Quantitative easing (QE) is a method used by the Federal Reserve to inject new currency (a.k.a. liquidity) into the monetary system. It was invented during the 2008 financial crisis to recapitalize an insolvent banking system – one that failed under reckless easy money and lending policies that catered to subprime mortgage borrowers (those with low credit scores, generally below 600).

Only big government central planners would make it easy for those with bad credit to borrow money to buy a house they can’t afford. Free-market lenders would never do such a thing.

Since the ‘08 crisis American government’s solution to everything has been trillion-dollar spending deficits financed by the Federal Reserve by printing new money to cover the nut (by purchasing U.S. Treasury bonds) in order to keep yields low (to make financing big government as cheap as possible). It is a practice that persisted for more than a decade after the economy recovered from the Great Recession (2010) and banks returned to solvency.

During the years that followed the subprime debacle, big government used QE to buy influence, power, and control of key industry segments beyond banking, namely education, housing, and healthcare – and now energy.

The Wall Street establishment, of course, brokered the deals (between the U.S. Treasury and Federal Reserve), and for their participation received fifty-cents of every new QE dollar in exchange for “toxic assets” – a.k.a. non-performing mortgage-backed securities. It should be no surprise to anyone that a large portion of that money found its way into the stock market.

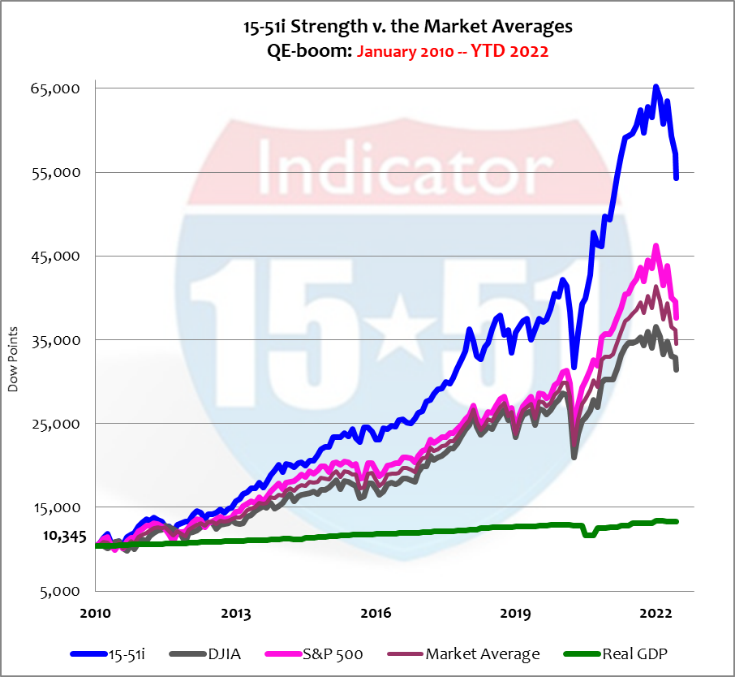

Printing money always causes inflation somewhere, and so the inflationary impact of QE can easily be appreciated in the stock market because it was injected into the investment banks on Wall Street. During the QE-boom the Market Average (DJIA + S&P500) produced 21% annual gains and Stock Market Strength via the 15-51i Indicator generated a 34% return per year, against an economy that grew only 2% per year in Real terms. See below.

The post-Great Recession-period is one where the stock market grew at abnormal rates due to excess currency injected into the Wall Street system via QE.

During the QE-boom the Federal Reserve’s balance sheet swelled to nearly $10 trillion (nearly 50% of American GDP) – and more than ten times its size before the ’08 crisis commenced.

Withdrawing that excess currency will deflate the stock market balloon QE inflated.

Quantitative tightening (QT) is the opposite of QE. It is a method used by the Federal Reserve to remove excess currency from the monetary system (Wall Street banks). The reason, of course, is to fight inflation – a condition that feeds on excess money.

Understanding the market environment and how government policies affect it is vital information used by investors to properly position their portfolios for the coming tide.

The first thing to appreciate is, just like in ’08, today’s crisis is manmade by prolonged bad government policies that created a hyperinflationary condition that is steadily heading towards correction.

The second thing to acknowledge is that there is a lot of bad information out there. It’s now a world where news is propaganda, facts are misconceptions, and lies are truth. In this new world I am old-fashioned, so let candid facts and common sense be submitted to an open-minded world…

Fact #1: it is impossible to add $6 trillion to a $20 trillion economy and not cause economic inflation.

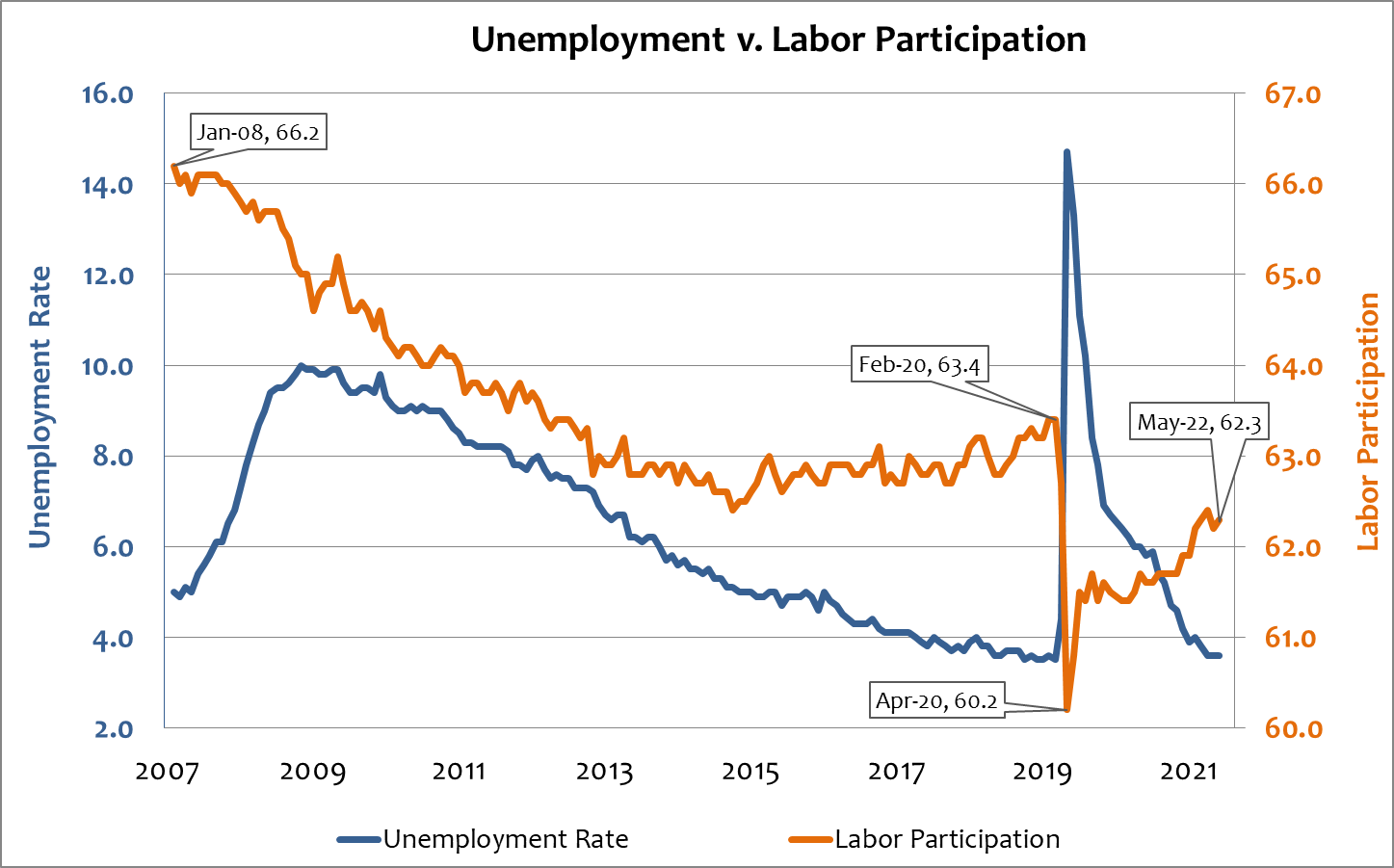

Fact #2: To call this the “strongest economic recovery” in modern history (and thereby contributing to the inflationary condition) is to ignore the economy sliding into recession (Q1 2022 GDP shrank by a -1.5% annual pace) and that labor participation hasn’t recovered to pre-Covid levels (see below).

To be surprised by today’s inflationary condition is to be one of two things – ignorant or corrupt. Place both, U.S. Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell, in either category. Both deserve to be removed from their posts – and that’s not a partisan position, it’s a common sense position.

Nevertheless, it is their world and we just live in it. Understanding the game, its players, and how it’s being played is the only way to chart a winning course.

The reason QE didn’t create economic inflation before Covid-19 was because most of the QE money remained at the institutional level – the Wall Street establishment, big government, and their favored businesses. Policies surrounding Covid-19 – the shutdowns and restrictions – did two significant things to cause major inflation: they destroyed small business, the supply chain, productivity, and business model metrics at every corner of the global economy; and they forced trillions of new currency into the hands of consumers (two-thirds of economic activity).

And Yellen and Powell couldn’t see inflation coming?

So now their response is to raise interest rates, which is another ruse. Inflation has no choice but to get worse with higher interest rates. And the reasoning for that is simple: inflation is the cost of money and interest rates are the cost of debt, which is only borrowed money. If the cost of money rises higher then how could the cost of borrowing money remain low?

Put another way, if inflation (cost of money) is running at 8% how can long-term interest rates (cost of borrowing money) remain at 3%?

Doesn’t make any sense.

Inflation will ultimately force yields higher but the Federal Reserve wants to make it look like they are doing it, which is the reason they just announced raising rates more aggressively than originally planned. They want to appear as if they are in control of rates, at least for now.

Quantitative tightening (QT) has also recently started but ever so slightly, to the tune of just $47.5 billion per month for the first quarter, and then increasing to $95 billion until September, when tightening will occur at “a substantially faster and more aggressive pace”. (This ought to make election season more interesting, don’t ya’ think?)

While that level of monetary tightening may sound like a lot, it’s not when considering the Fed needs to unwind $9 trillion from its balance sheet. This is an extremely slow pace, and will do little to change the inflationary picture.

After the ’08 crisis the Federal Reserve imposed new capital requirements on banks, who now have to carry more marketable securities (stocks and bonds) to cover market meltdowns and liquidity crunches. After all, America’s money center banks also make the market for stocks and bonds, they are investment banks, a.k.a. the Wall Street establishment.

So to reverse QE and remove excess currency from the system via QT, the Fed must either sell mortgage backed securities or U.S. Treasury bonds to the Wall Street establishment for cash.

Selling mortgage backed securities back to a market unwilling to buy a 3% income product because inflation is running at 8% causes those securities to sell at a discount – thus raising yields (and mortgage interest rates).

Selling U.S. Treasury bonds back to a market unwilling to buy a 3% income product because inflation is running at 8% causes those bonds to sell at a discount – thus raising yields (and long-term interest rates like the 10-year Treasury, which also affects long-term business rates).

The vast majority of businesses that produce products borrow money to finance their operations. Raising interest expenses increases their cost profile, which translates to higher consumer prices (inflation) and/or lower profit margins – neither of which are good for long-term growth and stock prices.

After destroying small business for more than two years, poorly conceived government policies are starting to affect big businesses, as companies like Microsoft and Target announce disappointing results and rougher waters ahead. You don’t have to be Jamie Dimon or Elon Musk to read the writing on the wall and appreciate an economic tsunami is on the way. And the reason for that is also simple…

For every crisis since the tech-boom government’s answer has been to spend more money and print more money – but they can’t do that this time because inflation is running at a blistering pace, and doing so would only make matters worse.

There is a perfect storm brewing – an incompetent, communist-like government, an economy in recession, political turmoil and upcoming elections, a monetary debt burden of epic proportions, and an over-valued stock market – tailor-made for major correction.

Biden’s solution will invariably be to raise taxes – to try to shift the recession to individuals so that big government can continue getting bigger by deficit spending. Because that’s the way it works. Government grows at the free-market’s expense.

A recession is needed, indeed, but it should be a recession in government accompanied by growth in the private sector – consumer spending and free enterprise. The solution therefore is to cut marginal tax rates for all individuals, manufacturers, and service providers – and drastically reduce central government spending across all departments so that budget surpluses can be used to retire debt, thus removing currency from circulation and easing inflationary pressures.

Smaller government and fiscal conservativism are the solution to solve America’s inflationary dilemma. Not more government.

Until then, stocks remain over-valued and out-of-whack with the underlying economy, bonds are high-risk because their values fall as yields rise, gold is worth its weight, and cash is king because you can’t buy low without it.

Have your plan ready, and let me know if you need help.

Stay tuned…

Thanks Dan, really appreciate how you articulate what is really going on…….. The corruption of government and MSM is mind boggling…….

best regards,

Bob Bahoshy

No kidding, Bob — and it’s so blatant! Thanks for chiming in!