Timing is one of the things that scares people away from taking control over their investment capital. The question of when to act – to buy, sell, or hold – paralyzes many because they don’t have guidelines that make action easy. My method, for instance, takes the guesswork out of decision making by inserting triggers like the one highlighted in ACTION POINT APPROACHING back in November ‘19. That blog demonstrates my market-based approach to using asset allocations driven by market activity – not gut instinct or speculation – to make investment decisions.

Another one of my prompts is when “the market” changes, typified by modifications made to the Dow Jones Industrial Average portfolio. That recently happened on August 31, 2020, when the renowned market index replaced three components with a peculiar, though stronger set of three. That was all the inspiration I needed to make adjustments to my portfolio.

Investors that get paralyzed to act do so partly because they are afraid of making a mistake – like selling when they should be buying, or buying when they should be selling. Note to self: perfect timing should never be part of an objective statement because it is damn near impossible to achieve – nor is it required to be successful. So why waste a moment fretting about it?

Logical timing, or rational timing, on the other hand, is easily had – like the market benchmark changed so you changed your portfolio. It makes perfect sense. Who could fault you?

Setting rules for yourself is smart investment practice because it makes decision-making substantially easier.

The recipe for success – for anything – is a two ingredient list. It begins by clearly defining your objectives and is followed by implementing strategies and tactics directed at supporting and/or achieving those objectives.

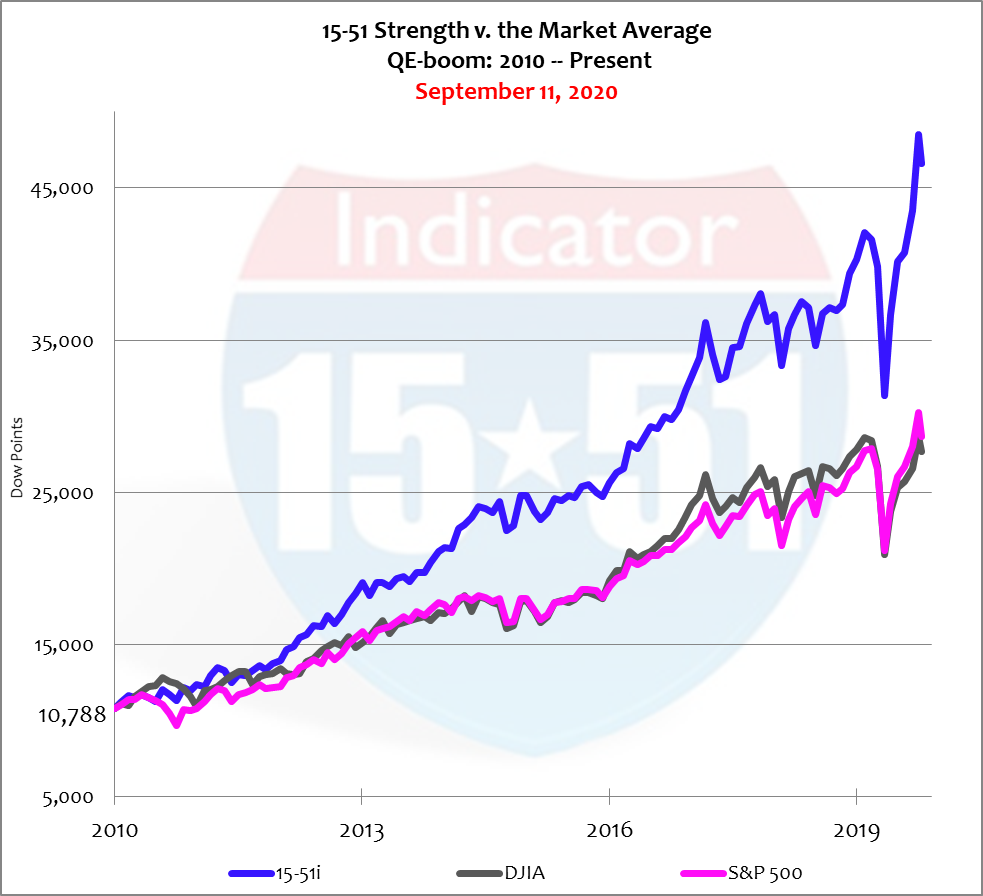

For example, the goal of my portfolio is to consistently outperform the DJIA over the long-term while traveling with the same rhythm of movement. By way of my dual-sided objective I employ two tactics to achieve success. First, I implement a similar market allocation to produce a similar movement pattern; and then I employ a superior method of construction (design and components) to produce greater returns (see: EXERCISE & A HEALTHY DIET for more information.)

Goals dictate tactics and strategies required for success.

When managers of the Dow portfolio modify their market portfolio they change the definition of “the market,” and because my 15-51i portfolio is intended to be a “market portfolio,” I must make sure my allocations remain close to it in order to produce my desired pattern of movement.

Another reason many investors get paralyzed about taking action is because they don’t know what their next move is going to be, or needs to be. In other words, it’s not lack of skill or ability that causes investor indecisiveness; it’s lack of planning.

Ask any soldier about the importance of preparedness. With it comes the ability to adapt and improvise at a moment’s notice – to ensure meeting the objective and safeguarding success. Investors should approach their investment planning with the same vigor – because only then can they be ready for the unexpected conditions financial markets so often put forth.

Other investors shy away from taking full control of their investment accounts because they’re afraid they are going to miss something important because they can’t sit and stare at the newswire 24 hours a day. Second note to self: minute-by-minute monitoring is not preparedness, nor is it required to be successful with investment.

The only thing investors need to be successful is a winning plan.

My method overcomes any shortcoming the average investor may think they have by employing a superior method of investment supported by sound strategies and tactics that encourage success, like 15-51™ design, a multiple asset class portfolio, and my market-based approach to decision making. All are proven to work over an extremely long period of time that spans more than two decades – even if life sometimes gets in the way.

For instance, news of the recently changing Dow snuck up on me this time because like so many the Covid-world has dramatically altered my regular behavior, making it easy to get distracted. No one knows better than me that you don’t have to live, eat, and breathe investments to put Wall Street’s performance to shame. Managing a portfolio to outperform the Dow Jones Industrial Average is an easy task, and no more than a small part-time job. I do it in just minutes per week. And you can do it too.

Life gets crazy sometimes for everybody. And it’s impossible to know everything or to be ready for every circumstance at every possible moment. Everyone gets caught off guard from time to time – even the experts. It happens. No biggie.

The greatest remedy to a surprise is having a well-thought plan at the ready.

As mentioned in my most recent whitepaper, CAPITALIZING ON THE COMING CRASH, five stocks in the 15-51 Indicator™ have underperformed my expectations for a long time and are no longer indicative of what is expected from an above-average stock portfolio. As a result, I have been tracking a modified portfolio with those five stocks replaced for several years now. I do that so I can get comfortable with the portfolio’s behavior before migrating into it. That kind of preparedness made it is easy for me to spring into action and make the necessary adjustments to my portfolio when news of the changing Dow finally found me. Two things to note…

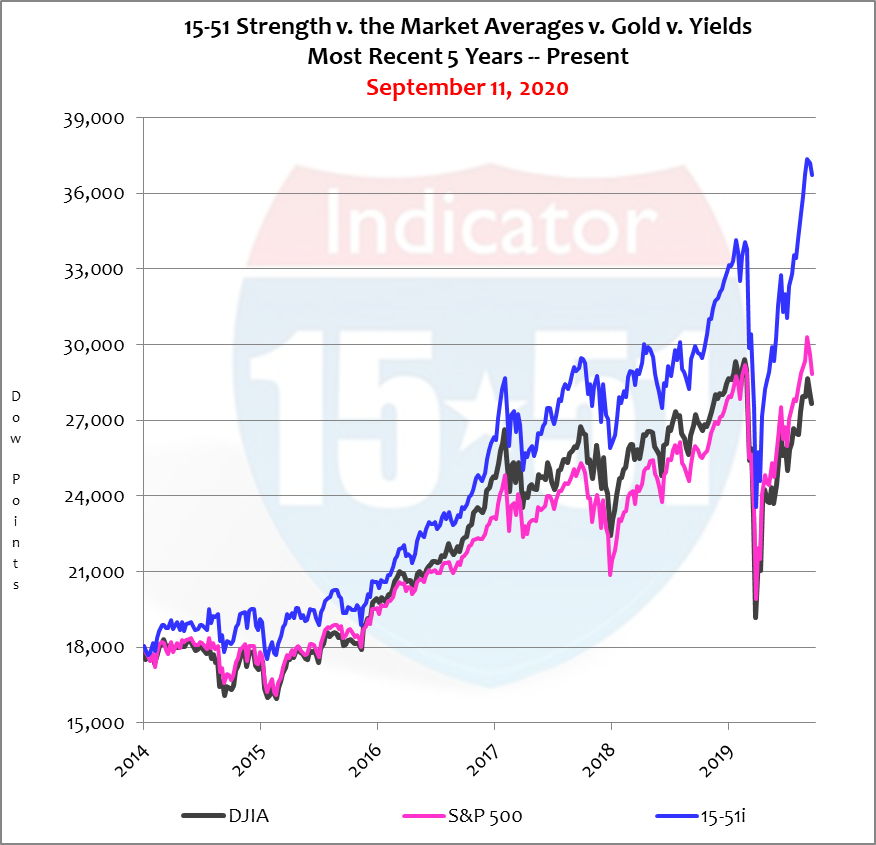

First, my 15-51i portfolio had five underperforming stocks (33% of the portfolio) for several consecutives years and it still outperformed “the market” by huge margins. Let that serve as more proof that constant attention or split-second execution are not required for long-term investing success – nor is a perfectly constructed portfolio. See chart below.

Second, August 31, 2020 wasn’t by any means perfect timing to make portfolio adjustments because stock values were near all-time highs, forcing me to sell high and buy high, which is not cliché. But again, the most important elements to action is moving for a reason and with a purpose; timing is secondary.

If you set rules for yourself follow them. Otherwise why have them?

The Dow upgraded their portfolio by eliminating three deadbeats for higher performing stocks and shifted half of their oil allocation to industrials and technology. Pfizer, ExxonMobil, and Raytheon were replaced by Amgen, Honeywell, and salesforce.com.

My objective is to stay ahead of the Dow by being better than the Dow.

Needless to say, the Dow’s upgrades, along with its hefty allocation to big-pharma, forced me to alter my 15-51i model to include the first ever allocation to bio-tech, while boosting allocations to technology and retail. I also took a more diversified approach to energy beyond simply oil, and upgraded components in the financial and defense segments. In all five stocks were replaced in the 15-51 Indicator™ and the portfolio was re-balanced back to target allocations at the end of August. Below is a table comparing “market diversification” as defined by the DJIA to stock market strength via the 15-51 Indicator™ as of the date shown.

| Index Comparison | 11-Sep-20 | ||

| Average | Strength | ||

| Industry | DJIA | 15-51i | Versus “market” |

| Basic | 4.8% | 10.5% | 5.6% |

| Energy | 1.8% | 3.3% | 1.5% |

| Financial | 17.1% | 13.1% | -4.0% |

| Industrial | 7.9% | 6.8% | -1.1% |

| Services | 27.6% | 19.9% | -7.7% |

| Staples | 12.8% | 13.5% | 0.6% |

| Technology | 27.9% | 33.0% | 5.1% |

| 100.0% | 100.0% | 0.0% |

As you can see my allocations are similar to the Dow’s (because I want to move like it) but not exact. A few allocations look substantially out of whack but I’m not concerned about them due to my stock selections. Here’s my reasoning…

My allocation to the Basic industry is just one stock that is highly rated for the purposes of diversification by GDP spending class – another tactic employed to achieve the movement pattern I desire. (see chapter 2 for more detail.)

Moving with purpose is the surest way to success.

I hate what the Federal Reserve is doing with money so I have absolutely no problem having less than “market” exposure to Financials. But because my portfolio is intended to be a “market” portfolio it needs a substantial allocation to that significant market segment.

Every decision should support your overall mission.

My Service allocation looks light but the Dow holds an exorbitant amount of retail that I think is unreasonable, and my allocation to it is complemented by a stock held in another industry. I like the balance in my portfolio much more than the Dow’s – which, quite frankly, is a hot mess from a structural perspective, and under-allocated in technology because of its overabundance of retail and exposure to big-pharma.

Successful investment is an extremely personal thing – your portfolio should reflect your preferences and priorities.

Market benchmarks like the DJIA are just guidelines. It is my target, however, and my competition. I aim to beat it, year in and year out, and the easiest way to do that is to fully understand it. It’s the old military adage, Know your enemy as well as you know yourself. I know the Dow portfolio as well as I know my own. That’s the simple reason why I can outperform it ten different ways to Sunday, and ten times more while I sleep.

One final thought about my allocations, because my portfolio is smaller than the Dow’s (15 versus 30 stocks) it is essentially impossible to cover every market segment with similar allocation. So I don’t try. I eliminate the pieces of “the market” I don’t want, and prioritize the segments I like most.

Nothing will make you more comfortable with investing than creating your own portfolio that reflects your personal opinions and priorities; and nothing makes that easier to do successfully than my award winning 15-51™ system (see my book for a full demonstration.) It makes building and managing high-output portfolios easy to understand and simple to do. And the results are vastly superior to any mutual fund sold on the market today. See comparison to market benchmarks below.

So forget about perfect timing, split-second execution, and omniscient awareness. They never factor into the success equation.

Take the first step to creating a better plan today.

You can do this!

Stay tuned…

Great article that makes complete sense to me (which is saying something since I find it all more than my brain can typically hang onto!) Thank you for cutting through the fog and making an investment plan a real possibility for us.

My pleasure, Lisa — thank you for the kind words!