treasury bonds) was less than $1 trillion before the subprime mortgage crisis. Their asset portfolio expanded boldly to $5 trillion in order to fund Obama’s spending plan to “recovery” after the ’08 crash – and then ballooned to $10 trillion in the wake of Trump’s Covid-19 shutdown and all that followed.

Consider that in one Covid-plagued year the Federal Reserve printed and injected nearly $6 trillion of new currency into a $20 trillion dollar economy (a 30% increase in money supply) that is now sliding deeper and deeper into recession (a terrible ROI) that is coming at the expense to all individuals – Democrat, Republican, or Independent – in the form of stinging inflation, which is nothing more than a tax on money imputed by a bunch non-elected bankers working at the Federal Reserve led by Jerome Powell.

Investors need to appreciate that in order to reverse this inflationary course the Fed must now rescind trillions of excess currency from the monetary system. To do so the Fed exchanges U.S. Treasury bonds (central government deficits) for cash with the investment banks on Wall Street. Wall Street then sells those bonds to investors via the capital markets.

Like all other markets, the bond market operates according to the laws of supply and demand, so at some point investors (also known as lenders to governments) will balk at 3% yields while inflation is running at 10%. And so those bonds will sell at discounts that produce higher yields – not just for America but for the world. (Yields and bond values have an inverse relationship, as yields rise bond values fall.)

Yields adjusting for inflation will force the Fed to fight both inflation and higher yields simultaneously – while continuing to remove currency in exchange for bonds. But it will be the massive size of bond sales that will cause steep discounts and spiking yields, and so to alleviate that condition the Fed will instruct Wall Street banks to no longer sell bonds to raise the required amount of cash. Instead, they will instruct Wall Street to sell stocks to effectuate their monetary tightening effort (to slow the rise in yields).

And there’s your sensational stock market sell-off.

He who giveth (massive stock market gains [inflation] via monetary easing called QE) can taketh away (via monetary tightening called QT to fight inflation).

One critical thing to appreciate with investment is this: it’s their world and we just live in it. We are playing their game, in their backyard, with their house rules. They, big government and their financial arm, finance and control market behavior and monetary condition, trade capital for equity and rights to it, and finance and fund big business and big governments everywhere – all of which is serviced or brokered by the Wall Street establishment.

Monetary tightening will cause another “financial crisis”, and once again the Fed will print money to bailout Wall Street (via QE) so they can continue making the market for stocks and bonds as valuations collapse.

And that’s the time for investors to buy.

So it’s happening, a major opportunity to buy low is ahead because the Federal Reserve must now act, and act aggressively, to remove trillions of excess currency from the monetary system via the investment banks on Wall Street – and it’s going to cause a major financial reset.

Remember, investment is all about performance.

More return with less risk is perhaps the greatest trait of my 15-51™ method. Since publication in LOSE YOUR BROKER NOT YOUR MONEY more than ten years ago, my 15-51i™ portfolio has experienced less variance and standard deviation than the market averages, has 20% more strength with 26% less risk as measured by beta, and because of it, has produced twice the gains. See below.

And you can do it too.

A great opportunity is on the way. Prepare your portfolio now and have your plan ready – and let me know if I can help.

Stay tuned…